Student loan debt nears $1 trillion: Is it the new subprime?

(MoneyWatch) Since the recession, Americans have vastly reduced the amount of debt they maintain, with one glaring exception: Student loans. Outstanding student loan debt now stands at $956 billion, according to the Federal Reserve Bank of New York's Quarterly Report on Household Debt and Credit. Student debt increased by 4.6 percent in the third quarter from the previous quarter -- when annualized, that's almost a 20 percent rate of increase.

Additionally, more student loan borrowers are falling behind on their payments, with the percent of student loan balances 90+ days delinquent increasing to 11 percent this quarter. This rate is now higher than the "serious delinquency" rate for credit card debt for the first time.

According to the Wall Street Journal, "since the end of 2007, just before the financial crisis hit, total student debt has grown by more than 56%, adjusted for inflation, the new Fed data show. During that time, overall household debt--including mortgages, student loans, auto loans and credit cards--fell by 18%, to $11.31 trillion as of Sept. 30."

Part of the problem is that unlike most other types of consumer debt, like credit cards or mortgages, student loans are notoriously hard to discharge, even if the borrower has filed for bankruptcy. Naked Capitalism's Yves Smith notes that "student debt is senior to all other consumer debt; unlike, say, credit card balances, Social Security payments can be garnished to pay delinquencies. As a result, it has contributed to the fall in the homeownership rate, since many young people who want to buy a house can't because their level of student debt prevents them from getting a mortgage."

Another way student loans are vastly different than other consumer debt is that they require little in the way of underwriting. Most student loans are made through the federal government, which only vets borrowers in the most cursory of ways. In fact, the government doesn't seem to care whether you are a liberal arts major, with little chance to earn enough to keep pace with your loan payments or a software engineer, who should easily make enough money to carry the debt load. Smith likens the current student loan debt balloon to the recent subprime mortgage bubble, where lending standards are practically non-existent, as "anyone who can fog a mirror can get a loan."

About two-thirds of bachelor's degree recipients borrow money to attend college, either from the government or private lenders, according to the Department of Education. However, the total number of borrowers is most likely higher since the survey does not track borrowing from family members. For all borrowers, the average debt in 2011 was $23,300, with 10 percent owing more than $54,000 and 3 percent more than $100,000.

Just because the government is willing to lend more, doesn't mean that students should take the money. With numbers skyrocketing, most education experts advise that students limit total college borrowing to their estimated first year salaries. Here are answers to some important questions about student loans:

What are the different types of college loans? There are three ways to borrow for education: Student loans (Federal Stafford and Federal Perkins loans), parent loans (PLUS loans), and private student loans.

What is a Stafford loan? A Stafford federal loan is awarded to students who are enrolled at least half time in college, complete the (dreaded) Free Application for Federal Student Aid and demonstrate financial need. Two-thirds of these loans are awarded to students with family adjusted gross income of under $50,000. Stafford loans come in two flavors -- subsidized and unsubsidized. With a subsidized loan, the government pays the interest while students are in school; with an unsubsidized loan, the student pays the interest and can defer payment until after graduation. So subsidized Stafford loans are preferable to the unsubsidized variety. The term is 10 years, although other terms are available via consolidation.

What is the interest rate on Stafford loans? Dating back to 1992, Congress set the interest rate on federal student loans at fixed rates ranging from 6 percent for loans issued in the 1960s to 10 percent for loans issued between 1988 and 1992. By the end of 2006, student loan rates were at 6.8 percent. The College Cost Reduction and Access Act of 2007 phased in a reduction of the interest rates on subsidized Stafford loans for undergraduate students starting July 1, 2008. The phase on newly originated undergraduate loans was 6 percent for 2008-09; 5.6 percent for 2009-10; 4.5 percent for 2010-11; and 3.4 percent for 2011-12. The rate is scheduled to revert back to 6.8 percent for the 2012-2013 school year unless Congress agrees to keep it where it is.

What's the cost to the government of extending the 3.4 percent interest rate for another school year? It would run $5.8 billion, according to an analysis by the nonpartisan Congressional Budget Office. That's why many deficit-sensitive politicians are demanding that the money be "found" somewhere else in the federal budget.

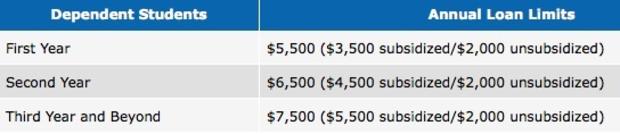

How much can an undergraduate borrow through a Stafford loan?

What is a Perkins loan? A Perkins loan is a subsidized federal loan offered though colleges. It works like this: The U.S. Department of Education provides funding to the school; the school determines which students have the greatest need; and then the school combines federal funds with some of its own funds for Perkins loans for qualifying students. The government pays the interest on the loan while the student is in school and also during the 9-month grace periods. There are no origination or default fees, and the interest rate is 5 percent for the 10-year repayment period.

What is the Federal Parent Loan for Undergraduate Students (PLUS)? PLUS loans allow parents to borrow money for uncovered education costs. Unlike with Stafford or Perkins loans, larger loan amounts are available up to the total cost of college, at a fixed interest rate of 7.9 percent. Interest is charged from the date of the first disbursement until the loan is paid in full. Credit checks are conducted for the loans, and PLUS loans are the financial responsibility of the parents, not the student.

What is the difference between a PLUS loan and a private loan? Private lenders may offer more flexible repayment options and perhaps a lower interest rate. However, more private loan rates are variable, which means the cost of the loan can rise in the future.