Is $1 million what you need to retire?

$1 million is the oft-cited amount people say you’ll need to retire comfortably. The theory behind that goes something like this: A $1 million nest egg can generate around $40,000 per year in inflation-adjusted income. That, combined with the typical retiree’s Social Security payment of $1,360 per month, brings that retiree’s income to around $56,320 per year, which is right around the median household income.

With that median income comes the ability to live a typical middle-class lifestyle.

While that theory might seem reasonable on paper, in practice, it leaves a lot to be desired. For one thing, the typical net worth of a household approaching retirement is only around $174,000, well below that $1 million level, yet we don’t hear of massive hordes of starving American retirees.

For another, retirees can structure their lives to keep their spending below that of most working folks without taking a noticeable hit to their lifestyles.

The costs most retirees don’t have

To start off with, Social Security taxes come from your employment income. You’ll be happy to know that, if you’re retired and relying on income from a pension, investment income or retirement account withdrawals, that income won’t be subject to a Social Security tax. For most people, Medicare taxes behave similarly, though there is a Net Investment Income Tax to support Medicare that affects higher-income retirees.

Additionally, if your mortgage is paid off by the time you retire, that’s another substantial chunk of cash you get to hold onto every month. Similarly, if your kids are grown and independent, you probably no longer have to support them.

Then there are the costs of working -- things like work wardrobe, commuting costs, taxes levied by your work jurisdiction but not your home jurisdiction, work social events, gifts to co-workers and power lunches, also go away.

In addition, with more of your time freed up from not having to work, you can do more things for yourself that you used to have to pay people for. Suddenly you have far more time to cook or maintain your lawn or any number of mundane tasks.

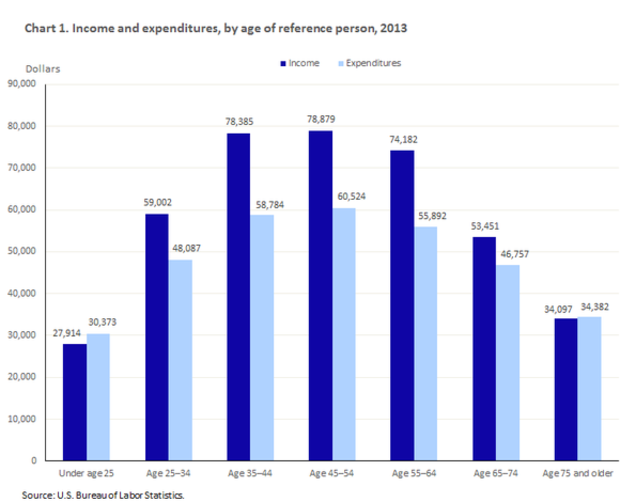

The net result is that retirees can -- and very often do -- face lower total costs than their younger compatriots, despite the fact that health care expenses are often heavier for retirees. The chart below from the Bureau of Labor Statistics shows that spending generally tends to taper off in retirement:

Lower costs need a smaller nest egg

Spending for a typical household headed by a retirement-aged person is below $47,000 per year, which means most households can get away with a smaller nest egg than the often touted $1 million level. The average married couple receives $2,260 per month in Social Security benefits, or $27,120 per year, leaving around $20,000 to be covered by your nest egg. Based on a rule-of-thumb for retirement asset management known as the 4 percent rule, that spending would require a $500,000 portfolio.

Under this rule, you can spend 4 percent of your portfolio’s initial balance in the first year of your retirement and adjust that spending each year based on inflation. If you start with a balanced and diversified portfolio and keep it balanced and diversified throughout your retirement, that method gives you a very strong chance of seeing your money last throughout your retirement.

Can you be comfortable on even less?

Even then, a $500,000 nest egg might be more than you’re able to reach. Still, that doesn’t necessarily have to be a barrier to a comfortable and happy retirement. There are other strategies you can take to help you with a comfortable retirement on a much smaller nest egg. For instance:

Delay retiring a few years: The longer you wait before retiring, the shorter the amount of time your nest egg will have to cover your costs. In addition, the longer you wait to collect Social Security -- up until age 70 -- the higher your monthly benefit will be. As a bonus, since your Social Security benefit is based on your highest 35 years of wages, continuing to work can potentially replace some $0 or low wage years in your record, boosting your benefit even further.

Work a retirement job: If you’re ready to leave the rat race but not necessarily ready to give up all work, a retirement job can both cover a portion of your costs and fill hours in your day. It’s a great opportunity to both stay active in retirement and potentially even continue supporting an organization you’ve long supported while working.

Help out your kids with their kids: Multigenerational housing can be a way to both lower your costs of living in retirement and help your kids out with their own kids. As a live-in grandparent, you can lower your costs of living by sharing space with family and also lower your kids’ costs of raising your grandkids by reducing their child care expenses. It’s a potential win-win, with the added bonus of more time with your grandchildren.

Plan for a happy retirement

No matter where you are in your retirement planning journey, the most important thing you can do to assure a happy retirement is to build a plan to take you there. Know where you stand today, where you want to be in retirement, and what levers you can pull to get yourself there, then use that knowledge to start building your roadmap to your golden years.

While a million-dollar nest egg may still be a nice target to shoot for, know that, with a little creative planning on your part, you can still achieve a happy retirement with less. So get started today, and improve your chances of winding up happy in your golden years, no matter what size nest egg you end up with.

This article originally appeared on the Motley Fool