Judge denies request to halt priority status for women and minority restaurant owners seeking aid

A federal judge has ruled against a conservative legal group that sought an immediate halt to the priority status for restaurants and bars owned by women and certain minorities in President Joe Biden's COVID-19 relief package.

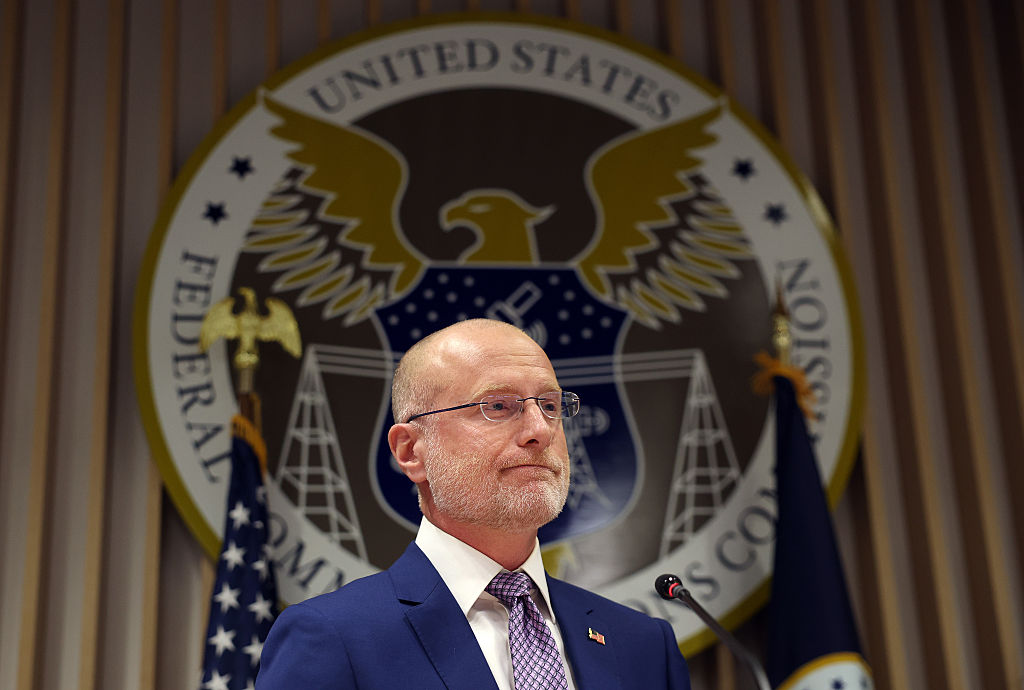

U.S. District Judge Travis McDonough in Knoxville, Tennessee, issued the opinion denying a temporary restraining order last week in the lawsuit brought by the Wisconsin Institute for Law & Liberty. The group is appealing the decision.

The judge wrote that "Congress has gathered myriad evidence suggesting that small businesses owned by minorities ... have suffered more severely than other kinds of businesses during the COVID-19 pandemic, and that the Government's early attempts at general economic stimulus ... disproportionately failed to help those businesses directly because of historical discrimination patterns."

Flaws in the Paycheck Protection Program, launched in April 2020, hindered small businesses owned by minorities and by women from securing federal coronavirus relief, according to lending experts and interviews with numerous owners.

Many diverse business owners applied for PPP loans through the Small Business Administration program, only to come up empty because they either didn't qualify or the funds had been exhausted by the time their applications were processed.

"Historical discrimination"

Experts estimated the number of minority and women owners shut out of of the paycheck program to be around 90%.

McDonough said "Congress had before it evidence showing that woman-owned businesses suffered historical discrimination that exposed them to greater risks from an economic shock like COVID-19, and that they received less benefit from earlier federal COVID-19 relief programs."

The lawsuit targets the three-week period from May 3 until Monday during which the $28.6 billion Restaurant Revitalization Fund has only been processing and funding requests from businesses owned by women, veterans, or socially and economically disadvantaged individuals.

Eligibility was slated to open broadly afterward. However, the SBA reported on May 18 it had already received more than 303,000 applications representing more than $69 billion, with nearly 38,000 applicants already approved for more than $6 billion. Of the applications, 57% came from women, veterans, and socially and economically disadvantaged business owners, who had already applied for $29 billion in the $28.6 billion program by May 12, the SBA has said.

The application portal remained open through Monday because money set aside for establishments with 2019 annual revenue of not more than $50,000 was potentially still available.

Plaintiff Antonio Vitolo, owner of Jake's Bar and Grill in Harriman, Tennessee, applied for aid on May 3 but doesn't qualify for the first tranche as a White male, according to the lawsuit, which argues White men are being "pushed to the back of the line" for aid for their eateries.

"Money will be gone" for White male applicants

The law says a business is required to have 51% ownership by someone in one of the priority groups to qualify for the early priority for aid.

The program relies on a definition of "socially disadvantaged" that is limited to people "subjected to racial or ethnic prejudice or cultural bias because of their identity as a member of a group without regard to their individual qualities."

Groups presumed by the program to be socially disadvantaged include: Black Americans; Hispanic Americans; Native Americans, including Alaska Natives and Native Hawaiians; Asian Pacific Americans, and Subcontinent Asian Americans.

Attorneys for the federal government said people could also check a box on the application if they thought they met the broader definition of "socially and economically disadvantaged," the judge wrote.

The lawsuit said the limited funding put White male "applicants at significant risk that, by the time their applications are processed, the money will be gone" — an argument that did not sway the judge.

"While this is certainly unfortunate, Congress cannot reasonably have been expected to predict with precision the level of demand for funds nor how the demand would break down between priority and non-priority applications," the judge wrote.

Under the Biden restaurant relief program, restaurants and bars can qualify for grants equal to their pandemic-related revenue losses, with a cap of $10 million per business and $5 million per location.

In a similar complaint, a group of Midwestern farmers sued the federal government in April alleging they can't participate in a COVID-19 loan forgiveness program targeting farmers who are Black or members of other minorities because they're White.

Megan Cerullo contributed to this story.