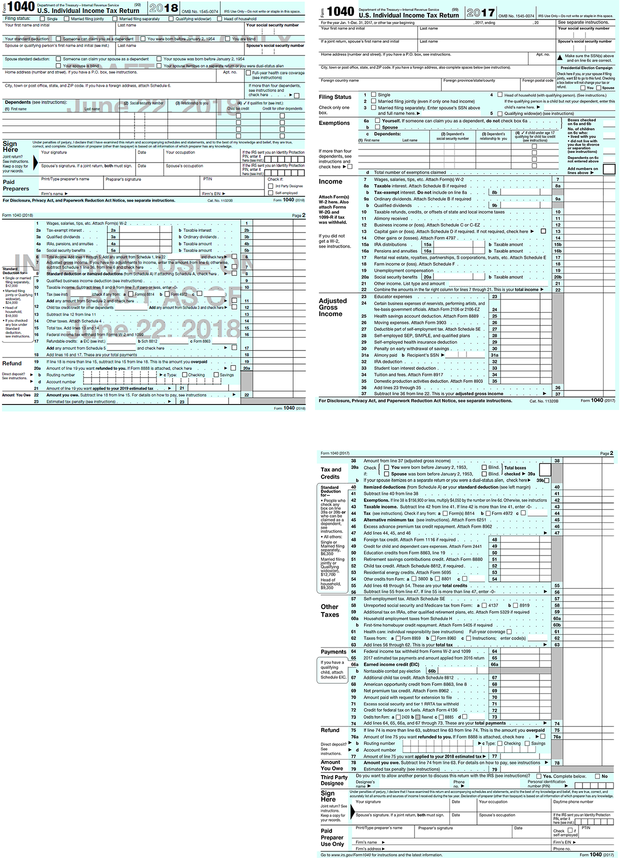

New "postcard-sized" IRS Form 1040 tax is smaller, but no less complicated

The government has succeeded in shrinking Americans' most common tax form down to one page -- but it hasn't necessarily made the IRS Form 1040 less complicated.

Here is a draft of the soon-to-be released Form 1040 that CBS News obtained (below left), compared with the current form (right).

A "postcard-sized" Form 1040 was a major selling point of the administration's divisive tax cuts. President Trump even kissed a version of a postcard at one meeting to show his approval.

But experts say that while the law does simplify the process for some Americans, many will still have to go through the same or similar hoops to complete their taxes with this new format.

"Don't confuse creating a postcard with simplifying a tax filing, it's not the same thing at all," said Howard Gleckman, a senior fellow at the Tax Policy Center.

The legwork to claim many popular deductions and provide other critical information has been moved off the tax form to one of six accompanying worksheets. Gleckman said that most taxpayers are going to have to fill out one, if not more, of the new accompanying forms. And the new structure makes some beneficial components of tax law, such as the ability to claim the earned income tax credit -- which is designed to help low- to moderate-income working people -- harder to find.

The new form is intended to replace the Form 1040, Form 1040A and Form 1040EZ (which already takes up a single page). About three-quarters of taxpayers currently use one of those three forms.

The tax law greatly increases the standard deduction, meaning that millions of Americans will simply claim the deduction and skip the time-consuming process of itemizing on their taxes. The Tax Policy Center estimates that about 27 million fewer taxpayers will itemize under the new law. But taxpayers may still need to crunch the numbers to see if they should itemize or not. And an estimated 19 million filers will continue to itemize, according to TPC, so they will still need to fill out one or more of the six additional forms.

The supplemental paperwork would be needed to make common tax moves, such as a reporting an educator expense or claiming a deduction for interest paid on a student loan, as well as reporting childcare expenses and retirement savings contribution credits.

It's likely that the bulk of taxpayers won't notice much of a difference, since more than 90 percent complete their taxes online. That means they still answer all the same questions regardless of how the paperwork is laid out.

"I am not sure this is going to make a whole lot of difference," Gleckman said.

The Treasury Department was expected to unveil the new form this week and did not immediately comment on the draft document to the AP. The IRS also did not comment.