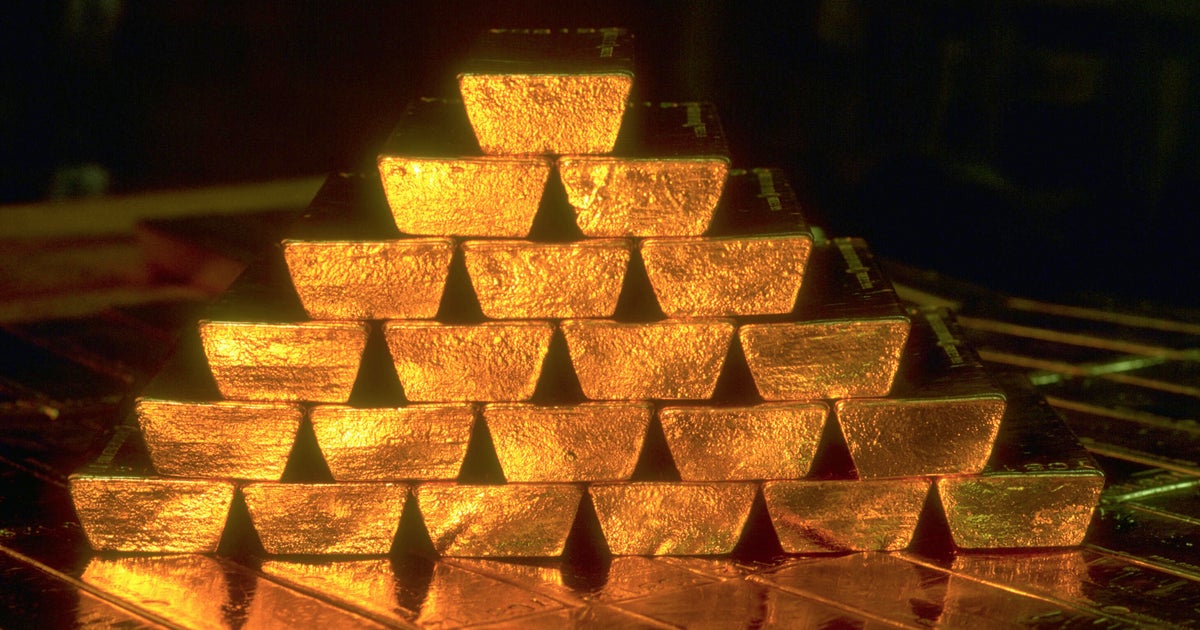

Investing in gold bars and coins? Pros and cons to know

Investing in gold is a useful way for investors to protect their wealth and safeguard their portfolios from losses — no matter what the broader economy looks like. And the most straightforward way to invest in gold is buying physical gold, or bullion, in the form of gold bars and coins.

Just like any other investment option, physical gold has its advantages and disadvantages, and it's important to understand them to make the best decision for your financial goals and needs.

Start exploring your gold investment options by requesting a free information kit today.

Investing in gold bars and coins? Pros and cons to know

Keep the following things in mind when considering whether you should invest in gold bars and coins.

Pros of buying gold bars and coins

There are plenty of reasons to invest in gold in any form. Here's why gold bars and coins can be particularly valuable.

- They're tangible. Unlike traditional investments such as stocks and bonds, you can hold a gold bar or coin in your hand and inspect it. This can give investors an added sense of security that more-abstract assets may not provide. Collectors in particular can enjoy the satisfaction of finding and displaying physical coins.

- They're universally recognized. Gold has been a universally accepted form of currency for centuries. If you need to, you can likely sell your gold bars or coins in any part of the world at any time and receive a fair price for them.

- They're easy to buy. Buying gold bars and coins is a simple process that even beginner investors can understand. You can find a reputable online seller easily from the comfort of your own home or visit a local dealer if you prefer to see and inspect your options in person.

- They're highly liquid. Physical gold is a highly liquid asset, which means it can be easily bought and sold for cash. You can sell gold bars and coins at any time, and there are plenty of buyers in the market. While you should ideally hold onto your gold investment long-term, it can be reassuring to know it can provide an extra source of cash if you need it.

Learn more about gold investing with this free investors kit.

Cons of buying gold bars and coins

While gold bars and coins offer plenty of benefits, it's important to also keep the following drawbacks in mind.

- You'll pay a premium. Since gold coins and bars must be produced, packaged and shipped, they can come with high premiums, especially if they're rare or have historical significance. These premiums can eat into the value of your investment. It's essential to know the current price of gold so you can determine whether a particular investment is a good deal.

- You must store it securely. It's crucial to keep your investment in a safe location, whether that means in a fireproof safe at home or in a safe deposit box at a bank. The more physical gold you have, the more storage costs will add up, reducing your total returns. Other gold investment options may offer more practical ways to benefit from gold's value without storing physical bullion.

- You must insure it. Even if your gold is stored in a safe place, you still need to insure it. Your homeowners insurance may not cover your full investment if your safe is stolen or broken into, and safe deposit boxes usually aren't insured by the bank. This adds to your investment costs.

- There are scams out there. Since gold is so popular, bad actors hoping to capitalize on investor demand do exist. Watch for the red flags of a potential scam, be sure to choose a reputable gold dealer and know what to look for so you can properly evaluate a bar or coin's purity and authenticity.

Wondering if gold investing is right for you? Learn more with a free investment guide online now!

The bottom line

Investing in physical gold is a great way to enjoy the benefits of gold as an asset. It's a tangible investment that's easy to buy and sell, it's a solid store of value and it can be converted to cash quickly. However, it's important to also consider the drawbacks of buying physical gold so you can make the best decision for you. Be sure to weigh the benefits against the overall costs (including storage and insurance), choose a trustworthy dealer and take the time to inspect your bars and coins carefully.

If you decide physical gold isn't the right investment for you, there are plenty of other ways to invest in gold, including stocks, ETFs and IRAs. If you're unsure which option to choose, consult a financial advisor who can provide customized guidance based on your financial situation.