Most tax dodges by the ultra-wealthy are perfectly legal

A recent New York Times report has set off a debate over whether President Donald Trump's family broke tax laws when they took over the business empire of his father, Fred Trump. But the bigger lesson, tax experts say, is that wealthy Americans avoid taxes all the time -- legally.

Most people work for a living and pay taxes on their earnings. (Many pay income tax as well as payroll taxes, which fund Social Security and Medicare.) The ultra-wealthy, however, are able to get generate most of their income in ways that are much less heavily taxed. They're also able to move those assets around while paying very little tax.

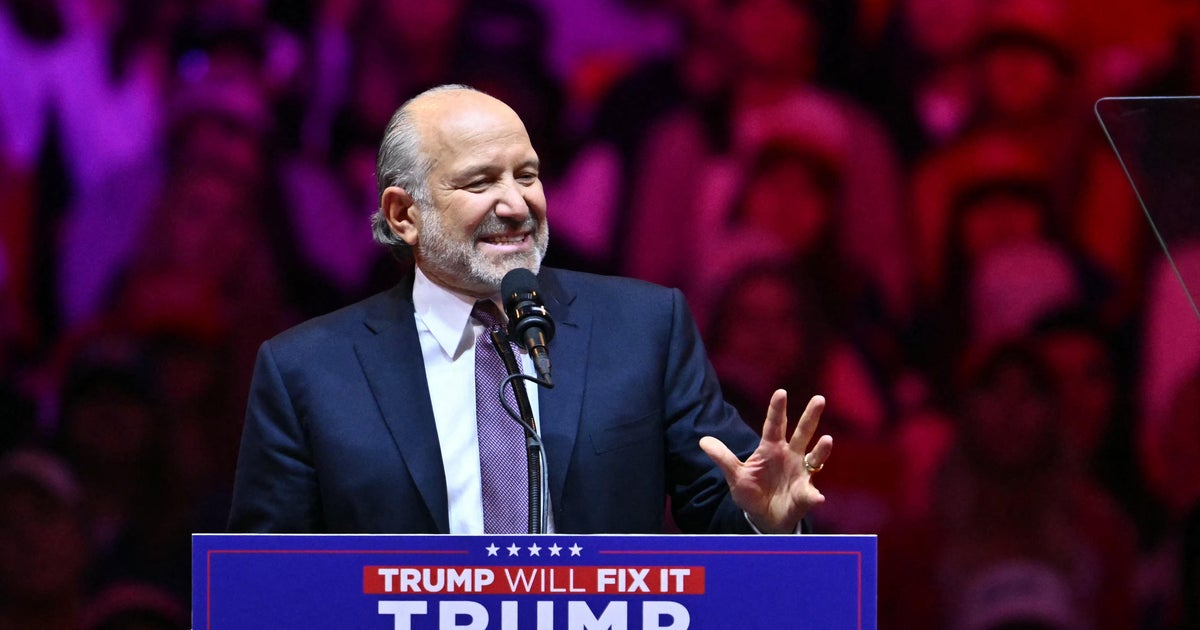

Broadly speaking, the government puts three types of taxes on individuals. "There's gift tax, for when you're alive and give stuff away; estate tax, for when you die and give stuff away, and income tax," said Harvey Bezozi, a CPA and founder of Your Financial Wizard. All of these taxes can be slashed -- if you have the resources.

Here's a slate of tried-and-true methods used by many top income-earners to lower their taxes.

Lose money, but only on paper

The richest Americans store wealth in many forms, including stocks, houses, boats and artwork. Most of these assets will gain value over time. But if a stock decreases in value, it's possible to sell it and use the losses to offset other income. That technique is called "tax loss harvesting," and it's perfectly legal.

Although there's a limit to how much you can write off in a given year, any losses over that limit can be used in future years.

If you happen to own real estate, the advantages are even greater. The IRS allows you to deduct many types of improvements made on your real estate, as well as wear and tear. In 1995, according to the New York Times, Mr. Trump reported a loss on real estate that was large enough to wipe out taxes on future income for a full decade.

Great GRAT

Say you want to transfer your real estate to a child. Typically, if a person makes a gift of a building worth $10 million, the IRS requires them to pay a gift tax, as if it were $10 million in cash. But by splitting it up among multiple children, it's possible to dramatically reduce the tax owed.

