Inflation still isn't following the Fed's game plan

Investors pushed the Dow Jones Industrials index to yet another record high on Thursday, increasingly hopeful for possible bipartisan action on contentious issues like immigration and tax reform. But one big stumbling block looming on the horizon is the specter of new monetary policy tightening by the Federal Reserve, starting as soon as next week.

On Sept. 20, Fed policymakers are expected to start the process of rolling back their bloated $4.4 trillion balance sheet -- a move that the financial cognoscenti has been dubbed "quantitative tightening." This comes ahead of another possible interest rate hike in December.

The problem for the Fed: The inflation outlook remains uneven. And thus, the underlying U.S. economy could be more fragile than the stock market's triumphalism suggests.

Thursday's Consumer Price Inflation report showed prices jumped 0.25 percent from the month prior. That's the strongest rise since January and kept the year-over-year rate steady at 1.7 percent. Societe Generale's Omair Sharif believes the result is "exactly what Fed officials were hoping to see" because it should partially ease concerns about a recent run of weak inflation readings dismissed as idiosyncratic (related to things like price cuts on cell phone plans).

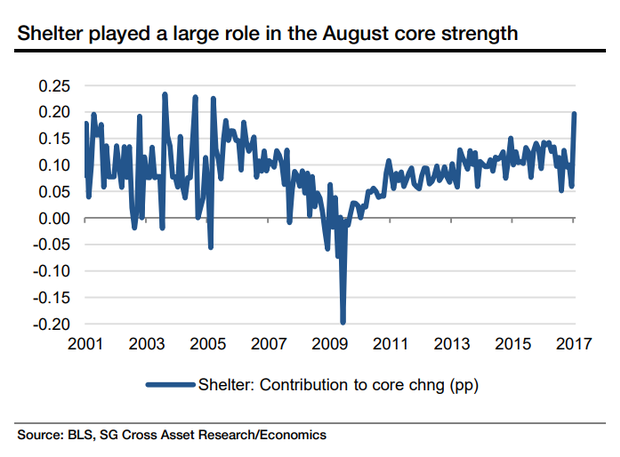

What drove inflation's August increase? In a word, housing. Overall shelter costs increased by 0.5 percent for the largest monthly increase since October 2005, right in the thick of the last housing bubble (chart above). Gasoline played a role, too, up 6.3 percent on a monthly basis due to the impact of Hurricane Harvey, which is already fading.

The futures market responded by pushing up the chance of a December Fed rate hike to better-than-even 51 percent odds (up from 41.3 percent on Wednesday). Higher interest rates are coming, it seems.

But is that the right call?

Paul Ashworth at Capital Economics noted that both the headline and the core inflation rates are still missing the Fed's 2 percent target. As a result, his firm expects the Fed to hold fire in December before accelerating its tightening pace in 2018, when it will push short-term rates up to 2.25 percent. Yet quantitative tightening, the process of ceasing to reinvest proceeds from maturing bond holdings, remains on track to begin on Sept. 20.

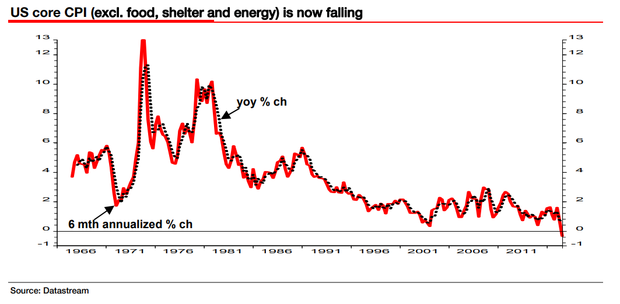

Societe Generale strategist Albert Edwards is more direct. A few weeks ago, he warned that on an underlying basis, the U.S. has already "slumped into deflation" -- and a Japan-like scenario beckons. He cites a lack of a clear inflation and wage gain upturn, which would normally be expected at this stage of the business cycle given a tight job market.

In fact, he finds that for the first time since records began in the 1960s, U.S. core CPI (excluding food, energy and shelter) has actually turned negative over a six-month period (chart above). This is clear evidence, in his mind, of a "slide into outright deflation" rather than the self-sustaining recovery Fed officials seem so confident of.