As tax deadline looms, small businesses face changes in deductions

While the Internal Revenue Service generally approves valid business-oriented deductions, the agency takes a firm stance against others, Selva Ozelli, and international tax expert, told CBSN.

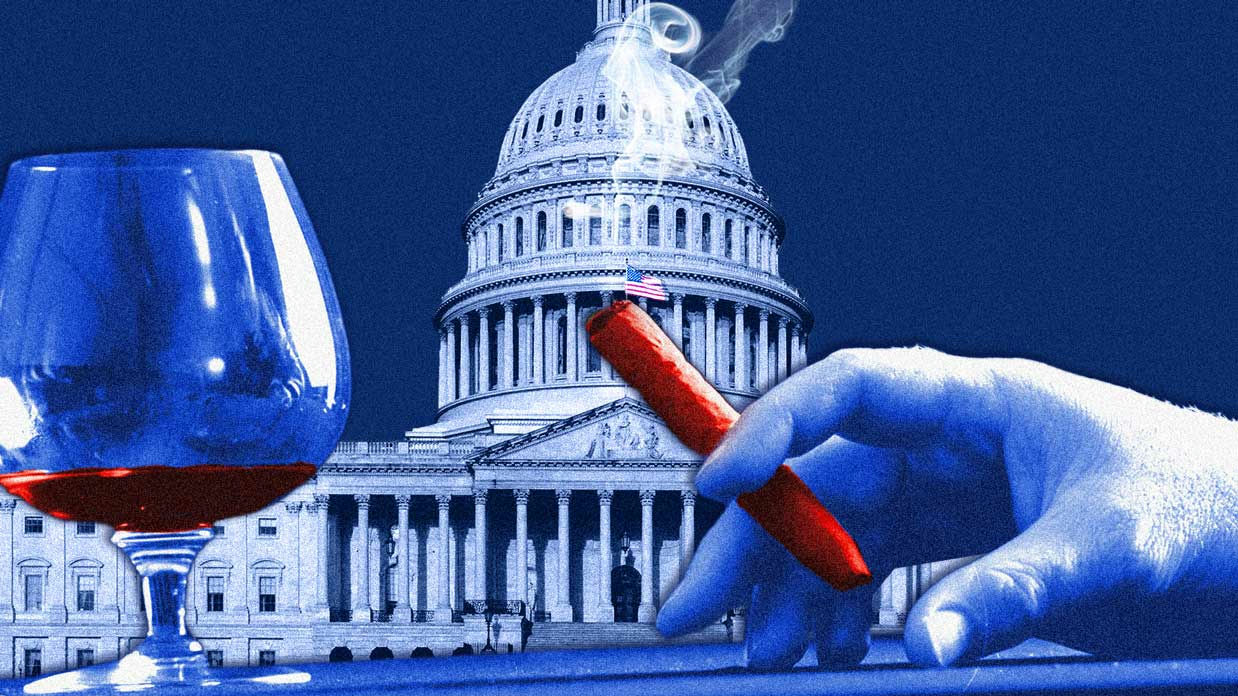

Classic business expense items like gifts for clients, business clothes, commuting or dining out will be difficult for many small businesses to write off under the new tax rules.

"Let's say outfits: You can deduct if you have a uniform or if you have to wear protective gear specific to your job," Ozelli said. But a custom-made suit or other classic business attire is not deductible as a business expense, she explained. "It has to be a uniform."

Small businesses like partnerships, limited liability companies or S-corporations are limited to $25 to spend per client on gifts. In 2017, small businesses could entertain clients with concert tickets for a 50 percent deductible, but now there is none.

Similarly, employers could deduct 100 percent of transportation costs for employees, but now items like transit or parking can't be deducted at all. Company parties, however, still count towards a 100 percent deductible.

Here are other expenses difficult to write off in taxes:

- Fines or penalties

- Life insurance premiums

- Political donations

- Cell phone expenses

The Tax Cuts and Jobs Act allows small business owners to take a 20 percent deduction known as a "pass-through" off their income before paying taxes, meaning that a small business that earns, say, $100,000 in come can deduct $20,000 before paying taxes on the remaining $80,000.

Small businesses can also take advantage of tracking finances on the cloud, according to Ozelli. The technology automatically updates, allowing businesses to share documents, protect against hacking, and pay for services as they go.

"It's a cost saver in many ways," Ozelli said.