Millennials more likely than seniors to fall for online scams, research shows

LOS ANGELES -- Older people are often warned they could be the targets of con artists, but a surprising new report from the Federal Trade Commission says younger Americans -- those in their 20s and early 30s -- are even more vulnerable to scammers.

Twenty-nine-year-old David Sigman of Los Angeles says he never thought he would fall victim to a scam.

"I felt violated. I was really beside myself. I was most upset that I let myself down," Sigman said.

Sigman needed money, so he signed up to "mystery shop" local businesses and review their customer service. The company he found online seemed legit, paying him a small fee for the first couple of jobs. Then in January, he got a bigger assignment: evaluate money-transfer businesses by cashing a $2,900 check the company sent him, then wire the money back to them.

"Shortly after, a couple of hours later, after taking all that money out from the bank, and sending it away, I got a call from Wells Fargo saying that its fraudulent, and I was on the hook for the entire amount that's been taken out," Sigman said.

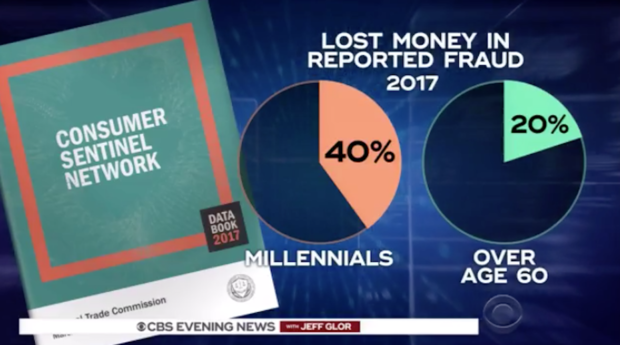

Fake-check fraud can hit anyone, but a new "scam risk report" from the Better Business Bureau (BBB) shows it's one of the most frequent tricks played on millennials ages 25 to 34. On top of that, the Federal Trade Commission (FTC) found twice as many millennials who reported fraud in 2017 lost money as did people over 60.

"Some of these older folks are doing a really good job recognizing fraud when they come upon it. They're doing a really good job avoiding a loss and they wanna warn people about it,' said Monica Vaca, Associate Director of the FTC's Division of Consumer Response and Operations.

While older people were more likely to become victims of phone scams, the BBB reports younger people were "more likely to fall for" online scams on social media or the Internet.

"I like to think I am fairly well-educated, and I was completely blindsided," Sigman said.

One interesting thing to note: When the older people did lose money, they lost more -- a median $621 for those in their 70s, as opposed to a median $400 for those in their 20s.