Investors embrace low-cost investing

(MoneyWatch) A recently updated study suggests that the Wall Street marketing machine hasn't worked so well in the past 10 years. Investors have been pouring money into the lowest-cost mutual funds and ETFs, while taking cash away from higher-cost funds. The study, by Vanguard, examined fund cash flows over the past ten years. In the following summary, the funds I'm referring to include both mutual funds and ETFs.

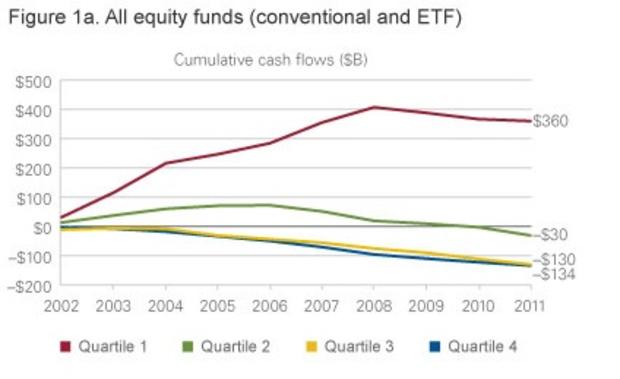

First, looking at stock funds, over the past 10 years

ending in December 2011, the lowest-cost quartile funds garnered $360 billion

in assets, while the more expensive 75 percent of funds saw $294 billion pulled out

by investors. From the chart, you can see that even the lowest quartile funds

have had some declines since the 2008 market crash.

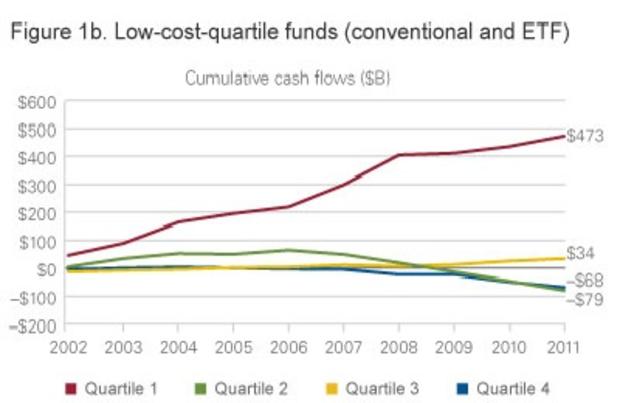

Drilling down to

the lowest cost of those lowest quartile funds, investors continued to put

money into those funds, although at a slower rate. In fact, the lowest-cost

funds of the lowest-quartile funds (the lowest quartile of the lowest quartile, or the lowest 1/16th cost funds) received $473 billion in cash inflows,

meaning that the rest of the lower-cost quartile funds also experienced cash

outflows.

Don Bennyhoff, Vanguard senior investment analyst, pointed

out that nearly 89 percent of the $473 billion in cash flows the lowest-cost

funds received were in index funds. By my calculations, index funds received about $420 billion of new money while active funds saw $350 billion pulled out.

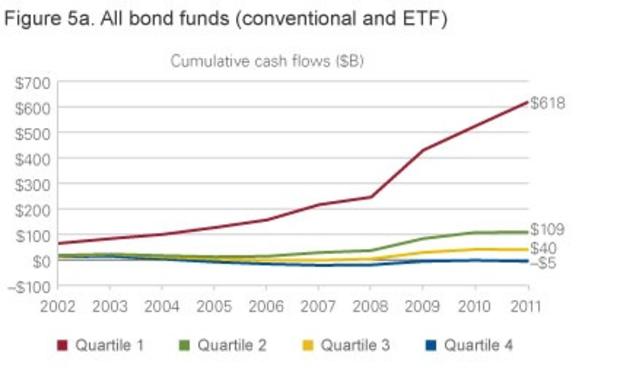

The story is similar for bond funds as well, as investors poured $618 billion into the lowest-cost quartile funds. The higher-cost bond funds didn't fare quite as badly as in stock funds, with all but the highest-cost quartile funds seeing some cash inflows. Still, 82 percent of investor cash inflows went to the lowest-cost quartile funds.

What this means

It appears that investors are beginning to appreciate how much costs matter in building wealth. My own hunch is that with information being more readily available, it is becoming harder for Wall Street to create illusions of outperformance. Anyone with an Internet connection can go to Morningstar and see the performance of nearly any fund relative to their peers.

Bennyhoff has an additional explanation. He strongly believes that advisors are embracing indexing and ETFs as superior to more expensive actively managed funds.

Whatever the reason, this bad news for Wall Street is very good news for the investor.