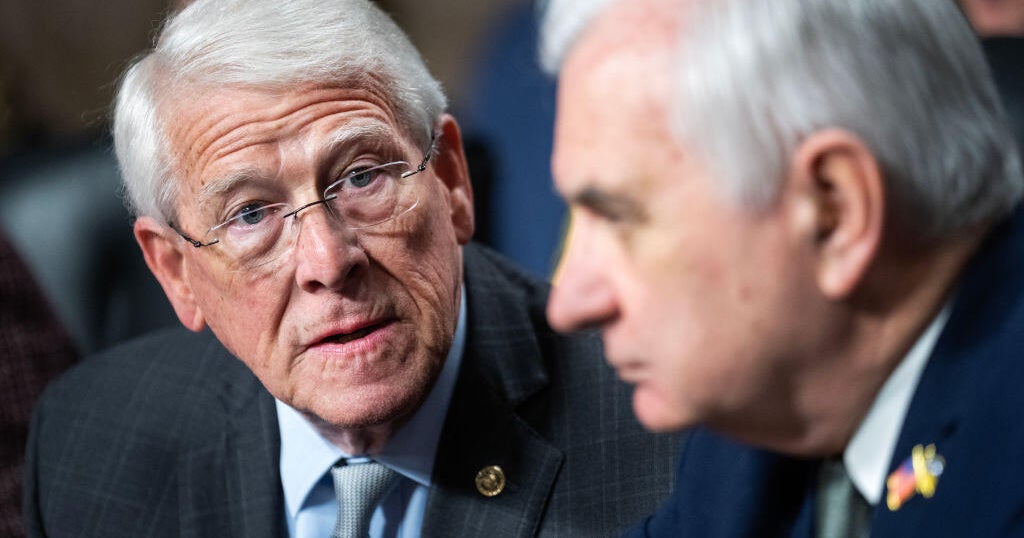

Richard Burr and other senators sold lots of stock as virus fears started

Senate Intelligence Committee Chairman Richard Burr, Republican of North Carolina, sold as much as $1.7 million in stocks just before the market dropped in February amid fears about the coronavirus outbreak, Senate records show.

Several other senators sold big stock stakes around the same time, Senate records reveal.

The documents show that Burr and his wife sold between roughly $600,000 and $1.7 million in 33 separate transactions in late January and mid-February, just before the market began to fall and as government health officials began to issue stark warnings about the effects of the virus. Several of the stocks were in companies that own hotels.

Burr's stock sales were first reported by ProPublica and The Center for Responsive Politics. Most of them came on February 13, just before Burr made a speech in his home state in which he predicted severe consequences from the virus, including closed schools and cutbacks in company travel, according to audio obtained by National Public Radio and released Thursday.

NPR said Burr told a small North Carolina audience the virus was "much more aggressive in its transmission than anything that we have seen in recent history" and "probably more akin to the 1918 pandemic."

Burr's remarks were more dire than remarks he had made publicly and came as President Trump was still downplaying the severity of the virus.

A week earlier, on February 7, Burr had coauthored an opinion piece with Tennessee Senator Lamar Alexander that had reassuring words for Americans concerned about coronavirus.

"Thankfully, the United States today is better prepared than ever before to face emerging public health threats, like the coronavirus, in large part due to the work of the Senate Health Committee, Congress, and the Trump Administration," he and Alexander wrote.

There's no indication that Burr had any inside information as he sold the stocks and issued the private warnings.

It's illegal for members of Congress to trade stocks based on information the public doesn't have that they receive through their positions as lawmakers. Burr was among only three senators who voted against that measure in 2012.

The Associated Press cited a person familiar with the matter as saying the intelligence panel didn't have any briefings on the pandemic the week when most of the stocks were sold. The person declined to be identified to discuss confidential committee activity.

But at the time the panel was being briefed daily about the coronavirus outbreak, the Reuters news service reported.

A spokesperson for the senator told CBS News in a statement that Burr "filed a financial disclosure form for personal transactions made several weeks before the U.S. and financial markets showed signs of volatility due to the growing coronavirus outbreak. As the situation continues to evolve daily, he has been deeply concerned by the steep and sudden toll this pandemic is taking on our economy." The spokesperson declined to be identified in order to share the senator's thinking.

Burr released a statement on Twitter Friday morning saying he had "relied solely on public news reports to guide my decision regarding the sale of stocks on February 13."

"Understanding the assumption many could make in hindsight however, I spoke this morning with the chairman of the Senate Ethics Committee and asked him to open a complete review of the matter with full transparency," Burr continued.

