Retirement income scorecard: Systematic withdrawals

(MoneyWatch) Continuing our look at how to assess your future retirement income, let's turn our attention to "systematic withdrawals," which are one of three ways to generate a paycheck from what you have stashed away. Note: In previous posts, I've called this method "managed payouts," but the term "systematic withdrawals" is more descriptive and won't cause confusion between the term "managed payout fund" used by some mutual fund families. For more background on the three methods, you may want to review my recent post, "My four favorite ways to generate retirement income."

Financial planners and writers will often tell you something along these lines: If you invest in a portfolio balanced between stocks and bonds, withdraw four percent each year for retirement income, and give yourself an annual raise to account for inflation, there's a roughly 90 percent chance that your money will last for at least 30 years. Hence, the justification for the so-called four percent rule.

My four favorite ways to generate retirement income

Retirement income scorecard: Interest and dividends

IRAs and 401k: 3 ways to generate retirement income

Method #2: Systematic withdrawals

The four percent rule is actually a good starting point for considering an appropriate withdrawal rate. But if you fall into one of the following two categories, you might want to consider withdrawing amounts of lower than four percent:

-- If your retirement investments are actively managed and incur investment expenses of more than 50 basis points (0.50 percent), over the long run you may fall short of the net rates of return that justify the four percent rule.

-- If you're married, both you and your spouse are healthy, and you retire in your early to mid sixties, there's a good chance that one of you will live for more than 30 years.

If either of these statements applies to you, you may want to consider payout rates on your retirement income of 3 or 3.5 percent.

In addition, there's a point of view emerging from some financial analysts, such as Dr. Wade Pfau, that the analyses supporting the four percent rule are based on a period of U.S. history that may have been a remarkably good time for stock and bond returns. It may be that future returns on stocks and bonds won't be able to support a four percent withdrawal rate. If you believe this, you may want to use a lower withdrawal rate.

In spite of the above thoughts, you might consider a higher withdrawal rate if you're willing to accept some chance of running out of money before you die, or if you're willing to curb your withdrawals down the road if your investments sour. In short, setting the appropriate withdrawal rate is both art and science.

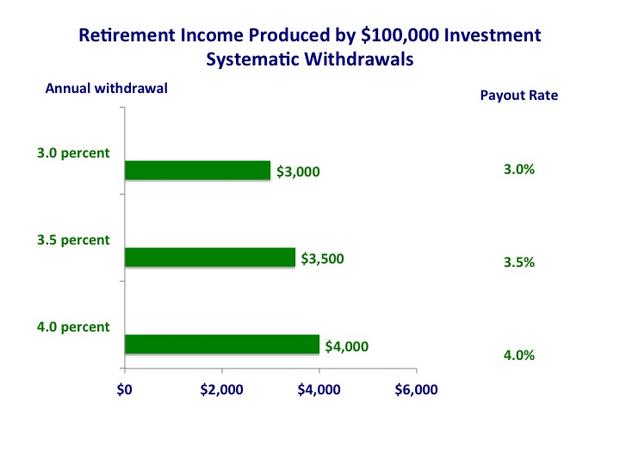

Here's the simple table comparing these payout amounts and rates for $100,000 in retirement savings.

Now let's look at managed payout funds offered by mutual fund companies. Vanguard offers its managed payout funds, and Fidelity offers so-called income replacement funds. These funds invest in portfolios balanced between stocks and bonds, and pay a monthly retirement income that includes interest, dividends, and principal payments. Here's a comparison of the annual retirement paycheck produced by these funds and their payout rates as of July 2012.

Since my April retirement income scorecard, the payouts from the Vanguard funds have slightly increased, while the payouts from the Fidelity funds have slightly decreased.

The payouts from these funds are generally higher than those from the simple managed payout rules shown previously. Why? A few reasons:

-- With the simple managed payout rule, your monthly income is intended never to decrease, even with poor investment returns (although it's not guaranteed). You start with a low payout rate to be able to withstand possible future unfavorable investment returns. With the Vanguard and Fidelity managed payout funds, your monthly income can decrease in the future if returns head south.

-- The Fidelity funds are intended to be exhausted at their target date (thus, the snarky nickname for this investment, "target death funds"). The Vanguard funds are intended to last throughout your life, but that's not guaranteed.

Also note that the Vanguard and Fidelity funds each have different asset allocations, depending on their growth goals, which explains the different payout rates.

Clearly, there are differences in the way managed payouts can work, and you'll need to spend some time learning about the different strategies and features. Don't simply pick the method or fund that generates the highest retirement income. And recognize that managed payouts require the most ongoing attention of the three different ways to generate retirement income.

The retirement income data in the charts above represent pre-tax income amounts. So it's important to recognized that federal and state income taxes will have a significant effect on your after-tax income and should be taken into account. The income taxes you pay will vary depending on whether your retirement savings have previously been invested before taxes in traditional IRA or 401(k) accounts or have been invested after taxes, such as in a Roth IRA. Your eligibility for special tax treatment on capital gains, ordinary dividends, or municipal bonds will also come into play.

Stay tuned for my next post that shows the third quarter retirement paycheck scorecard for Method #3, immediate annuities, and wraps up this series.