IBM Playing Mobile Roulette At The $100M Table

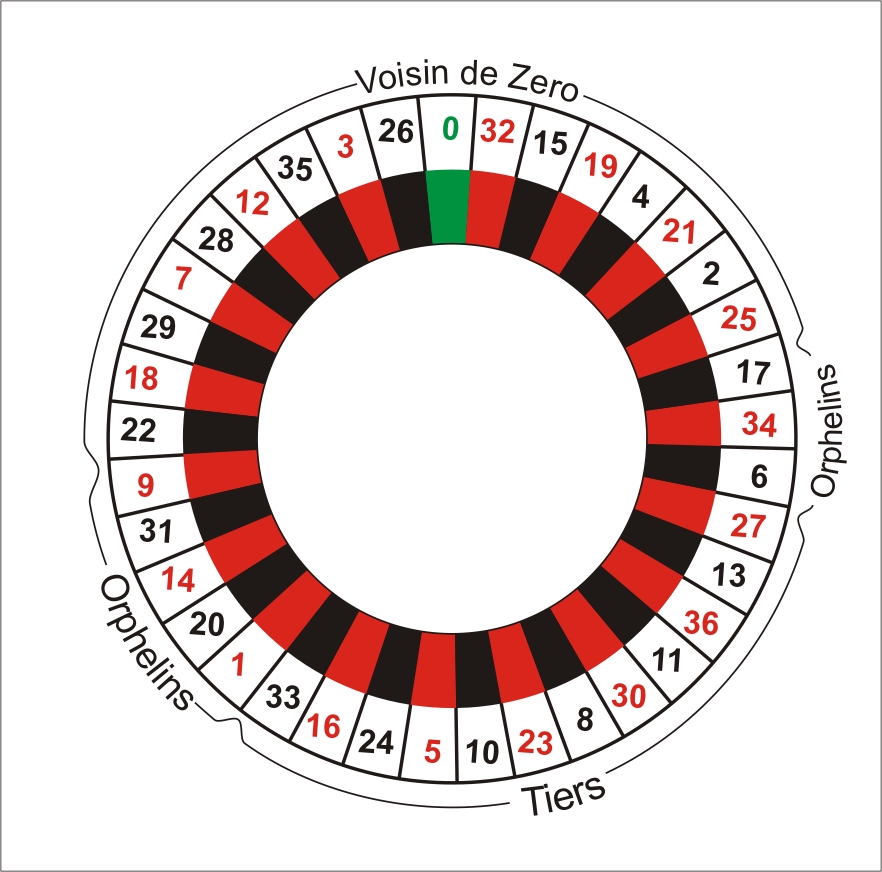

IBM's $100 million investment in mobile applications is as safe a bet as covering both odd and even numbers on the roulette wheel.

IBM's $100 million investment in mobile applications is as safe a bet as covering both odd and even numbers on the roulette wheel.

Mobile applications are growing thanks to the popularity of social networks on mobile devices, improvements in Web-browsing technology, and, perhaps most importantly, the fact that mobile enterprise applications have become critical to professional users. Apple, Research in Motion, Nokia and Palm have produced smartphones that are robust enough -- and developer resources attractive enough -- to elicit enormous interest among mobile application vendors.

Mellmo, a company that creates software that makes it easier to read reports on the iPhone, takes advantage of the polpular device's large storage capacity. Other vendors are using the advent of standards-based Web browsing technology like HTML 5 and Webkit to create applications running over the Web that rival anything made for the desktop.

This last item is not insignificant, because if applications can actually run effectively in the cloud and deliver the same kinds of performance as applications that run locally, vendors like Google, Salesforce and, yes, IBM, will be in a position to win the enterprise applications battle of the future against entrenched vendors like Microsoft and SAP. This is particularly the case as the economics of developing for the Web trump developing for desktop clients. "Given the choice, I'd go the browser route, because an application that runs on devices needs more investment and support than one that runs through only two or three different browsers," Mark Curtis, CEO of mobile social network vendor Flirtomatic, told me.

IBM understands that this is the end-game for enterprise software vendors, noting in its most recent annual report that

a new computing model has emerged, replacing the PC-based, client/server approach... [which is] networked, modular, open and represents a fundamental shift in the technology requirements of the company's clients... [IBM is] continuing its shift from commoditizing segments to higher value segments with better profit opportunity.IBM made a similar $100 million bet in 2006, when it promised to invest that sum over two years to explore the commercial possibilities of virtual worlds like Second Life, and has quietly rolled out products like IBM Virtual Worlds For Sametime, as a direct result of those investments.

But while IBM is clearly betting on the right numbers, I'm not sure it will ever be able to cash in those chips. IBM is a $104 billion company, which means it needs to generate an additional $10.4 billion in revenues next year just to make its shareholders happy; there's no way it can do that by offering customers inexpensive applications that don't require armies of consultants to implement -- in other words, without embodying the traditional software sales and support cycle that defines companies of its ilk. The winner may not be Google either, for that matter; selling search results to the highest bidder is what it does and, as the saying goes, the rest is commentary. The new world may instead belong to smaller application vendors that are set up to thrive on high volumes and low margins, and the mobile operators that deliver them.

I'll discuss those ideas in forthcoming posts.

[Image source: Wkipedia Commons]