Before the media reports about his stock sales surfaced, Burr shot back at NPR in a series of tweets Thursday, calling the NPR story "a tabloid-style hit piece" and saying NPR "knowingly and irresponsibly misrepresented a speech I gave last month about the coronavirus threat."

Burr tweeted that Americans were already being warned about the effects of the virus when he made the speech to the North Carolina State Society.

"The message I shared with my constituents is the one public health officials urged all of us to heed as coronavirus spread increased," Burr wrote. "Be prepared."

Burr said that, contrary to NPR's portrayal, the speech was "publicly advertised and widely attended."

Burr wasn't the only senator who sold stocks just before the steep decline due to the global pandemic.

Loeffler, Feinstein, Inhofe transactions

Georgia's Kelly Loeffler and her husband sold millions of dollars worth of stock in late January and early February as senators began to get briefings on the virus, also according to Senate records. In the weeks that followed, Loeffler urged her constituents to have faith in the Trump administration's efforts to prepare the nation.

The Daily Beast first reported that Loeffler sold the stock "on Jan. 24, the very day that her committee, the Senate Health Committee, hosted a private, all-senators briefing from administration officials."

Loeffler tweeted Thursday night that she was "informed of these purchases and sales on February 16, 2020 — three weeks after they were made." She also said, "This is a ridiculous and baseless attack. I do not make investment decisions for my portfolio. Investment decisions are made by multiple third-party advisors without my or my husband's knowledge or involvement."

She's married to Jeffrey Sprecher, the chairman and CEO of Intercontinental Exchange, which owns the New York Stock Exchange.

Loeffler, a Republican, is the Senate's newest member. She was sworn in on January 6 to replace Senator Johnny Isakson, who retired. She was appointed by Georgia Governor Brian Kemp and is up for re-election this year.

Pennsylvania congressman Brendan Boyle, a Democrat, tweeted that he's "officially referring" the Burr and Loeffler cases to the Securities and Exchange Commission for investigation.

In addition to Burr and Loeffler, California Democratic Senator Dianne Feinstein sold $1.5 million to $6 million worth of shares in late and mid-February, Senate records show.

However, Feinstein denied that this movement had anything to do with concerns about the coronavirus.

"During my Senate career I've held all assets in a blind trust of which I have no control. Reports that I sold any assets are incorrect, as are reports that I was at a January 24 briefing on coronavirus, which I was unable to attend," Feinstein tweeted.

She said that Senate rules also require her to report her husband's financial transactions. "I have no input into his decisions," she tweeted. "My husband in January and February sold shares of a cancer therapy company. This company is unrelated to any work on the coronavirus and the sale was unrelated to the situation."

That company was Allogene Therapeutics. Her disclosure form states that that on January 31, stock in the company worth $500,000 to $1 million was sold. Days later, a smaller portion was sold, worth up to $5,000. The company's share price actually rose substantially for weeks after the stock was first sold, before it started dropping after March 4.

Oklahoma Republican Senator James Inhofe sold as much as $400,000 in equities on January 27, disclosure reports show.

Inhofe said in a statement that allegations that he sold equities in response to the January 24 briefing were "completely baseless and 100 percent false."

At the Capitol Friday, he was asked by a reporter whether he had provided his financial adviser with any information on the coronavirus briefings.

"No," he replied, adding, "I was not at the meeting that was the controversial meeting." Inhofe's office confirmed that he had not attended the January 24 coronavirus briefing by top Trump administration officials.

Inhofe also said that once he became the chairman of the Senate Armed Services Committee over a year ago, he directed his investment adviser to "get rid of all stocks that we have — put it in mutual funds —no one can argue with that." Inhofe spokeswoman Leacy Burke told CBS News in an email that in December 2018, Inhofe instructed his financial adviser to move his investments from stocks to mutual funds in order to prevent any appearance of impropriety

At the Capitol, Inhofe was asked, "You did not direct the sale of any of these stocks?" He said, "I did not," and then offered the name of his adviser, "Keith," of whom Inhofe said, "he knows the instructions that were given, and he's been following those instructions for years." According to Burke, Inhofe's financial adviser does not consult or inform the senator of any transactions that are made. The "instructions" entailed only the direction to change from stocks to funds, were not for specific sales.

Word of the stock sales by senators elicited strong reaction. Among others, conservative Fox News host Tucker Carlson called on Burr to resign and face prosecution for insider trading if he can't offer "an honest explanation" of his transactions.

And former Democratic presidential candidate Julian Castro tweeted, "Senators Burr and Loeffler should be investigated by authorities and the Senate Ethics Committee. If the evidence suggests they engaged in insider trading, they should be charged and stand trial."