Scant wage growth muddies the Fed's rate moves

If there were a theme to this recovery, it would be conflicted. The stock market and corporate profitability have surged. The U.S. economy has never been larger. Energy prices are cheap. And yet the middle class has yet to really feel the improvement on a number of important measures.

Metrics such as full-time employment, median household income and the homeownership rate speak of a working class that isn't yet firing on all cylinders.

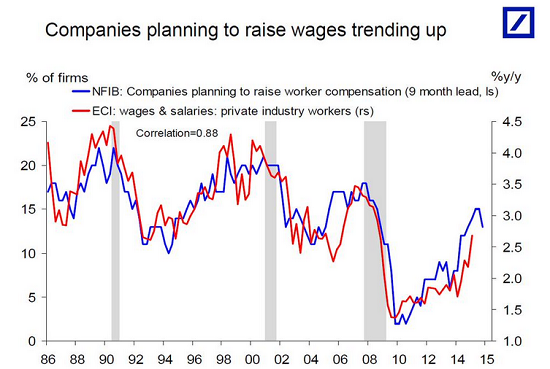

On Friday, we got more evidence something is amiss: The Employment Cost Index (ECI) report for the second quarter showed its weakest growth -- at 0.2 percent quarter-over-quarter -- in the 33-year history of the report. On an annual basis, wages and salaries are growing at just a 2.1 percent annual rate.

This dramatic slowdown in wage inflation, which admittedly could be a one-off fluke, flies in the face of other data showing a rapid tightening of labor market slack. Weekly jobless claims fell to 255,000 during the week of July 18, the lowest since November 1973. Job openings totaled 5.4 million in May, the highest on record. And the ratio of unemployed workers to job openings was 1.6 in May, the lowest since September 2007.

Moreover, survey data illustrated in the Deutsche Bank chart above shows that companies have been planning to raise worker compensation at a pace that suggests wages should be growing at closer to a 3 percent annual rate.

In looking for an explanation for the dissonance, Oxford Economics noted that the ECI was boosted in the first quarter by strong bonus payouts. Still, the slowdown is enough to question whether the Federal Reserve will move ahead with rate hikes at its September policy meeting.

For clues, they suggest keeping an eye on the Atlanta Fed's wage growth tracker as to whether this pay slowdown is actually happening. The measure currently suggests wages are growing at a 3.2 percent annual rate. Perhaps this explains why St. Louis Fed President James Bullard said on Friday afternoon that he's not concerned about the weak reading in the second-quarter ECI report and that the economy is in good enough shape for a possible September rate liftoff.

Jim O'Sullivan, chief U.S. economist at High Frequency Economics, believes some of the slowdown can be blamed on volatile commission pay. Wages for private workers minus incentive pay occupations grew at a 2 percent annual rate, an increase from the 1.8 percent rate seen last year. Given that wages are a lagging indicator, and the unemployment rate is still trending lower, higher pay is likely still in the pipeline.

We'll know more when the June jobs report is released next Friday. Currently, the unemployment rate stands at 5.3 percent, a post-recession low.

JPMorgan's Michael Feroli noted that in Fed Chair Janet Yellen's post-announcement press conference in March, she said the following about wages and rate hikes:

"We will be looking at wage growth. We have not seen wage growth pick up. We may not see wage growth pick up. I wouldn't say either that that is a precondition to raising rates. But if we did see wage growth pick up, that would be at least a symptom that inflation would likely move up over time."

His translation: "So wage acceleration would hasten liftoff, but is not required for liftoff."