Are Paycheck Protection Program loans working? Business owners divided on answer

The federal Paycheck Protection Program has been a lifeline for some small business owners as the coronavirus ravages the American economy. But other business owners are harsh in their assessment, calling the emergency loans overly restrictive and prone to exploitation by larger companies.

John Lettieri, co-founder of the Economic Innovation Group, an advocacy organization for entrepreneurs, underscored some of the program's shortcomings. The forgivable two-year loans charging just 1% interest emphasize the subsidizing of payrolls rather than the covering of rent, supplies and other major costs of doing business, he explained.

"By strictly linking relief to payroll expenses, PPP is by design of limited use to businesses struggling to meet a wider range of fixed costs," Lettieri said. "Even assuming a business can meet its other expenses, by limiting the total loan amount to roughly 10 weeks of average monthly payroll, it provides a short runway before a cliff of impending layoffs and permanent closure."

With millions of small businesses in jeopardy as the U.S. economy crumbles, the jury remains out on the $660 billion rescue effort. A coalition of business groups, including the American Hotel & Lodging Association, the National Restaurant Association and the National Small Business Association, is imploring Congress to improve the Paycheck Protection Program, dubbed the PPP and run through the U.S. Small Business Administration.

Not just about payroll

One complaint heard from many small business owners centers on the PPP's requirement that borrowers use 75% of the loan to cover payroll expenses if they wish to see the loan forgiven. That might help keep workers employed, but it doesn't leave much for realities like inventory, insurance and other business expenses that aren't favored under the terms of the loans.

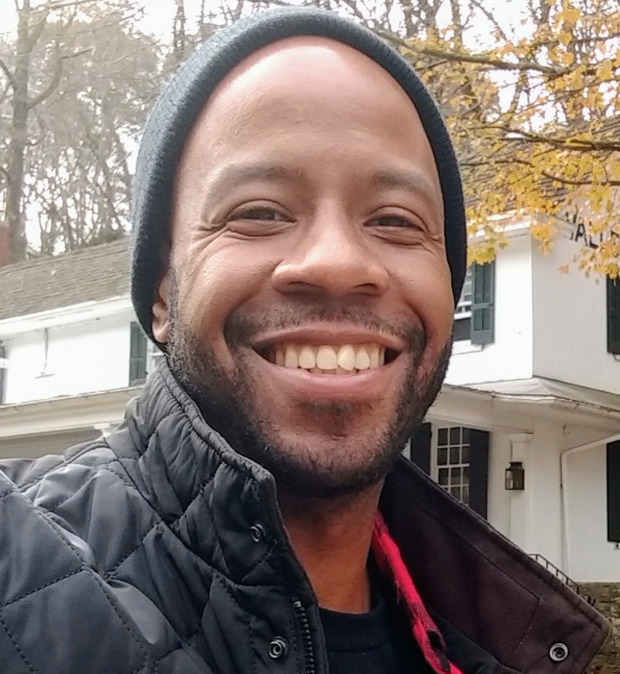

"While payroll is really important, our business has other critical expenses to handle in order for us to remain viable," Justin Moore, a store manager at Uncle Bobbie's Coffee and Books in Philadelphia told CBS MoneyWatch.

Although Uncle Bobbie's landed a roughly $80,000 federal loan, Moore said that the "PPP needs to be adjusted for these new realities. It's not about bringing people to work at this point when there is no work to be had."

The reality he sees is a long road to economic recovery: "It's a little redundant to use the PPP now when [Uncle Bobbie's workers] could and should collect unemployment, versus in four to five months from now when we reopen and we don't have the sales to buoy payroll," More explained. "We probably won't be open normal hours — we will probably have reduced hours, and that's when those funds would really help us out."

Meantime, the clock is ticking for Moore's 17 workers. While all have filed for unemployment, the money has been slow to materialize. He is weighing using part of the PPP money to keep employees on the payroll, which would qualify at least some of the loan to be forgiven. The other funds could go to covering his insurance premium, maintaining the coffee shop's security system and other costs.

"A great fit"

The PPP is working better for small businesses that need to get employees back to work immediately. Jared Ingold, owner of Vardagen, a Los Angeles-based apparel company that prints original, hand-drawn designs on garments, said his sales plummeted when the store closed and customers stopped placing orders.

"Retail is our biggest revenue stream, and also our print shop in Indianapolis where we do some custom printing. So the two biggest parts of the company were shut all the way down immediately," he said.

To keep his 10 workers gainfully employed, Ingold worked quickly to beef up internet sales by designing a coronavirus-themed collection and investing in online advertisements. He applied for an $80,000 loan through the program, which he plans to use on employee salaries and rent.

"It would put us back on track, and we would be able to pull right through this. For what we are doing it would be really valuable," he said.

Dan Barber, a chef and owner of Blue Hill restaurant in Manhattan's West Village and Blue Hill at Stone Barns, New York, said the PPP will buy him time as he rethinks his approach to the business, which employed more than 170 people before the shutdowns. To that end, he is putting some of his staff to work packaging produce from his upstate New York farm into boxes for at-home preparation.

"For us, it's a great fit, but for others, it's just encouraging them to congregate people. Anyway, I am grateful for it if it can come through it's exactly what we need. It's all deductible if you are employing people — that's the ticket — and my employees are my biggest cost," Barber said.

Public relations professional Warren H. Cohn, founder of New York-based Herald PR and Emerald Digital, a New Orleans marketing firm, narrowly avoided having to cut workers after receiving PPP loans of $157,000 (for Herald) and $55,000 (for Emerald).

Though business is down by some 20%, Cohn said, a few clients are relying on his guidance to navigate the pandemic. "We represent an ambulance company, an event medical service company, and some law firms that are pivoting toward coronavirus angles and talking about custody battles, quarantine visitation, the increase in divorces and commercial real estate bankruptcies," he said.

Still, there are some things the PPP cannot protect against. Public health experts warn that the coronavirus, which is now spreading more slowly in most parts of the U.S., could flare again toward the end of the year.

"Certainly if the pandemic comes back in fall and winter, we will be in deep doo-doo with or without the loan," Cohn said.