MoneyWatch Week Ahead: Election Day and markets

(MoneyWatch) "The trouble with free elections is, you never know who is going to win." - Leonid Brezhnev

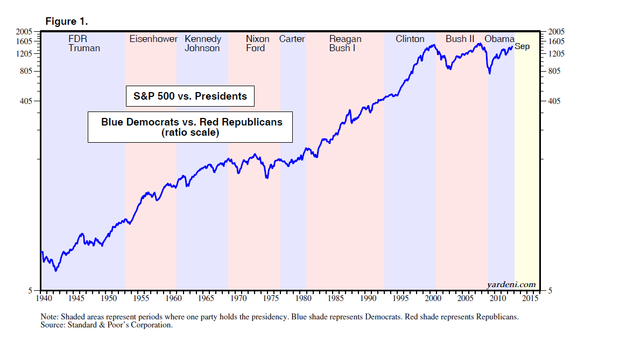

Every four years, investors try to divine which candidate would be better for markets. Of course, as every mutual fund prospectus says, "past performance is not an indicator of future results." That said, since 1900, the U.S. stock market has returned 7.1 percent annually under a Democratic president and 3 percent under a Republican president.

Before you buy or sell anything Wednesday morning, Dr. Ed Yardeni has reviewed the data and doesn't "see any reliable pattern relating the market's performance to which party is in the White House or has majorities in both the House and the Senate at the same time."

Regardless of who wins the election, most economists agree that there will continue to be tough times ahead for the U.S. economy. Neither candidate has a magic wand that he can wave that will miraculously make economic growth soar from the current 2 percent to the post World War II average of 3.3 percent; create 300,000 jobs per month; increase wages for lower to middle income earners; or propel housing prices to bubble highs. Additionally, with the country more focused on debt reduction, it is likely that taxes will rise for most Americans and government spending social programs will drop. In short, the clean up and recovery from the past years of excess will continue to cause pain.

In a Sandy-shortened week, stocks were essentially unchanged, despite better-than-expected economic news, culminating with the last jobs report before the election. The U.S. economy added 171,000 new jobs in October and the unemployment rate inched up to 7.9 percent from last month's reading of 7.8 percent. No president since Franklin Delano Roosevelt has won re-election with a jobless rate higher than 7.4 percent. FDR won a second term in 1936, when the rate was 17 percent, down from down from 22 percent when he was first elected. The last president since the Great Depression to win re-election with a rate of 7.4 percent or higher was Ronald Reagan in 1984. Of course, as mentioned above, take all references to past performance with a grain of salt!

-- DJIA: 13,093, down 0.1% on week, up 7.2% on year

-- S&P 500: 1,414, up 0.1% on week, up 12.4% on year

-- NASDAQ: 2,982, down 0.2% on week, up 14.5% on year

-- December Crude Oil: $84.86, down 1.6% on week

-- December Gold: $1,675.20 (8-week low)

-- AAA National Average Price for Gallon of Regular Gas: $3.48 (down $.30 from a month ago)

THE WEEK AHEAD:

Mon 11/5:

Toyota, Zillow

10:00 ISM Non-manufacturing survey

Tues 11/6: ELECTION DAY

CVS, NYSE Euronext

Weds 11/7:

CBS, Macy's, J.C. Penney, Kraft, Time Warner

7:00 MBA mortgage purchase applications index

3:00 Consumer credit

Thurs 11/8:

Disney, Groupon, Nordstrom, Kohl's

8:30 Weekly jobless claims

8:30 International trade

Fri 11/9:

8:30 Import-export prices

9:55 Construction sentiment

10:00 Construction spending