The clock is ticking on a key retiree deadline

Will you have you reached age 70-1/2 by the end of this year? If so, you face a looming tax deadline -- the IRS required minimum distribution (RMD) from deductible IRAs and retirement accounts. You must withdraw minimum amounts from these accounts or face hefty IRS penalties.

The IRS’ required minimum distribution -- aka minimum required distribution (MRD) -- prevents you from indefinitely delaying payment of income taxes on your retirement accounts by requiring you to withdraw minimum amounts each year. Those amounts are then added to your taxable income for the year.

The IRS rules regarding RMDs are quite complex, so let’s look at just some of the most important features. We’ll also look at some strategies for avoiding paying penalties and manage the requirements.

What accounts are subject to the rules?

RMD rules apply to the following accounts: deductible IRAs, SEP-IRAs, SIMPLE IRAs, deductible and Roth 401(k) plans, 403(b) plans for nonprofit organizations and 457(b) plans for government employers.

Note that Roth IRAs aren’t subject to the RMD rules, but Roth 401(k), 403(b), and 457 plans are. If you participate in a Roth version of one of these plans and want to avoid the RMD, you’ll need to roll over your account to a Roth IRA.

Regular investments and bank accounts without special retirement tax treatment aren’t subject to the RMD rules at all.

When must you comply with the rules?

If you attain age 70-1/2 by Dec. 31, you’ll need to withdraw the RMD that applies to you by that date. As a practical matter, if your 70th birthday is June 30 or earlier, you’ll be subject to the rules in the current year. If your 70th birthday is on or after July 1, you aren’t subject to the rules until the following year.

The IRS allows one exception: In the first year -- and the first year only -- in which you’re subject to the rules, you can delay your RMD until April 1 of the following year. If you take advantage of this delay, however, you’ll have two taxable withdrawals in the following year: one for the prior year and one for the current year.

How much must you withdraw?

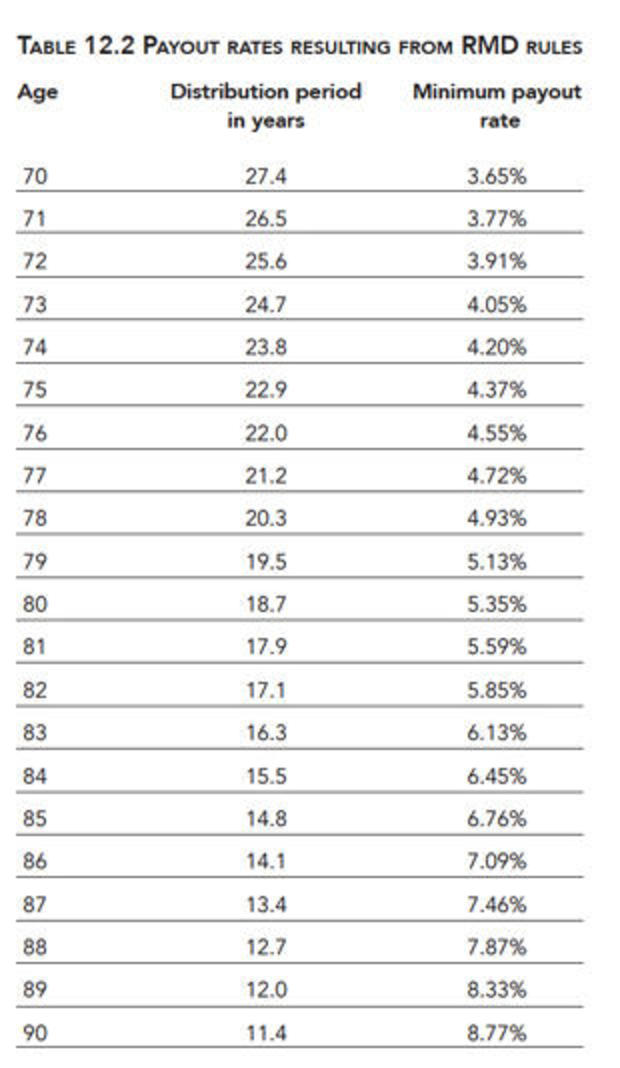

You can determine the RMD that applies to you by starting with the value of your account on Dec. 31 of the previous year. Divide the total of your account by your life expectancy according to an IRS table. Here’s a table from my book “Money for Life” that does the calculation for you and shows you the percentage of your account that you must withdraw.

