Oil prices steady despite Iran tensions

Weak demand for oil among big, developed world countries has kept the price of crude remarkably steady despite increasing tension with Iran, according to new research.

Benchmark Brent crude-oil futures have been essentially unchanged for more than six months, notes economist Ed Yardeni of Yardeni Research. Oil futures traded in New York have likewise been steady, stuck at around $100 a barrel even as the crisis mounts in the Middle East.

The surprising stability in oil prices comes amid the European Union's new ban on Iranian oil imports and the U.S. enacting tougher sanctions against the nation late last year. Furthermore, Iran has threatened to close the Strait of Hormuz, potentially disrupting global oil supplies.

Gold prices driven by Asia, not inflation

Oil prices poised to hit 150-year high

"Despite Iran's saber rattling, the price of oil hasn't soared," Yardeni notes. "The price of a barrel of Brent has been hovering around $110 since last summer."

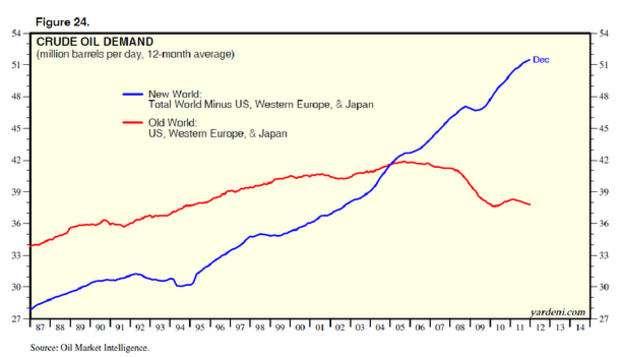

Indeed, if it weren't for Iran, the price of oil would probably be falling, Yardeni says. "Demand is especially weak among the Old World countries of the U.S., Western Europe and Japan -- where crude oil usage has slipped back down in recent months to the 2009 recession low," Yardeni writes. See the chart, courtesy of Yardeni Research, below:

Demand is weakest in Western Europe, Yardeni says, as the continent struggles with its sovereign debt crisis and looks poised to fall into another recession. The region's oil demand recently hit its lowest since the end of 1994.

"Crude oil usage also turned down in the U.S. during the second half of last year," Yardeni writes.