3 perks of using online tax preparation services

Filing your taxes doesn't always have to be a chore. When you file your taxes online, you'll find easy ways to cut time and hopefully boost your return. The time to file is now: Tax Day 2023 has arrived.

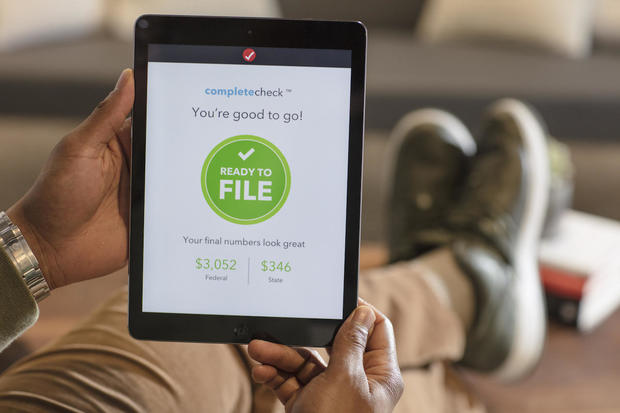

Filing electronically has grown increasingly popular over the past few years. More than 90% of U.S. taxpayers filed their taxes online last year, receiving an average refund of $3,039, International Revenue Service (IRS) data shows. The IRS reports 47% of e-filings were self-prepared.

Choosing to e-file, however, doesn't mean you have to go through the process alone. Online tax preparation software sites, like TurboTax, allow taxpayers to choose between a variety of versions — from basic to premier and others that include different features. A majority of taxpayers (53%, according to the IRS) who filed online last year sought professional help.

If you haven't filed your taxes yet, don't delay. It takes seconds to create an account on TurboTax, which has received more than 155,200 customer reviews rating the service 4.6 out of 5 stars. Get started now!

3 reasons to file your taxes online

As you can see, the majority of Americans opt to e-file, and the International Revenue Service even encourages it.

"IRS encourages taxpayers to file their tax returns electronically, which saves IRS money and allows taxpayers to get their refunds faster," the U.S. Government Accountability Office explained in a blog post last year while highlighting the IRS Free File program.

Here are three reasons why taxpayers decide to file their taxes online:

1. Convenience

More Americans are choosing to file electronically purely out of convenience. Many tax preparation services can connect you to a tax professional who can provide advice or review your return virtually.

"Filing electronically cuts out the mail time, and including direct deposit information on an electronically submitted form provides a convenient and secure way to receive refunds faster," the IRS says.

E-file.com agrees, highlighting convenience and accuracy as one of the top perks of filing electronically.

"Whether you use an online tax preparation service (compare popular services here) or use the IRS filing program, e-filing is the more convenient option. Instead of tackling mountains of paperwork, e-filing offers easy, step-by-step instructions and prompts," E-file.com states online. Learn more about filing your taxes electronically on E-file.com now!

2. Speed

Are you looking to get your tax refund as soon as possible? If so, e-filing can help.

If you decide to file on paper, you may end up waiting six weeks or more for the IRS to process your return, the IRS warns. "If you mail a paper Form 1040, U.S. Individual Income Tax ReturnPDF, it can take 6 to 8 weeks to process your return," the IRS states on its website.

E-filers typically receive their tax refunds in less than 21 days, possibly even faster if they chose to get their funds back via direct deposit — a recommendation by the IRS. TurboTax can help you track your refund so you get updates from beginning to end. Get notified when your e-filing is complete, when the IRS accepts and approves your refund, and when it's deposited into your account.

"Direct Deposit into a bank account is more secure because there is no check to get lost. And it takes the U.S. Treasury less time than issuing a paper check," the IRS notes.

If you've been waiting for six weeks or more and you filed electronically then utilize the IRS' Check My Refund tool to view your status. There are many reasons for potential delays. The IRS will usually reach out to you by mail to flag if there have been any issues with your information.

3. Options

There are plenty of free and low-cost filing options available to taxpayers — just make sure to do your research.

Mainly taxpayers with simple tax returns qualify for free versions. But it's worth noting that free versions typically only cover a limited number of situations such as W-2 income, IRS standard deduction and more. So, make sure to carefully do your research to ensure you fit the criteria and aren't hit with hidden charges. If you're in need of more guidance, consider getting an upgrade.

The IRS strongly recommends that taxpayers look into its Free File program which allows eligible taxpayers to file their taxes online via a trusted partner site or utilize Free File Fillable Forms.

"Free File is available to taxpayers with incomes in the bottom 70% of taxpayers. The income limit is adjusted annually for inflation. As stated above, for the 2021 tax season, Free File was available to taxpayers with an income of $73,000 or less," the U.S. Government Accountability Office describes. "Free File is not available to businesses no matter their size. To access Free File, taxpayers can visit IRS's website (IRS.gov), which lists companies that can help taxpayers with their returns online. Those companies ask the taxpayer questions about their tax situation and then prepare and submit taxpayers' returns to IRS."

You can also review different programs offered on other websites, like TurboTax. "Over the past nine years, Americans filed approximately 113 million tax returns completely free of charge using TurboTax, more than all other tax prep software companies combined," TurboTax claims in a February blog post. Again, not every customer will qualify. Learn more.

Ultimately, the best way to cut costs is by comparing tax preparation offerings and services to determine which program fits your needs for less. Use the table below to get started.