7 tips for lowering your life insurance costs in 2024

For many people, the right life insurance policy is a crucial financial tool. After all, this type of policy is what provides a safety net for your loved ones when you die — with the beneficiaries receiving a lump-sum payout that can help cover everything from funeral expenses to household bills. That, in turn, makes it a critical component of many people's financial plans. And, when you consider the other potential life insurance benefits, it's easy to see why this coverage is so important for the right person.

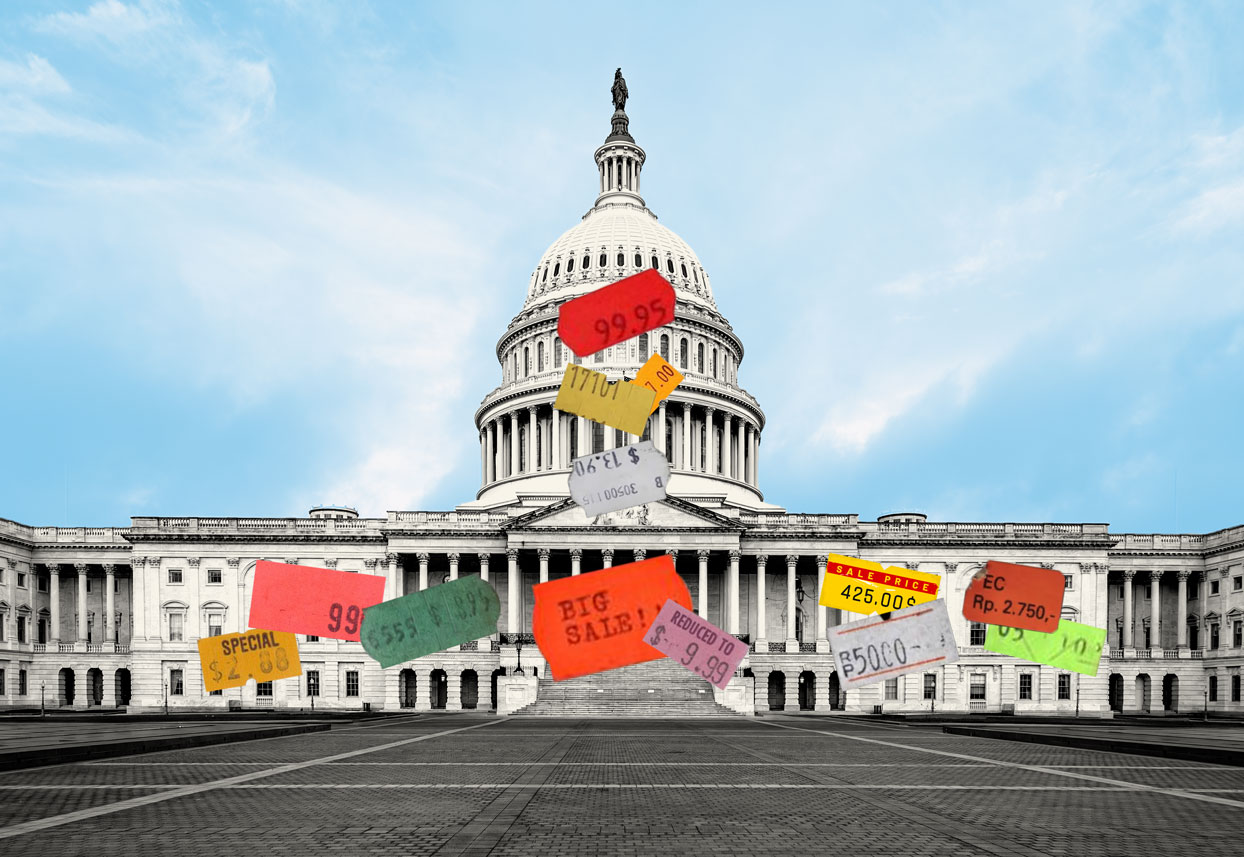

But while the right life insurance policy can be an essential aspect of financial planning, the cost of life insurance can sometimes be a concern. And, that may be especially true if you're on a tight budget due to the current issues with inflation and the economy or are anticipating a significant decline in your income soon.

