Romney's role at Bain under fire

UPDATED 1:02 p.m. ET

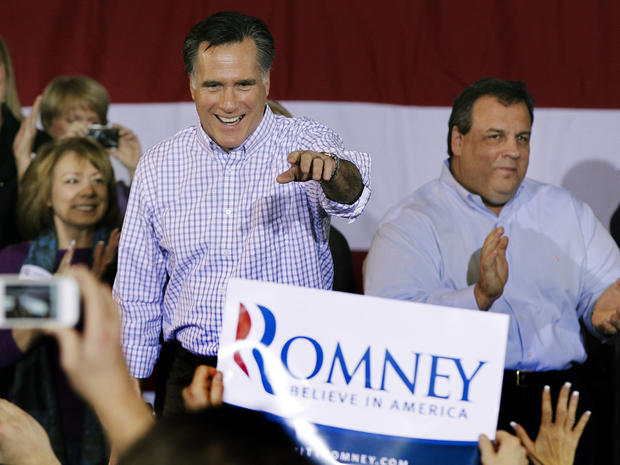

On the eve of the New Hampshire primary, Republican presidential candidate Mitt Romney is getting attacked by opponents looking to be the clear alternative to the former Massachusetts governor.

Romney is widely expected to win New Hampshire Tuesday, but the race for runner-up among former House Speaker Newt Gingrich, former Pennsylvania Sen. Rick Santorum, Texas Rep. Ron Paul and even former Utah Gov. Jon Huntsman is heating up.

Romney has been having trouble garnering more than 25 percent of the vote and the other candidates have been splitting support of conservative Republican voters looking for someone else, but he got some welcome news last week in South Carolina, which holds its primary January 21.

Romney took the lead in the Palmetto state with 37 percent support in the latest CNN/Time/ORC poll released last week and many analysts expect that if Romney wins the first three contests -- he won Iowa last week -- it could become almost impossible for one of his rivals to catch up.

A group supporting Gingrich plans a major television advertising blitz in the Palmetto state, hitting Romney for his record as the head of Bain Capital for the investment firm's first 15 years through 1999. More than $3 million of radio and television ads, first reported by the New York Times, could go a long way in South Carolina, which has picked the eventual Republican nominee in every primary since 1980.

The ads claim that Romney destroyed communities when Bain invested in companies that later shed workers and some even went bankrupt, a charge which had been most often heard from Democrats, not fellow Republicans.

Meanwhile, the Wall Street Journal published a story Monday that attempts to provide a more comprehensive assessment of his tenure at the helm of Bain.

The Journal said a key finding of its analysis was that "Bain produced stellar returns for its investors--yet the bulk of these came from just a small number of its investments. Ten deals produced more than 70 percent of the dollar gains." And four of the ten firms that produced the biggest gains for Bain investors ended up in bankruptcy court.

Of the 77 firms the Journal looked at, about 22 percent of them either reorganized under bankruptcy protection or shuttered altogether within eight years of Bain's initial investment.

The newspaper noted that supporters of Bain say it is unfair to look at the record after eight years, because in many cases the company had either gone public or been sold by then.

But politically, it could be a problem for Romney because Gingrich has decided to push the issue hard. On Sunday, the former House speaker said the firm was comprised of "rich people finding clever legal ways to loot a company."

Romney is pushing back, but he may have created a gaffe of his own in doing so.

On Monday, he said he likes being able to "fire people" who are not up to the job.

He was explaining why he thinks it is better for individuals to have their own insurance because the insurance company can be fired if the services provided are not adequate.

"I want individuals to have their own insurance that means the insurance company will have an incentive to keep you healthy it also means if you don't like what they do you can fire them. I like being able to fire people who provide services to me," he said at a breakfast at the Chamber of Commerce in Nashua, New Hampshire.

"You know if someone doesn't give me a good service that I need I want to say I'm going to go get someone else to provide that service to me," he said.

Full CBS News coverage: Mitt Romney