Minority-owned small businesses could see relief in $484 billion aid package

Washington — On top of the disproportionate health impact the coronavirus has had on communities of color, the economic toll has also been particularly severe for minority business owners, many of whom already faced structural challenges in establishing and maintaining their companies.

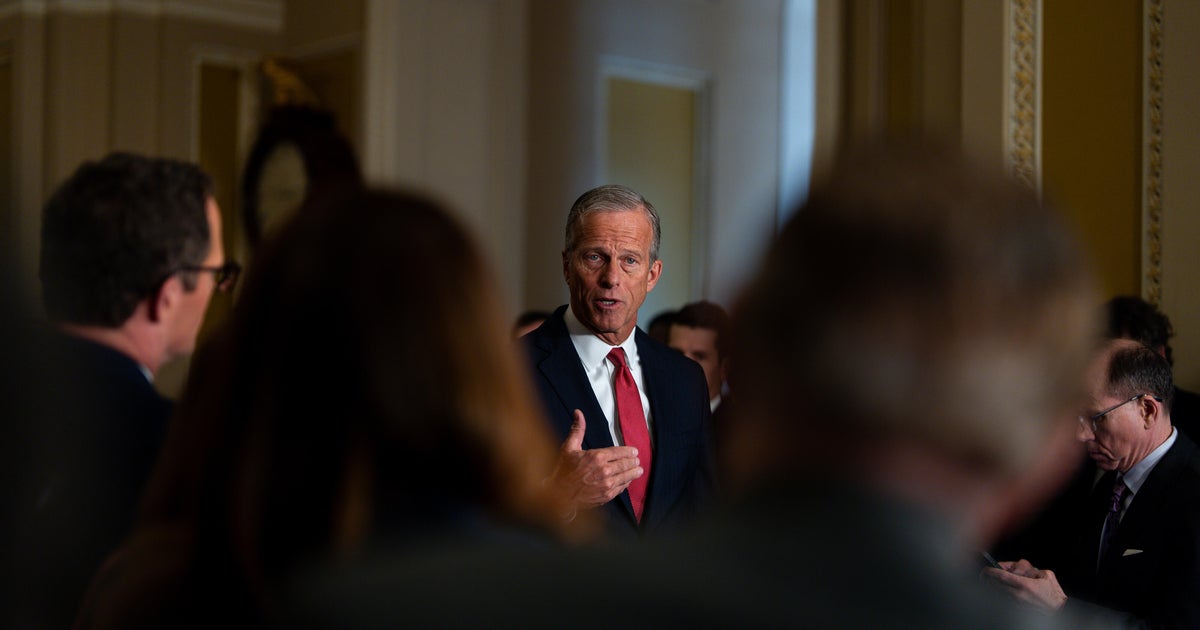

Lawmakers in Washington took a step toward ramping up relief to those businesses on Tuesday, with the Senate reaching a deal to expand funding for the Paycheck Protection Program (PPP), the main vehicle for providing loans to small businesses to cover payroll and certain other expenses.

The program ran out of its initial $349 billion in funding last week. The new bill allocates an additional $310 billion to the program and, crucially, $60 billion of that money is set aside for small and medium-sized financial institutions, with the goal of funneling more money to small, rural and minority-owned businesses.

Many of those companies found themselves excluded from the first round of relief, since they didn't have existing relationships with the large banks processing the loans. All told, nearly 5,000 institutions approved 1.7 million loans in the first two weeks of the PPP.

Democratic Congresswoman Barbara Lee, who is black and a former business owner, said in an interview with CBS News that it can be more difficult for minority owners to establish relationships with banks and gain access to capital even without a global pandemic. Banks may be less willing to provide loans to black business owners or people looking to set up businesses in neighborhoods with majority-minority populations. Lee noted that there were very few African-American owned banks in her California district.

A Brookings Institution report found that while people of color represent about 40% of the population, they comprise just 20% of the nation's 5.6 million owners of businesses with employees. Women make up 51% of the population, but only 33% of business owners with employees.

