4 signs you should add gold to your portfolio, according to experts

Interest in gold has picked up in recent years, thanks to high inflation and geopolitical tensions, which tend to send investors toward safe-haven investments that protect their wealth. In fact, even big-box stores like Costco have begun offering the precious metal.

But while gold is certainly a smart move for many investors, it's not right for everyone's portfolio. Are you considering buying gold to expand your portfolio? Below, we'll break down a few expert-backed signs that indicate your portfolio is ready for gold.

Start by exploring your gold investing options here to learn more.

4 signs you should add gold to your portfolio, according to experts

Here are four items that may indicate your portfolio could benefit from gold.

Your portfolio isn't very diversified

If your investment portfolio is very heavily inclined toward one asset class or industry, then buying gold might be something to consider. Generally speaking, you'll want a well-diversified portfolio one that's spread across different assets and markets. This protects you in the event of an economic downturn in one specific type (i.e., you don't lose all your money at once!)

Gold is a well-known diversifier, particularly for investors heavily invested in the stock market. As James Rickards, author of "The New Case for Gold," explains, "Gold prices do not correlate closely to stock prices. Gold and stocks are driven by separate factors."

Gold can also diversify your portfolio if you're invested in other asset classes. But exactly how much should you put into it? Experts typically recommend devoting between 5% to 10% of your portfolio to it.

"This amount aims to balance the benefits of diversification with the unique risks and fluctuations of the gold market," says Nicholas Ganesh, manager at Endeavor Metals Group. "It's like adding a pinch of salt to a recipe — you need just enough to enhance the overall flavor without overwhelming it."

Learn more about how gold can diversify your portfolio here.

Inflation is elevated

If inflation is high — meaning the value of the dollar is weak — then gold tends to be a smart investment, too. Currently, inflation is at 3.4%. While that's down from the over-9% it was in 2022, that's still above the Federal Reserve's 2% goal.

"Inflation means the dollar is worth less in terms of purchasing power," Rickards says. "That means it takes more dollars to buy gold, so the dollar price of gold goes up. What you lose in terms of dollar purchasing power in inflation is made up in the dollars you gain from the higher dollar price of gold."

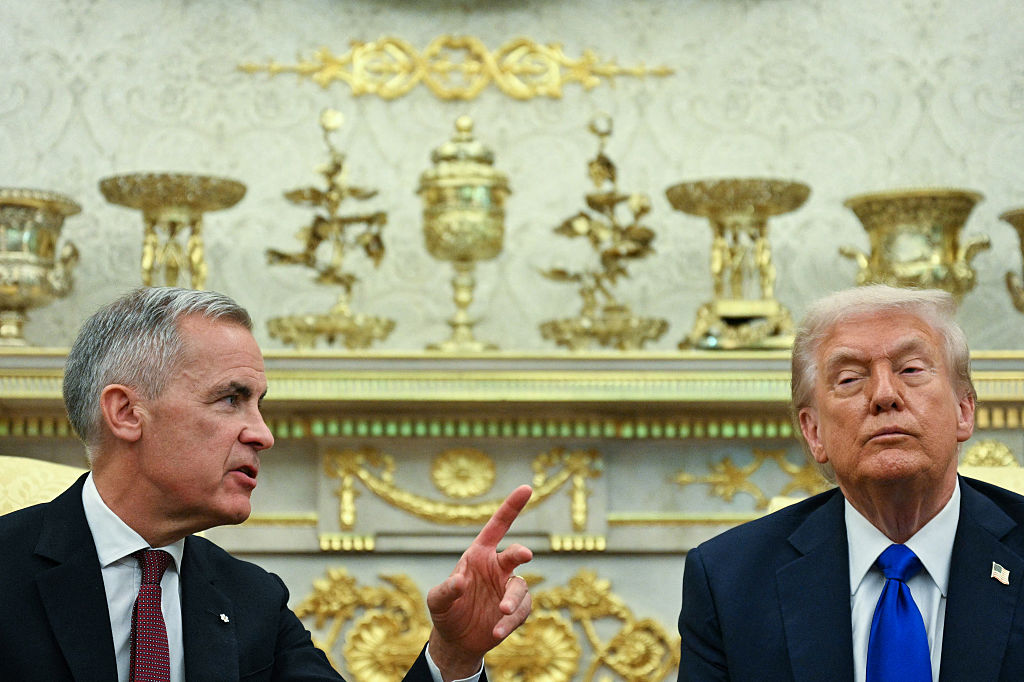

There's political or global conflict

Political turmoil and global conflict can make gold a wise choice as well. In fact, it typically sends demand for gold upward and is a "tailwind" for gold prices, according to Liz Young, head of investment strategy at SoFi.

"Geopolitical turmoil tends to affect currencies and government debt of the involved countries and regions," Young says. "In war time especially, government debt and currencies can see extreme levels of volatility, and gold tends to serve as a defensive investment on the expectation that it will hold its value and be more steady than investments exposed to the global or political conflict."

Central banks will often purchase gold during times of conflict, as it is in finite supply and holds its value, despite what might be going on politically on the ground.

"Geopolitical conflicts and political turmoil can result in unforeseen consequences," Rickards says. "These consequences can include supply chain disruptions, economic sanctions, asset seizures and freezes, bond defaults, bank failures, and inflation. Assets such as stocks, bonds, real estate and alternative investments can be adversely affected by such changes without warning. Gold tends to be insulated from such shocks because there is no issuer, no creditor, and no country involved. It's just gold. That means you can hold it safely and wait out the turmoil without adverse effects."

Interest rates are falling

Finally, gold can be a good place to invest your money when interest rates are low or falling (or if they're about to).

Generally speaking, low interest rates mean other investments, like bonds or even just savings accounts, have less to deliver. And with the Federal Reserve poised to make three rate cuts this year, inevitably decreasing the rates on many financial products in step, that could be a sign to move some cash into gold.

As Ganesh puts it, "With lower interest rates expected in 2024, gold could become even more attractive to investors, given its tendency to perform better in such an environment."

Start small and do your research

If you've never bought gold before, there are many ways to do so. You can open a gold IRA, buy gold stocks or ETFs, invest in gold futures or purchase physical gold bars and coins.

And while most experts recommend devoting somewhere between 5% and 10% of your portfolio to the precious metal, don't be afraid to start small, says Mike Perkins, who owns Causeway Coin Company in New Orleans.

"Adding some gold to your investment mix is a smart move, no matter the size," Perkins says. "But hey, start small. Let's face it, our country's financial situation is a bit shaky, and not everyone sees it coming. Including some gold in your game plan is like having a solid defense against the economic curveballs headed our way."