Retirement income scorecard: Interest and dividends

(MoneyWatch) How much retirement income can you generate from your 401(k), IRA or other savings? It's a critical question because it will affect how much money you'll have to spend for the rest of your life.

The answer can vary widely depending on a number of factors, the most important being the retirement income generator that you use (In my latest book, "Money for Life: Turn Your IRA and 401(k) Into a Lifetime Retirement Paycheck," I call these RIGs for short.) Your age, sex and marital status also have a significant influence. And your income will depend on a number of economic factors, such as interest rates, dividend payout rates and annuity purchase rates in effect at the time you retire.

- 3 ways to turn your IRA and 401(k) into a lifetime retirement paycheck

- Your most critical retirement planning challenge

- How to avoid going broke in retirement

To help you answer the vital question above, here's the next installment for 2013 of my retirement paycheck scorecard series. It shows you the amount of retirement income that can be generated from $100,000 in retirement savings as of the beginning of July for each of the three RIGs I summarized in my recent post, "3 ways to turn your IRA and 401(k) into a lifetime retirement paycheck." You may want to review that post for background and to familiarize yourself with the advantages and disadvantages of each method.

Retirement income generator #1: Interest and dividends only

One way to generate retirement income is to invest in a mutual fund that pays a regular dividend and then use just the interest and dividend payments to cover your living expenses. Because you aren't dipping into your principal, there's a very good chance you won't outlive your money. This method also offers the maximum flexibility and access to your retirement savings. The downside is this method produces the lowest amount of retirement income, as you'll see from this scorecard.

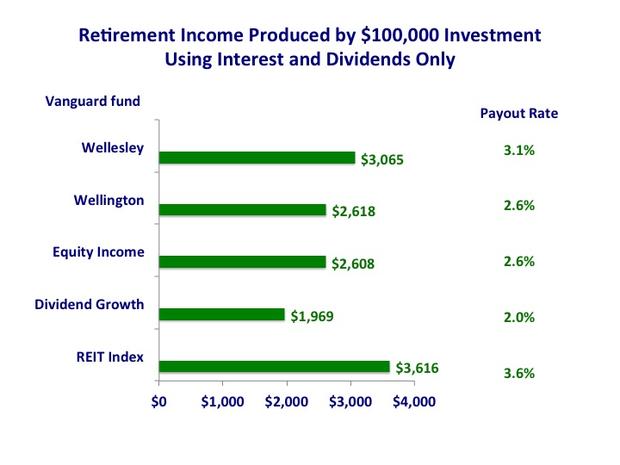

Shown below are the estimates of annual dividends paid from various Vanguard mutual funds that have regular dividend payouts and low investment management expenses, a very desirable feature with mutual funds.

These Vanguard funds don't chase yield, which is another desirable goal in investing for a retirement paycheck. Stocks and bonds with high dividend or interest rate payouts contain risks that can result in subsequent depreciation in the value of your savings.

The chart below also includes the payout rate -- the annual income as a percentage of the investment -- for the purposes of comparing it to other methods of generating retirement income.

How has the chart changed since the previous scorecard?

Compared to my previous scorecard in January, the payout rates have decreased slightly for all the funds except the REIT (which stands for real estate investment trust) index fund. That is because of the net result of changes in stock dividend payouts, reductions in interest income due to declining interest rates and changes in the underlying fund values.

Note that these funds have different asset allocations between equity and fixed income investments, which is one important reason for the differences in income. Roughly 37 percent of the Wellesley fund is invested in stocks, with the remainder in fixed income or cash. The Wellington fund is invested roughly 65 percent in stocks, with the remainder in fixed income or cash. The Dividend Growth and Equity Income funds are invested nearly 100 percent in stocks, while the REIT index fund is invested nearly 100 percent in real estate investments.

All the funds but the Dividend Growth product pay dividends quarterly, while the Dividend Growth fund pays dividends semi-annually. The above amounts assume the payout rates for the past 12 months will continue for the next 12 months. Your actual income will change to the extent that future dividend payments are increased or decreased from the past 12 months.

There are other mutual funds with goals similar to the Vanguard funds mentioned above. While these Vanguard funds have low expenses and favorable investment histories, I encourage you to do your own shopping with an online service such as Morningstar.

Finally, please note that the amounts shown above are pre-tax income amounts. Federal and state income taxes will have a significant effect on your after-tax income and should be taken into account. The income taxes you pay will vary depending on whether your retirement savings have been invested before taxes in traditional IRA or 401(k) accounts; have been invested after taxes, such as in a Roth IRA; or are eligible for special tax treatment on capital gains, ordinary dividends or municipal bonds.

Stay tuned for my next post, which will show the retirement income scorecard for RIG No. 2, systematic withdrawals.