Retirement income scorecard: Immediate annuities

(MoneyWatch) In the third part of our series this week on how to calculate your future retirement income, let's turn our attention to "immediate annuities," which are one of three ways to generate a paycheck from your retirement savings. (For background on these methods, you may want to review my recent post, "My four favorite ways to generate retirement income.")

Method #3: Immediate annuities

With an immediate annuity, you give your retirement savings to an insurance company, and it promises to pay you a monthly retirement income for the rest of your life (no matter how long you live). You can continue the income flow for your spouse or partner after you die by using a joint and survivor annuity.

Retirement income scorecard: Interest and dividends

Retirement income scorecard: Managed payouts

Retirement income drawdown: How to fix a serious flaw with the "four percent rule"

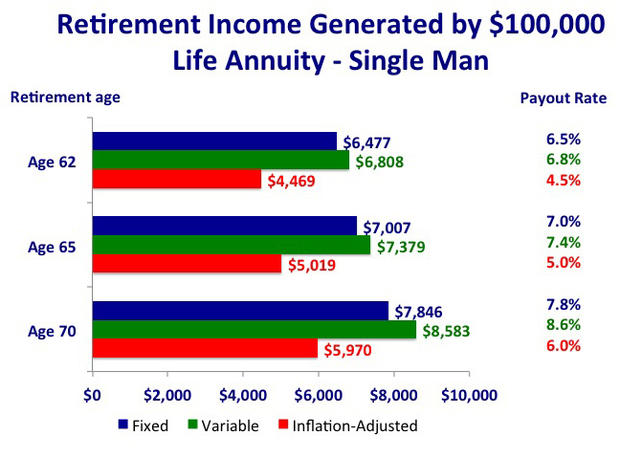

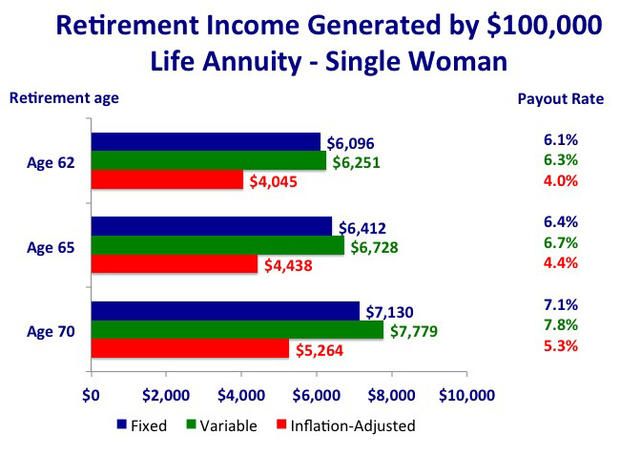

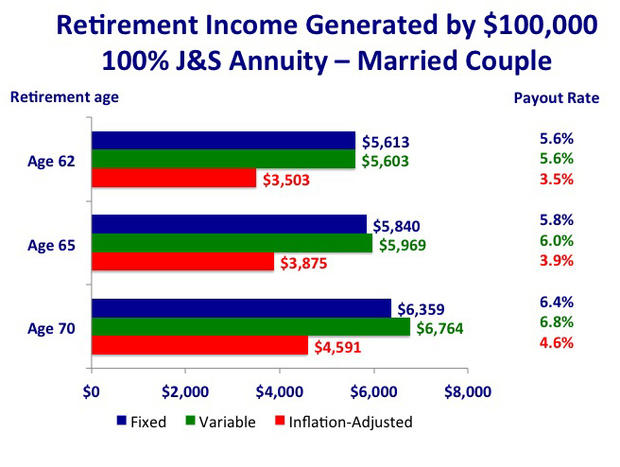

The amount of income this method generates will vary depending on the type of annuity you purchase, as well as your age, sex, and marital status. To provide more of an across-the-board look at this method, I've shown the results for fixed annuities, variable annuities, and inflation-adjusted annuities. For fixed and inflation-adjusted annuities, I used rates from Vanguard's Annuity Access service that uses the Hueler Income Solutions platform. I used immediate variable annuity rates offered by the mutual fund company Vanguard and American General Life Insurance, with an assumed investment return (AIR) of 3.5 percent.

Below are the annual incomes generated for a single man, a single woman, and a married couple at three different ages. I've used annuity purchase rates at the beginning of April 2012, assuming you have $100,000 to buy the annuity. I've include the annual payout rates in order to compare immediate annuities to other methods of generating retirement income. These payout rates are not to be confused with investment rates of returns.

Compared to annuity rates offered at the beginning of January, fixed rates have improved slightly, while inflation-adjusted rates have worsened slightly. Variable annuity rates are unchanged.

If you compare the retirement income amounts generated by the three methods I've described in this and the two previous posts, you'll see a wide range of results, depending on the method you use and your individual circumstances. In particular, you'll see that immediate annuities usually provide a higher initial retirement paycheck than managed payouts or depending only on interest and dividends.

It's particularly helpful to compare inflation-adjusted annuities with the "four percent rule," which is an application of managed payouts often recommended by financial planners. Inflation-adjusted annuities have higher initial payouts than the four percent rule for single men and single women; the initial payout rates for married couples are slightly lower with inflation-adjusted annuities. compared to the four percent rule. And keep in mind that the four percent rule has been questioned lately as possibly being too high, considering the current low interest rate environment and the significant fees for investment managers and financial advisors.

With inflation-adjusted annuities, you're guaranteed that your income lasts for the rest of your life and is adjusted for inflation, no matter how long you live and whatever happens in the stock and bond markets. With managed payouts, you hope to achieve these outcomes, but there's no guarantee, particularly if you suffer poor investment returns or live a long time.

The big tradeoff with immediate annuities is that you generally give irrevocable control of your savings to the insurance company, while with managed payouts you have the flexibility to tap into your savings. And with annuities, there's no money left for a legacy after you and your beneficiary die; with managed payouts, you can leave a legacy, with any money left in your accounts when you die.

When it comes to generating a retirement paycheck that will last the rest of your life, there's no single answer that is appropriate for everybody. Your answer depends on your goals and circumstances. I often recommend that you split your retirement savings between annuities and managed payouts, so that you diversify your retirement income and realize the advantages of each method.

Please note that the incomes shown above are pre-tax amounts. Federal and state income taxes will have a significant effect on your after-tax income and should be taken into account. The income taxes you pay will vary depending on whether your annuity was purchased with pre-tax investments in traditional IRA or 401(k) accounts, or with after-tax investments.

Because only you know which method or combination of methods might work best for you, you should take the time to learn as much as you can about the various methods of generating retirement funds. You'll thank yourself when you reach your 80s and 90s and your retirement income keeps chugging along.