More tips to fit your retirement finances to your life

(MoneyWatch) Welcome back to my third post on the methodical approach you can use for implementing one of the most important retirement planning decisions you'll make -- sorting out out which retirement income generator (RIG) or combination of RIGs might best fit your goals and circumstances.

- How to fit your retirement finances into your life

- How to make better decisions about retirement income

My previous post looked at the RIGs that would correspond to your rating of the first two LIFE goals that I introduced in the first installment of this series. Here I'll show how you can assess the importance of the last two goals, and will summarize the RIGs that might fit under different ratings for these goals.

LIFE Goal #3: Flexibility and Potential for a Financial Legacy

Now it's time to consider the third LIFE goal: Flexibility and the potential to leave a financial legacy. Once again, imagine how you'd feel if you weren't able to leave a legacy to your children or charities. Is it more important to generate as much retirement income as you can at the expense of leaving a legacy? Or can you accept a reduced retirement income so that you're able to leave a legacy?

You also need to consider how important it is to you to be able to access your money whenever you want. But remember, if you can access it -- and spend it -- it won't be there to generate retirement income for you.

So you'll give this goal a low score if you don't have a big need to access your savings and have set aside a reserve for emergencies or other large expenditures. You'll also score this goal low if leaving a legacy to your children or charities isn't important to you. For example, you may have other assets that you can leave as a legacy, such as your home, jewelry, art, cars, and so on. On the other hand, you'll rate this goal higher if flexibility and access to capital are important to you and if you want to leave a legacy to your children or charities from your retirement savings.

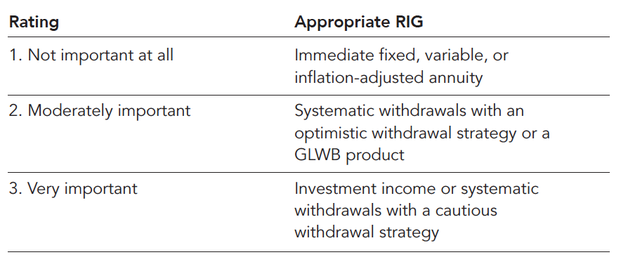

After rating this LIFE goal, take a look at which RIGs might best fit your circumstances:

LIFE Goal #4: Exposure to Minimal Market Risk

Before you rate this goal, here's something to think about: How have you reacted during previous market declines? Did you lose sleep, or panic and sell your assets? Try to imagine how you'd feel in the future when the market declines, as it inevitably will. Did you react negatively or did you calmly ride out the market shift?

You'll give this goal of exposure to minimal market risk a low rating if you have significant sources of lifetime retirement income that won't decrease during market downturns, such as Social Security and an employer-sponsored pension. You'll also give this one a low score if there's a large margin between your total retirement income and your estimated living expenses; if that's the case, you could probably tolerate a decrease in your retirement income if there's a market downturn.

If, on the other hand, you can't tolerate a drop in income and you're living "close to the edge," then you'll give this one a higher score. You'll also give this one a higher score if you panicked during previous market downturns and sold your assets at a loss because you were too scared to hang on during the rollercoaster ride.

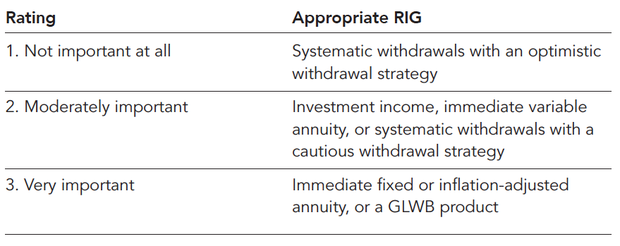

After you've assigned a rating to this one, see which RIG or RIGs might work best for you:

It might take awhile for you to think about your circumstances, rate each LIFE goal, and investigate the RIGs that meet your circumstances. It will also help a lot to see how much retirement income you can generate with each RIG, as the amount of income can influence your decision. It's good use of your time to figure this out, since you're planning for a retirement that can last 20 to 30 years or more.

This post and the tables are an edited excerpt from my recent book Money for Life: Turn Your IRA and 401(k) Into a Lifetime Retirement Paycheck.