Let’s do the math for one example, so you can see how this works. Suppose your account is worth $100,000 on Dec. 31, 2015, and your 70th birthday was in the first half of 2016. In this example, by Dec. 31, 2016, you’ll need to withdraw $3,650 (that’s 3.65 percent of $100,000) and add it to your taxable income for 2016.

Alternatively, in this same example, you could defer withdrawing $3,650 until April 1, 2017, since you attained age 70-1/2 in 2016. However, you’ll also need to withdraw the RMD for 2017 in calendar year 2017, so you’d be paying income taxes on two withdrawals in 2017.

Note that the percentage of your account that you need to withdraw increases for each year that you get older. In other words, you don’t lock in a withdrawal percentage when you start withdrawing from your account.

Note also that different rules apply if your spouse is more than 10 years younger than you, and to beneficiaries after the account holder has died.

Keep in mind the IRS doesn’t require you to spend the RMD. So if you want keep your savings invested, you can pay taxes on the withdrawal amount and then invest the remainder in an after-tax account.

Here’s a trap for the unwary: If you use the 4 percent rule or some other strategy to generate a retirement paycheck, or if you invest in a managed payout fund that automatically generates a retirement paycheck for you, such as funds sponsored by Fidelity, Schwab, or Vanguard, you might not be withdrawing sufficient amounts to cover the full RMD that applies to you. Be sure to check each year to verify that you’ve withdrawn enough to cover your RMD.

What’s the penalty if you don’t withdraw the funds?

You’ll be hit with a 50 percent penalty on the amount you should have withdrawn but didn’t. In the above example, suppose you withdrew only $1,650 in 2016 instead of $3,650. Your withdrawal would be $2,000 short. In that case, you’d pay a penalty of $1,000.

Bottom line: Don’t violate the RMD rules!

Are there any special situations you need to be aware of?

There are a few. For instance, if you have multiple IRAs, you’re allowed to satisfy your total RMD by making a single withdrawal from just one of these accounts to cover the RMDs for all of them (i.e. you aren’t required to withdraw the RMD from each account). This rule also applies to 403(b) plans but not to 401(k) and 457 plans. With these last two, if you have multiple accounts, you must make the RMD from each one.

Here’s another special situation: If you’re still working for the employer that sponsors your retirement plan, you don’t need to make the RMD from that plan until you actually retire, even if you’re older than age 70-1/2 (but this deal doesn’t apply if you own 5 percent of more of the business). In this case, however, you’ll need to withdraw the RMD from any retirement account you have that isn’t invested in your current employer’s plan.

This leads us to one strategy you can use to manage your RMDs: If you plan to work beyond age 70-1/2 and want to minimize your RMDs, you might want to do your homework to determine if you can roll over accounts from prior employers into your current plan.

How can you manage the RMD requirements?

You have a few options. If you buy an immediate annuity from an insurance company that pays you (and your spouse or beneficiary) a monthly check for the rest of your life, you’re deemed to automatically comply with the rules for the amount of your savings that you’ve used to purchase the annuity. If you have a guaranteed lifetime withdrawal benefit (GLWB), however, you’ll want to check with your insurance company regarding compliance with the RMD rules.

In 2014, the U.S. Department of the Treasury issued regulations on qualified longevity annuity contracts (or QLACs) that you can use to manage RMDs. QLACs allow you to invest in an annuity that starts the monthly payments at an advanced age, say age 80 or 85. The amount you invest in the annuity isn’t subject to the RMD requirements, even though the monthly payments start after age 70-1/2. The amount you’re allowed to invest in a QLAC is limited to the lesser of two amounts: 25 percent of your account balance, or $125,000.

You can use QLACs strategically for a few different goals, such as:

- managing your RMD requirements,

- giving you a boost in income at an advanced age when you might incur additional expenses for medical or long-term care, or

- integrating with systematic withdrawal plans to generate retirement income before age 85.

If you don’t buy an annuity and instead invest your retirement accounts to generate retirement income, many IRA, 401(k), 403(b) and 457 administrators will allow you to elect periodic distributions that will comply with the RMD rules.

Finally, any amounts you withdraw from your retirement accounts before age 70-1/2 aren’t subject to the RMD rules. If you experience a year when your tax bracket is quite low, you might want to consider making additional withdrawals from your savings and investing them in an after-tax account.

As you can see, there’s a lot to consider with respect to the RMD rules. It might be smart to consult with your tax adviser as you approach your 70th birthday to make sure you don’t get hit with substantial penalties.