Is silver a good investment? Here's what experts say

With interest rates high, several banks collapsing and a possible recession on the horizon, it's a good time to reevaluate your investments.

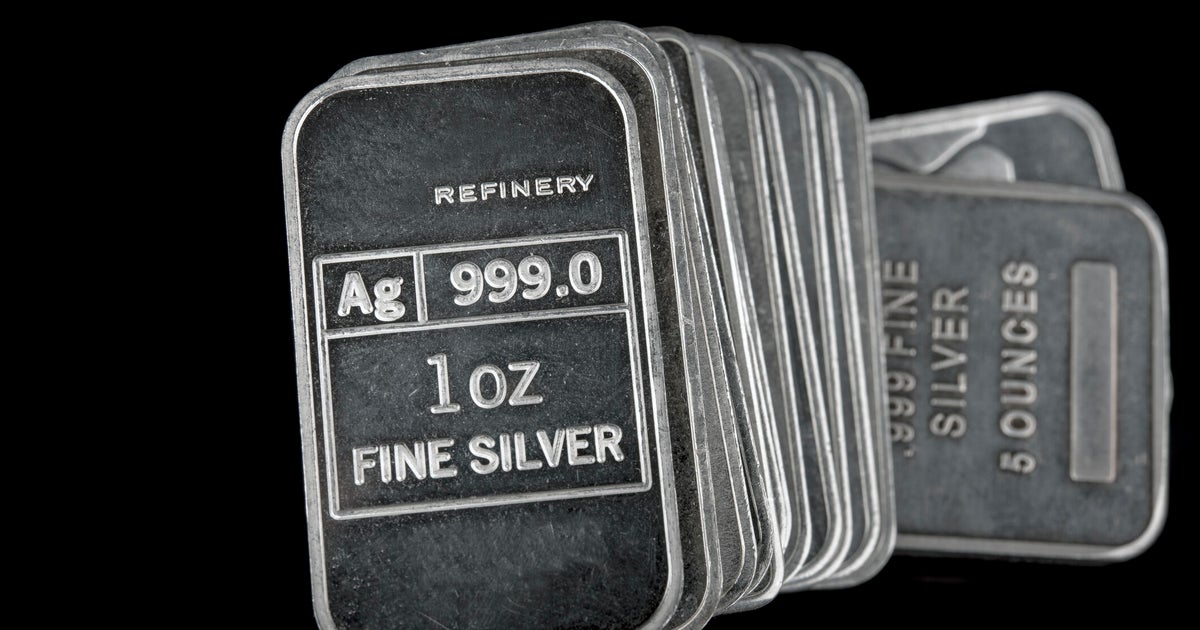

One option many consumers are exploring during these challenging times is precious metals — more specifically, gold and silver.

Gold and silver investments are often considered good hedges against inflation and can help you diversify against riskier investments like stocks and bonds, which have seen volatility in recent months.

But when is silver the right move, and when should you invest in gold instead? Here's what you need to know.

Learn more about gold investing by requesting a free information kit here.

When are silver investments smart?

Silver is one of the many precious metals you can invest in. It might be wise to invest in silver when:

You're seeking long-term growth

Silver isn't just a metal to collect and stow away for the future. It has endless real-life uses, and with those uses — and future, yet undiscovered ones — comes the potential for growth.

"Silver is not only a precious metal but also an industrial metal," says Sankar Sharma, CEO of Risk Reward Return. "Silver is used in medical applications, solar panels, batteries, nuclear reactors, semiconductors, touch screens and more."

It's also a large component in electric vehicles, which have jumped in production and popularity in recent years. By 2025, The Silver Institute estimates that 90 million ounces of silver will be needed for vehicle production.

"It's smart to invest if the investors have the patience to hold it for the long term," Sharma says. "With a growing commitment to green infrastructure, clean alternative energy sources and anticipated growth of EVs, one should only expect the demand for silver to grow from here."

You're comfortable with some risk and volatility

Silver is generally seen as a safe investment, but its value ebbs and flow more than gold does.

In the last year, silver prices have gone as low as $17 an ounce to nearly $26 an ounce. Over the last decade, silver has vacillated even more. Its lowest price was just under $14 per ounce, while it cost almost $28 per ounce at its peak. That's a peak-to-trough difference of 101%.

Still, the volatility can be worth it — at least for investors with patience and good timing.

"The amount of silver annually produced is only currently valued at around $20 billion," says Ian Everard, owner of ARK Silver Gold Osmium. "When you do the math, the slightest inflows into the gold and silver markets will cause exponential rises in value."

Get a free investors kit today to learn if gold investing is right for you.

You want to diversify your portfolio

Silver is also a smart way to diversify your portfolio and offset your exposure to other, riskier assets, such as stocks.

"It can be smart to invest in silver when you're seeking diversification or when you expect inflation or economic turmoil," says Nick Ganesh, manager at Endeavor Metals. "Silver often holds value well under these conditions."

When silver investing isn't wise

Silver can often be a smart investment, but it's not right for everyone. You might not want to invest in silver if:

You want a risk-free investment

One of the biggest silver investment disadvantages is its volatility. While that can often mean big growth, it can mean significant loss if you need to sell at the wrong time.

If you're not prepared to ride out the waves of this volatility, you may want to explore other investment options. As Sharma puts it, "Silver is ideal for a long-term investor who is not afraid of seeing volatility."

You're looking for quick returns or dividends

If quick profits or a regular income stream are what you're looking for, silver won't be of much help.

"Silver doesn't provide interest or dividends," Ganesh says. "So if you're seeking a steady income stream, other investments might be more suitable. Assets like stocks or bonds may provide better returns."

You need easy liquidity

Silver isn't completely illiquid, but if being able to sell your assets fast and turn them into cash is a priority, it's not the best choice. In this scenario, gold may be a better option. As Ganesh explains, "Gold is highly liquid. It can be bought or sold easily."

How to invest in silver

There are many ways to invest in silver. You can purchase silver coins and bullion (just remember you need somewhere to store it), or you can invest in silver futures, which allow you to bet on or against silver's future value. Buying stocks in silver mining companies or investing in silver ETFs are other options.

You can also open a silver IRA, which allows you to use silver to build your wealth for retirement. These are specialized retirement accounts that must be managed by an IRS-approved custodian. You can only purchase certain coins and bouillon, and they must be stored in an official depository. (There are also gold IRAs if you're interested in investing in gold).

When to consider gold investing or other precious metals instead

As Ganesh notes, gold is your best bet if you're looking for a very liquid asset. It's also smart if you're risk averse, as it tends to be less volatile than silver in the long run.

"If you're seeking a relatively more stable investment, gold might be your go-to," Ganesh says. "Plus, gold is often perceived as a safe haven asset, making it a popular choice during economic uncertainty."

Find out if gold is the right investment for you — request a free investment guide now!