Kim Kardashian, after taking over popular culture, is launching a takeover firm

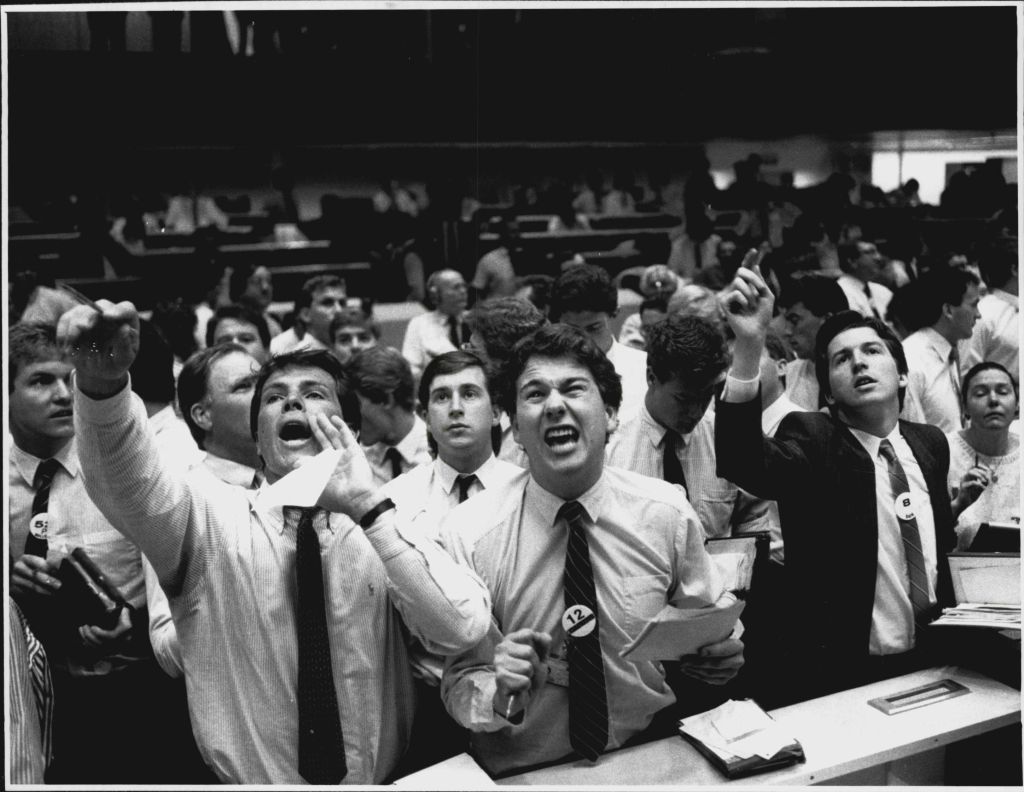

Kim Kardashian is diving into the private equity game, starting a buyout firm that will invest in and buy a range of companies.

The new firm, called Skky Partners, will target consumer products, e-commerce companies, consumer media, hospitality services and luxury brands, the firm said in a tweet Wednesday. Kardashian, a reality TV star turned entrepreneur, co-founded Skky Partners with Jay Sammons, the former global head of consumer, media and retail at investment firm Carlyle Group.

Skky Partners didn't immediately respond to a request for comment Wednesday.

Sammons left Carlyle Group in July after being with the company since 2006, Bloomberg News reported. He led Carlyle's investments in Beats by Dre, Beautycounter and Vogue International, according to the news service.

Sammons pitched the idea of a private equity firm to Kardashian earlier this year, he told the Wall Street Journal. Kardashian's mother and business manager Kris Jenner will join Skky as a partner, Sammons also told the Journal.

Skky Partners has not started raising funds yet or identified early-stage companies it wants to invest in, the Journal reported. The firm will be based in Boston and Sammons will run day-to-day operations.

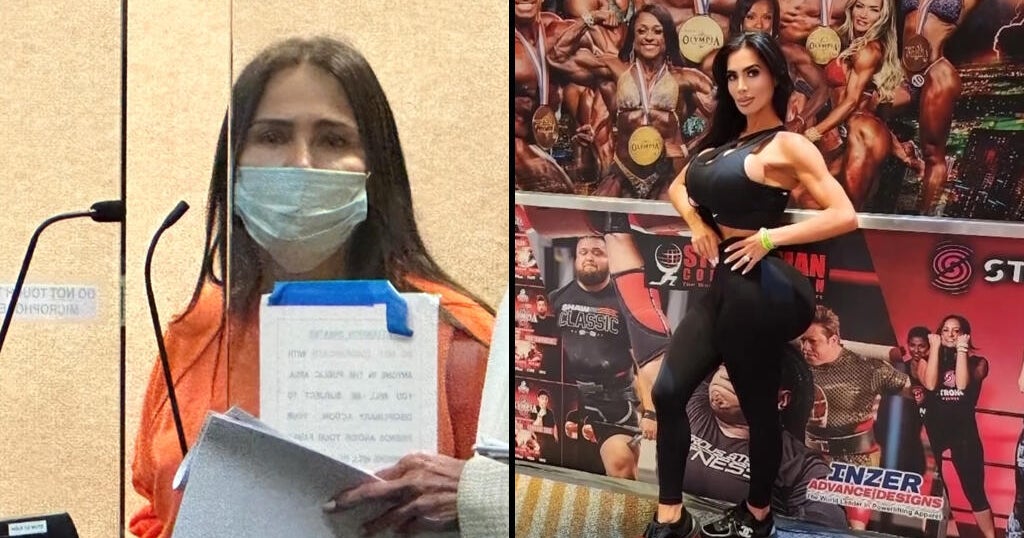

Kardashian is best known for starring in reality shows "The Kardashians" and "Keeping Up With the Kardashians," while amplifying her celebrity with a massive social media following.

Kardashian has also built a burgeoning business empire. She started a shapewear clothing company in 2019 called Skims that's now valued at $3.2 billion. In 2020, Kardashian sold her makeup line KKW Beauty to CoverGirl for $200 million. In June, she launched nine skincare products, called SKKN by Kim, that will be sold exclusively online by cosmetics company Coty.