One headwind the stock market can't keep bucking

Making February's market volatility seem like a distant nightmare, the tech-heavy Nasdaq Composite keeps climbing to new highs. Helping ease that earlier fear were Friday's "Goldilocks" jobs report, with payroll growth strong but wage gains modest. That boosted expectations of a gentle rate hike pace by the Federal Reserve.

And thanks to President Donald Trump's willingness to entertain exceptions for Canada, Mexico and other allies, investors shrugged off his steel and aluminum tariffs, which had initially sparked fears of a global trade war.

But investors aren't out of the woods just yet.

Before the month is out, the Federal Reserve will hold its first policy meeting under Chairman Jerome Powell, and it is likely to raise interest rates. It will also update its economic projections revealing whether officials have increased their expectations for four quarter-point hikes this year, rather than the three Wall Street now has penciled in. Moreover, Washington will need to hammer out another budget deal before the end of the month.

In a recent note to clients, Citigroup (C) analysts wondered aloud why investors have been so slow to price in the receding tide of central bank stimulus. Setting aside whether the Fed will raise interest rates by 0.75 percentage points or by a full 1 percent -- or maybe even more this year -- the pace of "quantitative tightening" is set to keep accelerating as the central bank reverses years of bond-buying stimulus.

As asset purchases slow and eventually turn negative, history reveals a close connection to the performance of high-yield bonds and global equities. Without much stronger (and inflation-free) economic growth and credit creation (especially in China), these will be massive headwinds as 2018 pushes toward 2019.

Moreover, the trade war threat hasn't gone away. Over the weekend, China's Commerce Minister said the U.S. calculation of its trade deficit with China is exaggerated by 20 percent. Even though China has responded to Mr. Trump's tariffs by saying a trade war would be a "disaster," watch for possible retaliatory actions.

Goldman Sachs' (GS) chief equity strategist David Kostin tries to answer the question from clients of "what happens next?" by suggesting a focus on the 10-year U.S. Treasury yield, which appears to be on the verge of pushing past the 3 percent threshold. But as long as the rise in interest rates is relatively controlled, stocks can continue to rise.

Only when rates push toward the 4 percent level, which should happen sometime in 2019 as things stand now, will even higher economic growth be needed to keep equity valuations aloft. That will be difficult to attain if trade hostilities commence for an economy that has grown dependent on low-cost credit.

The team at Capital Economics believes higher rates will begin to bite stock prices sooner than that, pushing them down 7 percent from current levels this year.

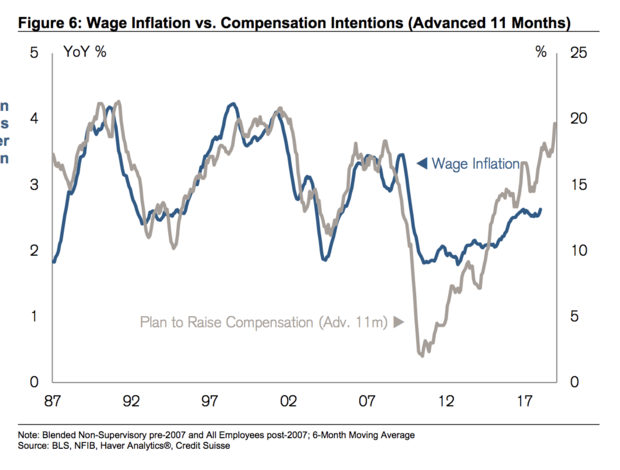

While wage growth slowed in February, Credit Suisse (CS) analysts note that compensation intentions (a leading indicator) point to annualized wage inflation accelerating toward 4 percent percent soon (chart above). That would force the Fed to respond by quickening its rate hike pace.

In turn, that would bring forward the day Treasury yields push past the 4 percent threshold and endanger the stock market -- including all those tech stocks now driving Nasdaq higher.