Large banks processing PPP loans favored businesses with whom they had preexisting relationships, leaving many minority-owned companies that rely on smaller institutions or banks that didn't participate on the sidelines. Data from the 2018 Small Business Credit Survey, conducted by the 12 Federal Reserve banks, shows discrepancies in approvals for non-PPP loans. Bigger banks approve 60% of loans requested by white business owners, 57% of loans sought by Asian business owners, 50% of loans sought by Hispanic business owners and 29% sought by black business owners.

"The old rules haven't worked, the old processes haven't worked in the past, so now we're seeing this pandemic exacerbate the old rules and processes that weren't working in the beginning," Lee said.

Widespread job loss during the Great Recession could be a harbinger of what's to come in the fallout from the pandemic. A 2014 study by the Census Bureau found that black and Hispanic-owned businesses were less likely to survive the recession than white-owned businesses.

In a letter to Treasury Secretary Steven Mnuchin last week, a group of Democratic senators and representatives, led by Senators Kamala Harris and Sherrod Brown and Representatives Ayanna Pressley and Gregory Meeks, asked that minority businesses not be "shut out" of the PPP. They also asked the Treasury Department and Small Business Administration to require lenders "to report on PPP lending to minority-owned businesses relative to their overall lending through the program."

"As we work to secure additional funding for the survival of small businesses across the country, it is crucial that we can verify the accessibility of federal assistance to all eligible companies. Without stringent reporting, we can neither confirm racial disparities nor correct any exclusionary lending practices under the Paycheck Protection Program," the letter said.

"The story of minority-owned businesses struggling to access capital is the story of banking practices that too often exclude people of color as potential customers. A federally guaranteed loan program must not do the same," the letter continued.

Lee, who signed the letter to Mnuchin, said that the pandemic had made people realize where the preexisting "gaps" are for minority-owned businesses.

"This is historical, and it's just felt a thousandfold now because we're in an emergency situation," Lee said.

Chris Scott Jr., a small business owner in the Germantown neighborhood of Philadelphia, told CBS News that he was not optimistic about "when or if" he'll hear back after applying for a PPP loan — especially now that the program is temporarily out of funding.

Scott, who is black, owns CES Technologies, an IT company that primarily provides field technician support for a contractor of the Philadelphia school district. When the city's schools closed due to the pandemic, Scott was forced to furlough his employees.

Scott received a $5,000 grant from the city of Philadelphia, which he used to extend his employees' health benefits for an extra few months. Scott himself filed for unemployment at the end of March, but has yet to hear back from the state.

"There's a bunch of bills that just don't stop coming," Scott said, referring to upkeep for his company's offices, as well as rent. He said he would likely have to go through a process of rehiring and retraining whenever he can get back to work.

"It's really starting all over," Scott said.

Gerrae Simons Miller is the owner of Mellow Massage & Yoga in the East Falls neighborhood of Philadelphia, which abuts Germantown. She told CBS MoneyWatch that she tried four times to apply for a PPP loan to support her massage and yoga studio, each attempt through a different lender. She successfully submitted an application last week, only to learn a few days later that the program has been tapped out.

"Now, it's been a month since we are closed, and I am starting to feel the pressure and negativity. It's hard to wake up and hear that there is no more funding. I mean, I applied four times, how was I missed?" Miller said.

The PPP loans are provide an incentive for small businesses to retain employees by making the loans forgivable if companies meet payroll. That dynamic can counterintuitively put a strain on a small business that's forced to furlough workers.

"My goal has always been to use it for payroll — that's the purpose of the loan. But why would I do that if laid off workers are getting an extra $600 a week and we don't have any work for them to do?" Miller told CBS MoneyWatch. "I would essentially be paying them for no work, which is fine, but at the end of two months, we could still be closed with no income and no savings and bills that need to be paid."

Scott, from Philadelphia, expressed frustration with the seeming lack of coordination between federal, state and local governments. The interim relief package passed by the Senate doesn't include assistance for state and local governments. President Trump has also frequently sparred with Democratic governors. Governor Tom Wolf of Pennsylvania is a Democrat.

"While they're having a pissing contest with each other, we're just waiting for them to get on the same page," Scott said about state and federal officials, noting that the need was dire for many small businesses in his neighborhood who were struggling even before the pandemic.

"This is the final nail in the coffin," he said.