Student loan defaults rising despite a way out

(MoneyWatch) Although levels of household debt have steadily receded in the U.S. since the housing bubble burst, Americans are conspicuously falling behind in one area -- student loans.

The number of people who are at least 90 days late on student loan payments has jumped 3.2 percent in only two years, rising from 8.5 percent in 2011 to 11.7 percent today, according to a recent study by the New York Federal Reserve.

And the true picture for borrowers is even worse. That delinquency rate counts all student loans, including those currently in deferment or in grace periods and therefore temporarily not in the repayment cycle. Excluding those loans, the actual delinquency rate is more than 30 percent, the New York Fed found in a separate study. In 2004 it was under 20 percent.

For the 2011-12 school year, students and their families borrowed $76 billion to pay for college, according to the Pew Research Center. That's just one year. Currently, Americans owe a total of nearly $1 trillion in student debt.

From 2004 to 2012, the number of people getting student loans and their average debt have both increased by 70 percent. Student debt is the only kind of household debt that continued to rise through the Great Recession and has now the second largest balance after mortgage debt. Currently, nearly 40 million people owe an average of $26,000 after graduation.

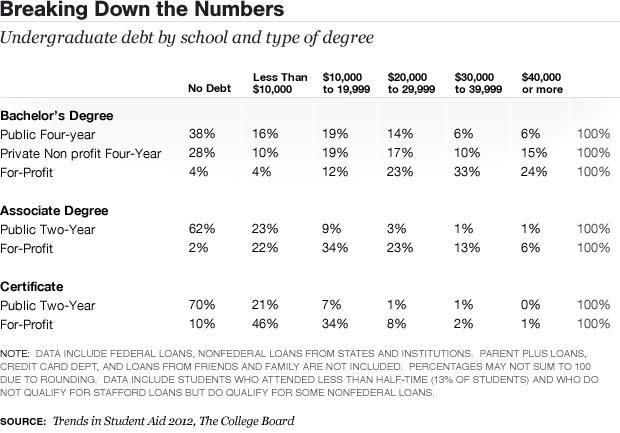

Most of this is owed by people under 30 and people who attended for-profit colleges. More than 40 percent of people under 30 have outstanding student loan debt. As of the 2007-08 academic year, 57 percent of graduates of private, for-profit schools owed more than $30,000 in debt. Only 25 percent of students who graduated from private non-profit colleges owed that much and only 12 percent of public-college graduates.

As a result, students at private, for-profit schools are at a higher risk of falling behind on their loans. As the New York Fed reported,

Graduates of private for-profit schools are demographically different from graduates in other sectors. Generally, private for-profit school graduates have lower incomes, and are older, more likely to be from minority groups, more likely to be female, more likely to be independent of their parents and more likely to have their own dependents.

The increase in defaults is happening despite a government program designed to help at least some of these students avoid falling behind on their payments. The Income Based Repayment plan, which is for public loans, caps the amount being paid each month at 15 percent of discretionary income. If that doesn't cover the interest payments, the government will pay the interest for up to three years on many types of loans.

- Student loans -- public or private?

- Senators propose freezing student loan rate

- Crucial resume advice for new college graduates

And if you're out of work? "If you're unemployed your payment is zero," said Joshua Cohen, a lawyer specializing in student debt cases. "So how do you default if your payment is zero?"

So why are defaults increasing?

"Most of my clients are in default and most of them should never have been in default," Cohen said. "I don't think the loan servicers are doing their job and letting people know there are affordable payment plans out there. Because of that, people continue to bury their head in the sand thinking it's not affordable. Then they end up in default and dealing with debt collectors who are not even telling all of the truth or even half the truth. So people think they're stuck in default when they're really not."

Tomorrow: New options to make it easier to repay a student loan