If you're one of the people who's concerned about covering the cost of their life insurance policies, there are several strategies you can employ to lower your life insurance costs in 2024. And, you can do so without compromising on your coverage. To help you get started, we compiled a few tips to help you make the most of your life insurance while keeping your premiums in check.

Compare your life insurance policy options online here.

7 tips for lowering your life insurance costs in 2024

If you need to cut down on the costs of your life insurance this year, the following strategies may help you do so:

Assess your coverage needs

One of the common mistakes people make is overestimating the amount of coverage they require from their life insurance policy and too much coverage can result in unnecessarily high policy costs. So, take the time to assess your current financial situation, outstanding debts and future financial needs.

If you've paid off your mortgage or your children have become financially independent, you may not need as much coverage as you did in the past. By right-sizing your coverage, you can lower your premiums without sacrificing protection.

Find out how affordable your life insurance policy can be here.

Compare quotes from multiple insurers

Shopping around for life insurance is essential, as premiums can vary significantly between insurance providers. Take advantage of online comparison tools or consult with an independent insurance broker to get quotes from multiple companies.

By comparing offers, you can identify the most cost-effective policy that meets your specific needs. Be sure to consider the reputation and financial stability of the insurance companies you are evaluating.

Improve your health habits

Your health plays a significant role in determining life insurance premiums. Insurers often consider factors such as your weight, blood pressure, cholesterol levels and overall health during that process.

In turn, making positive lifestyle changes, such as adopting a healthier diet, exercising regularly and avoiding tobacco products, can lead to lower premiums. Some insurers even offer discounts or incentives for policyholders who actively engage in wellness activities.

Opt for term life insurance

Term life insurance is generally more affordable than permanent or whole life insurance, so this type of coverage may be worth considering — as long as it fits your needs and goals. The big difference between the two types of coverage is that while permanent policies offer lifelong coverage and accumulate cash value, term life insurance provides coverage for a specific term (e.g., 10, 20 or 30 years). If you're primarily looking for protection during a specific period, opting for term life insurance can result in substantial cost savings.

Bundle policies for discounts

Many insurance providers offer discounts for customers who bundle multiple policies, such as life insurance, auto insurance and homeowners insurance. Bundling can lead to significant savings on premiums.

So, before committing to a life insurance policy, inquire about potential discounts for bundling to see if you'll be able to save money by taking that route. If there's a chance that bundling will save you money, you may want to explore consolidating your insurance needs with a single provider.

Consider a no-exam policy

Traditional life insurance policies often require a medical exam as part of the underwriting process. However, some insurers now offer no-exam life insurance policies that allow you to skip the medical exam.

While these policies may come with slightly higher premiums for the average person, they can be a convenient and cost-effective option for individuals who prefer to avoid medical examinations or have minor health issues. That's because, by removing the medical exam requirement, you may be offered lower premiums than you would otherwise get due to your pre-existing health issues, especially if your health issues would be considered more serious or high-risk by insurers.

Review and update your policy regularly

Life circumstances change over time, and it's crucial to review your life insurance policy periodically. As your financial responsibilities evolve, you may find that you need more or less coverage. And, as you age, the cost of life insurance may increase. But by regularly reviewing and updating your policy, you can ensure that you have the right amount of coverage at the most cost-effective rate.

The bottom line

Lowering your life insurance costs in 2024 involves a combination of strategic planning, lifestyle adjustments and smart decision-making. By assessing your coverage needs, comparing quotes, improving your health habits, choosing the right type of policy, bundling insurance, considering no-exam options and reviewing your policy regularly, you can take control of your life insurance expenses without compromising the protection it provides for your loved ones.