No Fed surprise now, but prepare for drama ahead

For all the buildup to Wednesday's Federal Reserve policy announcement -- the first in nine years in which an interest rate hike was considered -- the result was a bit anticlimactic: The Fed held interest rates near zero percent, downgraded its 2015 GDP growth forecast to account for beginning-of-the-year softness and left its "dot plot" of rate expectations for 2015 unchanged.

That means the Fed still expects two interest rate hikes this year, as it did in March, with four policy meetings left in the year. With the first liftoff expected in September, that means a second hike could come in October or December.

Investors yawned in response, with the major averages finishing mixed. The Dow Jones industrials remain just below the 18,000 level -- a threshold first reached back in December.

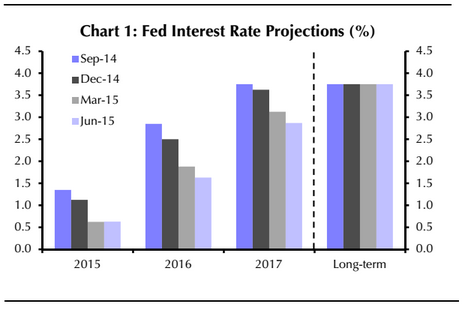

The median forecast from individual Fed policymakers puts the Federal Funds rate at 0.625 percent at the end of the year, which is where the estimate was in March. However, the median forecast for year-end 2016 and 2017 has been lowered to 1.625 percent and 2.875 percent, respectively (down from 1.875 percent and 3.125 percent).

This remains well ahead of the futures market, where traders expect only a single rate hike around December.

In her post-announcement press conference Fed chair Janet Yellen said she's still waiting for improvements in inflation and the labor market (specifically, wage gains) before moving to raise rates. But she also tried to stress that the exact timing of rate liftoff isn't as important as the trajectory of subsequent rate hikes. That's her attempt to diminish the drama surrounding the approach of the first rate hike since 2006.

Joseph LaVorgna at Deutsche Bank believes the Fed is on track for a September rate hike as the policy language highlighted continued job gains, saying "underutilization of labor resources diminished somewhat."

Paul Ashworth at Capital Economics agrees on the September timing, but worries that rising wage growth and core price inflation will force the Fed to hike rates three times this year to upwards of 1 percent.

That's because he's looking for the unemployment rate to fall from 5.5 percent in May to 5 percent by year-end and 4.5 percent by the end of 2016 (vs. the Fed's projections of 5.2 percent and 5 percent, respectively). As a result of this improvement, the annual pace of wage inflation should increase to 3 percent by year-end 2015 and 3.5 percent by year-end 2016.

Ian Shepherdson at Pantheon Macroeconomics shares a similar view, warning that the "game will be up" should the unemployment rate drop faster than the Fed currently expects. Yellen will run out of excuses for holding short-term rates at emergency levels first reached in late 2008. And that means the end of the greatest experiment in accommodative monetary policy in human history -- with interest rates never this low for this long -- is about to begin.

It's hard to believe stocks will remain so calm once that happens.