In California, a "disturbing" gap in what drivers pay for car insurance

- Auto insurers commonly offer rate discounts to white-collar professionals in rich neighborhoods, but deny those benefits to people of color in low-income areas, California regulators say.

- Insurers provide discounts to so-called affinity groups, often professionals such as doctors and lawyers who are more likely to live in wealthier areas.

- California's insurance commissioner said the state is evaluating whether the discounts violate state law.

A doctor who lives in ritzy Beverly Hills, California, and who has a clean driving record gets a nice financial perk — a generous discount on their car insurance rates. But in Watts, a lower-income neighborhood in Los Angeles just 20 miles south, a cashier who is equally prudent behind the wheel is likely to pay considerably more for auto coverage.

That practice — standard among car insurers — is now being challenged by regulators in the state. A first-of-its-kind investigation by California insurance officials recently found that auto insurers in the state offer discounts to white-collar professionals in wealthy neighborhoods, but typically deny those benefits to people of color in poorer areas.

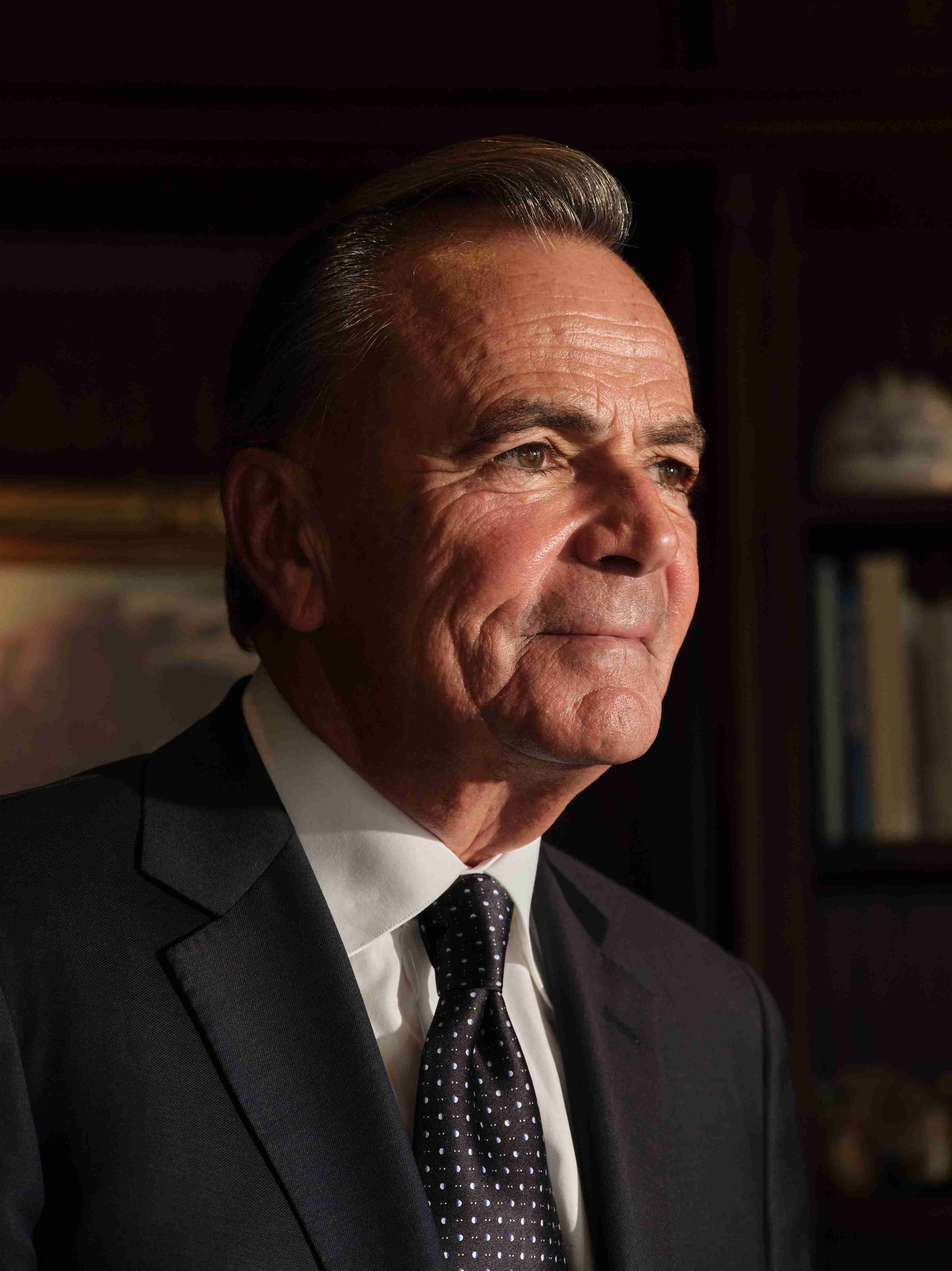

California Department of Insurance Commissioner Ricardo Lara says that results in a "disturbing" gap in premium costs between such "affinity groups," as insurance jargon describes such customer segments. His agency examined insurance policies gathered in May and found that some insurance companies offer discounts to doctors, lawyers, engineers and other well-paid professions.

"This disturbing data confirms what we have heard for years — that auto group discounts do not apply equally across California," he said last month. "We are evaluating whether insurer affinity group discounts violate state laws, and I am prepared to act to ensure all Californians have access to affordable auto insurance regardless of their income, education or ethnicity."

Your Zip code matters

As part of their probe, California officials asked 95 of the biggest insurers that sell car insurance in the state to provide data on their policies. Thirty-three companies, representing 16.5 million insured vehicles, responded.

Customers enrolled in affinity groups enjoy discounts ranging from 1.5% to 25.9% off their premium, the analysis found. While 55% of residents in high-income areas who are enrolled in an affinity group get a break on their rates, only 26% of people in poor Zip codes receive a discount, the study found.

