Tax cheats beware, whistleblowers are telling the IRS

Taxpayers who have information about people or businesses that cheat on their taxes are increasingly acting as whistleblowers and turning them into the IRS.

According to an IRS report, its Whistleblower Office issued 418 whistleblower awards during fiscal 2016 compared with just 99 in 2015 (however, the dollar amount of those payouts fell from 2015’s $101.3 million to 2016’s $61 million). All told, whistleblowers have helped the IRS collect more than $3.4 billion over the past decade that would have otherwise been lost to fraud, and they’ve won more than $465 million in rewards over that period.

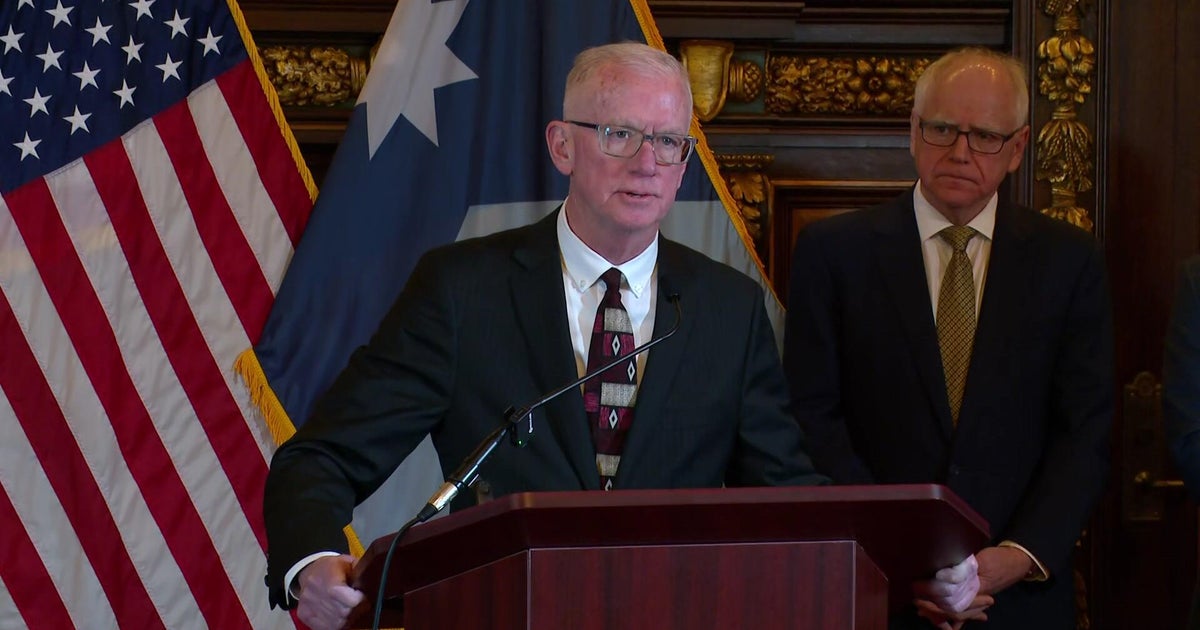

Even so, critics such as Sen. Chuck Grassley, R-Iowa have accused the agency of moving too slowly to address whistleblowers’ claims. He has discussed the issue with Steven Mnuchin, nominated by President-elect Donald Trump to be Treasury secretary.

“The IRS still is not as fast as it could be in considering whistleblower information,” Grassley said in a press release, adding that he was pleased with the improvements that have been made.

“Whistleblowers often have put their livelihoods on the line to come forward, and they deserve timely answers from the IRS,” said Grassley. “Another challenge is making sure the IRS interprets the whistleblower statute in a favorable light toward whistleblowers, which it doesn’t always do.”

The IRS’s Whistleblower Office has struggled to keep up with its work in the face of steep cuts to the agency’s budget, which has caused the office’s staffing level to shrink from 61 to 37 between 2015 and 2016, according to Stephen M. Kohn, an attorney who represents whistleblowers.

“The IRS is making progress, but the long delays in investigating and processing cases [has] hurt the American public and the whistleblower program,” said Kohn in a press release. Kohn represented whistleblower Bradley Birkenfeld, who earned a record $104 million award in 2012.

“Political officials in the Department of Treasury have starved the Whistleblower Office, resulting in delays and an unacceptably large backlog,” added Kohn. “It is inconceivable that an office that generates billions in income, and is mandated to help whistleblowers has a backlog of 29,835 open cases, and a staff of only 37 employees.”

The IRS argues that the backlogs have been “fully addressed or eliminated” and that it was taken steps to prevent the problems from reccurring, including improving communications with whistleblowers and their legal protections against retaliation.

However, also needed is protection for taxpayers against whistleblowers who improperly disclose information obtained from the IRS in connection with their whistleblower claims, according to Lee D. Martin, the head of the IRS Whistleblower Office.