Hiring surged in June despite inflation, with 372,000 jobs created

Hiring stayed strong in June despite persistent inflation and worries about a coming recession. Employers added 372,000 jobs, the Labor Department said Friday, surpassing the 270,000 economists had expected.

The unemployment rate remained at 3.6%, close to its pre-pandemic low.

"Today's jobs report is a milestone marking a more-than-full recovery in private-sector employment," Julia Pollak, labor economist at ZipRecruiter, said in a note. "Employment gains were surprisingly broad-based, with gains even in those industries that tend to be most sensitive to interest rate hikes."

The government reported increases in professional and business services, leisure and hospitality, and health care. The information sector, despite high-profile layoffs at tech companies in May and June, gained 25,000 jobs.

Manufacturing added 29,000 jobs, bringing the sector's employment to pre-pandemic levels. Transportation and warehousing added 36,000 jobs.

Government employment showed a slight decline of 9,000 jobs.

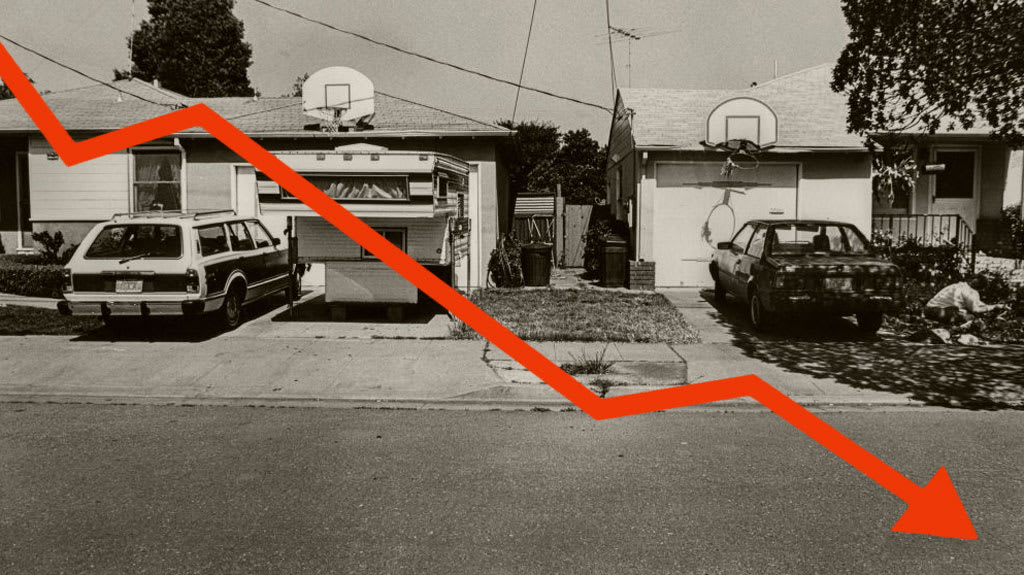

A gradual cooldown

Monthly job gains have slowed from an average of 500,000 in the first three months of the year to an average of 375,000 in the next three. Before the pandemic, a month where 200,000 jobs were added was considered strong.

At the same time, the government's report revised down early estimates for May and June to show 74,000 fewer jobs were created than initially thought. Wage growth slowed, with average pay increasing 5.1% year over year, showing the job market is cooling.

"Average hourly wages decelerated for the third consecutive month to 5.1% in June, down from a recent peak of 5.6%. While still proceeding at a strong pace, wage growth continues to trail inflation — especially for important household expenditures such as food, fuel and housing," Joel Kan, assistant vice president of Economic and Industry Forecasting at the Mortgage Bankers Association, said in a research note.

The participation rate for workers aged 25-54, which measures people who are working or looking for work, also edged down slightly.

The figures complicate the Federal Reserve's job of slowing inflation without plunging the country into a recession. The Fed has already embarked on its fastest series of rate hikes since the 1980s, and further large increases would making borrowing much costlier for consumers and businesses, increasing the risk of a recession.

The Fed may regard the June job gain as evidence that the rapid pace of hiring is feeding inflation as companies compete to attract workers.

Last month, Powell conceded the Fed's rate hikes were likely to increase the unemployment rate, and said that overseas factors, such as Russia's invasion of Ukraine, which has elevated gas and food prices, will make it difficult to avoid a recession.

The Associated Press contributed reporting.