Recession fears mount as stocks fall sharply

A wave of heavy selling driven by investors' concerns that the global economy could fall into recession rocked major stock indexes around the world Friday.

The Dow Jones Industrial Average, the S&P 500 and the Nasdaq each lost more than 1.5% on Friday, with the Dow closing at its lowest level since late 2020. The S&P is down 23% since its peak in January.

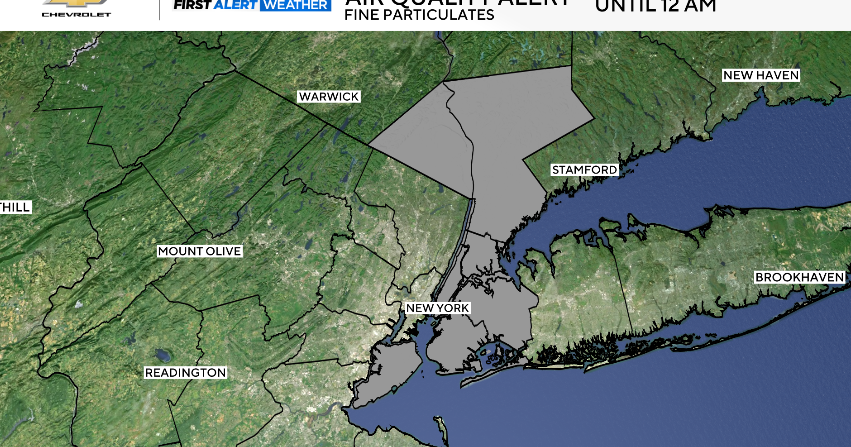

As Michael George reports for "CBS Saturday Morning," interest rate hikes aimed at cutting inflation are having a ripple effect on the economy. On Friday at the New York Stock Exchange, the president of a company called Sustainable Development Equity officiated the close of what was a terrible 486-point drop-day, preceded by a terrible week.

The market has dropped more than 5,000 points in 12 months, with more than 1,000 points lost this week. And there are more storm clouds ahead, according to UC Berkeley economist James Wilcox.

"It is very likely that we are going to have a recession, and the probability of that occurring has been rising all year really, and especially since the summer with the Fed being so aggressive about raising interest rates," he said.

The Federal Reserve board's trio of 2022 interest rate hikes has made borrowing harder for companies that want to grow, and for consumers — particularly those who hope to own a home. The average 30-year fixed mortgage interest rates have spiked from 3.3% to 6.7% over the past nine months thanks to the Federal Reserve board hikes.

"How much further mortgage interest rates might go up is awfully hard to know, but I think we could still see some other interest rates, auto rates, credit card interest rates, moving up, and that'll make it more difficult for people to buy new cars or to buy more expensive cars," said Wilcox.

In all of this, White House press secretary Karine Jean-Pierre addressed the economy on Friday.

"That is why we passed, that is why Democrats in Congress passed the Inflation Reduction Act. By the way, no Republicans supported that," she said.

The White House also points to gas prices, which have fallen significantly over the past few months, and one part of the economiy that remains strong: the job market. Unemployment is at 3.7%.