The regulators examined insurance policies in Zip codes around Los Angeles, San Diego and San Francisco. In Los Angeles, areas encompassing Watts, Compton and Crenshaw — all low-income neighborhoods — showed the lowest enrollment in discount programs. In San Diego, the lowest enrollment was in Logan Heights and San Ysidro, while in San Francisco the Fruitvale area and points immediately south had the lowest enrollment. Fruitvale, San Ysidro and Logan Heights are predominantly communities of color.

A 2018 study by the Consumer Federation of America found that car insurance costs could vary by hundreds of dollars simply because drivers lived in different ZIP codes — even among those with similar driving records.

A question of access?

An auto insurance representative defended the use of affinity groups, saying their discounts "give millions of Californians access to more affordable auto insurance," including labor unions, teachers and law enforcement personnel.

"If affinity groups are restricted, millions of California drivers already in these programs could be forced to pay more for auto insurance," said Mark Sektnan, vice president of the American Property Casualty Insurance Association. "If changes are to be made, more affinity groups should be created to encourage greater access."

California auto insurers generated more than $20 billion in revenue each year since 2013, according to state data.

A California law enacted in 1988 known as Proposition 103 is supposed to ensure fair insurance rates. It requires insurers to base premiums on a driver's safety record, miles driven and years of driving — factors within a person's control — and not where they live. In January, California's insurance department also banned gender as a factor when setting rates.

Officials with Consumer Watchdog, an advocacy group, are now urging Lara to make the remaining 62 auto insurers originally contacted for the study to release their customer data.

"Just because a person doesn't have an advanced degree or a professional job doesn't mean they are bad drivers," Daniel Sternberg, an attorney for Consumer Watchdog, said in a statement. "Now that the Department of Insurance has confirmed the impact of this on regular people, we look forward to prompt and decisive action by the commissioner to end these unlawful overcharges."