Will North Korea rain on Wall Street's endless summer?

After nine straight days of the Dow Jones Industrials index setting new highs ended on Tuesday, U.S. equities slid again on Wednesday. The consecutive drops were primarily in response to the frightening feud between North Korea's Kim Jong Un and President Donald Trump, who promised to hit North Korea with "fire and fury" if it makes any further threats to the U.S. Kim immediately responded by threatening Guam -- a U.S. territory -- with a preemptive nuclear strike.

For investors, who've been enjoying a "Goldilocks" scenario in the markets -- with economic growth, monetary policy and inflation all just right to support the ongoing vacation from volatility -- the sudden prospect of a nuclear exchange is rattling sentiment.

Coming after Tuesday's modest decline in stock prices, Wednesday's follow-up marks the first two-day retreat since July and could violate uptrend support for the first time since June. But more than that, it could lead to the possible violation of the post-election "meltup."

It has been more than a year since the last significant market correction. Investor sentiment and positioning has reached extremes since then. How painful would a correction -- a 10 percent pullback -- be?

Of course, that depends on how overweight an investor's equity allocation is. If you bulled up on recent momentum favorites like Boeing (BA) and Apple (AAPL), you'll likely feel it worse. Those who focused on defensive, yield-sensitive areas like utilities and consumer staples will be less affected because yields are set to decline in a risk-off environment, boosting interest in dividend stocks.

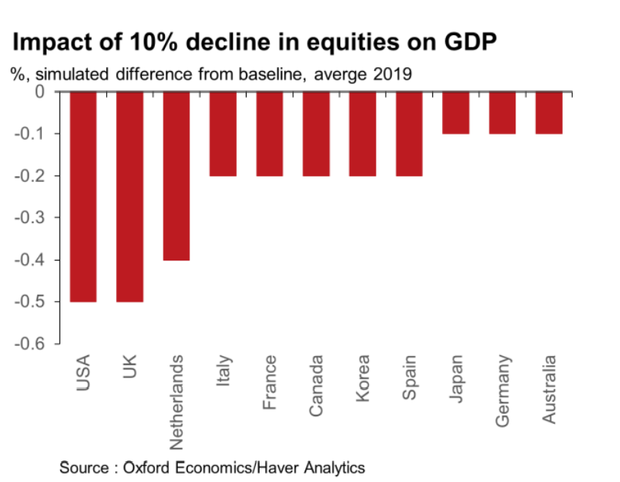

What about the economy as a whole?

Oxford Economics crunched the numbers: A sell-off led by a reduction in "irrational exuberance" could trim about 0.5 percent off U.S. GDP growth (chart above). And certainly, many believe confidence is too high: On a cyclically adjusted price-earnings basis, U.S. equity valuations have already exceeded the highs seen before the 1929 crash. The only time in history stock prices relative to fundamentals were more expensive was during the dot-com bubble.

A larger impact would be felt if the catalyst for the market correction directly hits the economy, via a policy mistake, like the Federal Reserve tightening too aggressively. A war with North Korea, likely spilling over into relations with China and Russia, probably qualifies.

In fact, the most severe declines of this bull market's post-QE3 era -- that is, since the Fed unleashed its third round of bond-buying stimulus in 2012 -- have been related to fears over China. Signs of a Chinese economic slowdown in August 2015 dropped stocks 11 percent. New Year gloom surrounding China and its currency volatility resulted in a 10.5 percent decline in 2016.

A hot war with North Korea could make those episodes seem benign in comparison.