One instrument designed for this purpose is what's known as a "grantor-retained annuity trust," or GRAT, which is specifically designed for shifting wealth to avoid taxes. Once the GRAT is set up, splitting up its ownership among multiple people greatly reduces the tax owed on the total.

Say that $10 million building is split among four people -- a wealthy couple and their two children. One-fourth of $10 million is $2.5 million. As long as the owner has less than a 50 percent stake -- in this case 25 percent -- the IRS allows the person to discount it severely.

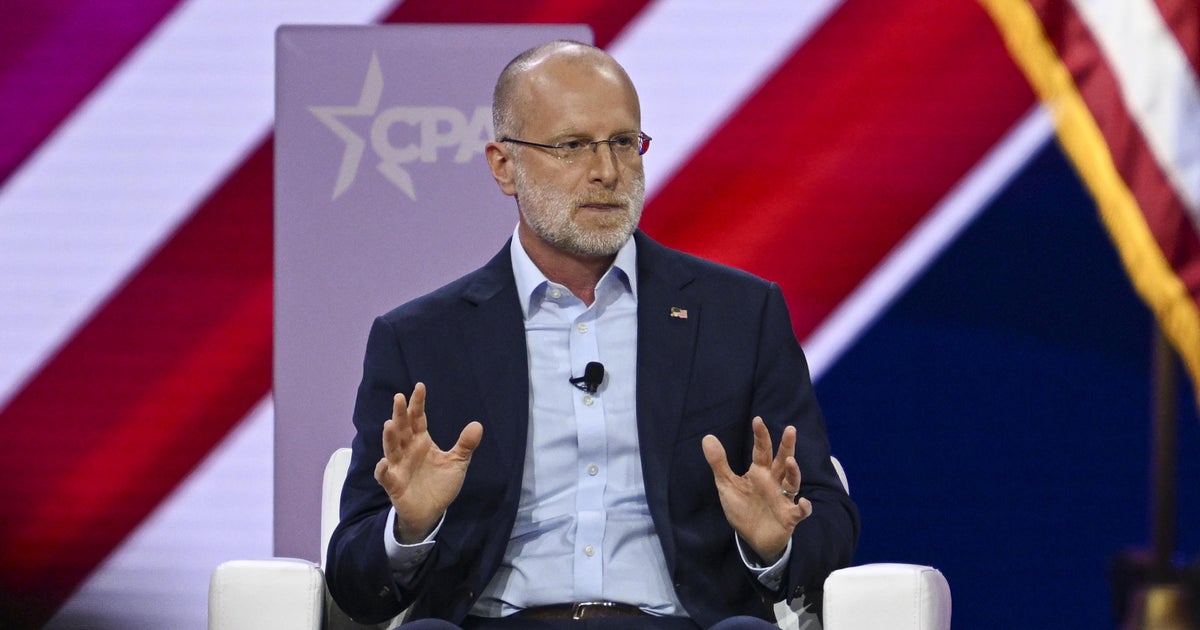

Fred Slater, a CPA working in Manhattan, used the example of four children who inherit a parent's condo: "If you have four people owning an apartment, if you're one of them and you want to sell it, how easy is that?" he said. The lack of control over an asset allows its owner to discount what it's worth by 20 or 30 percent, so that a $2.5 million portion of a building would be taxed as if it's worth just $1.5 million.

Appraisal games

Unlike pricing a stock, which is straightforward, pricing assets like buildings or artwork requires using the services of a professional appraiser.

There are many types of appraisers and many methods for arriving at a price—and therein lies the potential for fudging. There is no single set of rules an appraiser must follow in arriving at a dollar value for a given asset. Because they're so reliant on a single individual, "Valuations are perhaps the most easily fudged and most difficult to disprove numbers in tax reporting," according to Wealth Management, a trade magazine.

Of course, there's a chance the IRS will accuse you of undervaluing that asset, and it may ask you to pay a higher tax rate. But the changes are usually minimal. In fact, the IRS audited the Trumps' gift returns and determined that their estate had been undervalued, and bumped up the valuation to $57 million.

Nine years later, the buildings fetched a total sale price of 13 times that amount.