How to get out of tax debt now

Not everyone has a simple tax situation where their employer withholds more than enough money for taxes, and the person perhaps ends up getting a small refund the following tax season.

Instead, many people end up owing money to the IRS.

That tax debt could be due to several reasons such as if a taxpayer's employer didn't withhold enough, they're self-employed and didn't pay enough in estimated taxes, or they had more tax liability than expected.

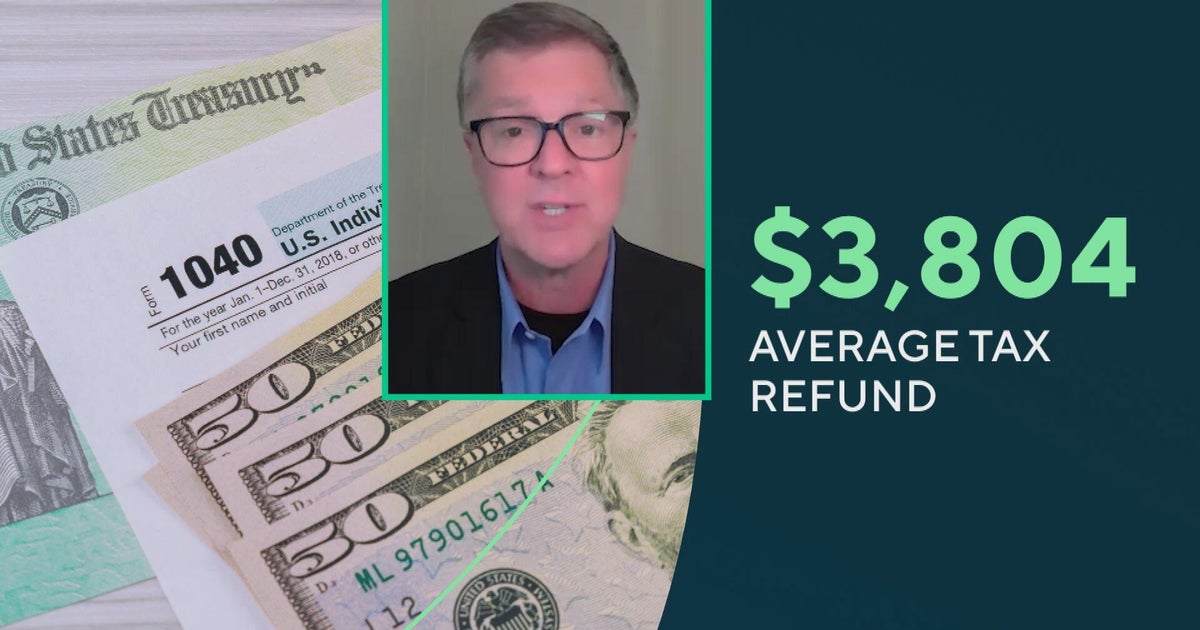

For the fiscal year 2021, IRS data shows there were more than 10 million taxpayer-delinquent accounts. Total federal tax debt, including penalties and interest, equaled over $133 billion, or approximately $13,000 per delinquent account.

The longer you wait to pay back taxes, the more interest and penalties can accrue. And if you have tax debt, the IRS can take matters into its own hands to collect money from you. That's why it's so important to solve your tax debt now. Reach out to Anthem Tax Services to get started today.

The IRS can issue a tax levy, which legally allows the agency to collect the money you owe such as by seizing vehicles, pulling money out of your bank account, implementing a wage garnishment to take money from your paycheck, etc. The IRS could also put a tax lien on your house, which is a legal claim on your property.

If you owe taxes to the IRS and don't have enough money right now to pay them in full, there are several potential solutions. Here's what you need to know to get started.

How to get out of tax debt now

To start getting the situation under control, "put together a budget, organize your financial priorities and put a plan in place to pay down the debt," says Autumn Lax, a financial advisor at Drucker Wealth.

But not all tax debt situations can be handled through basic budgeting and debt management practices. If you have a complex tax situation, you might need a tax expert to provide further tax debt relief guidance.

"If you have extenuating circumstances that would prevent you from being able to pay — such as being unable to work, severe hardship or illness — a tax relief expert may be able to help negotiate repayment terms with the IRS," adds Lax.

How can a tax debt relief expert help me?

A tax debt relief expert can help you manage your tax debt in several ways.

For example, the IRS offers payment plans in some situations. So, a tax relief expert could help you figure out if that's a good option for you and how to navigate the process of applying for an installment agreement.

In other cases, the IRS provides what's known as an offer in compromise, which could enable you to settle tax debt for less than the full amount you currently owe. Here too, a tax relief expert could guide you through the process and help you figure out the best solution. Plus, a tax relief expert can assist in areas like getting penalties removed.

Overall, a tax relief expert can help you figure out how to optimally navigate your tax debt since there can be more than one option to pay back taxes. Some people might contact the IRS directly to resolve tax issues, but others prefer getting professional help.

"Having someone help lay out the path forward and help ensure you are sticking to the plan can be critical in reaching your goals," says Lax.

Keep in mind, however, that only certain qualified professionals can represent you when dealing directly with the IRS, including enrolled agents, CPAs and attorneys, as the FTC advises.

If you have tax debt then you don't want to wait any longer to get rid of it. It's easy to get started today!

How much is a tax relief expert and how can I find one?

The cost of a tax relief expert can vary widely depending on your tax situation. Some tax relief experts might be able to help for around $1,000 whereas others might charge more.

Compare several options to see which tax relief expert, if any, works for your situation. Use the table below to get started.

Some tax relief experts offer free consultations, so it could make sense to talk to a few to gain clarity on how they could help you.

To find a tax relief expert, you might start by searching online, including on review sites to make sure you're finding a qualified, reputable professional. You also might ask for recommendations from similar professionals, such as if you currently have a financial advisor for your general finances and would like to speak with someone who specializes in tax relief.

Anthem Tax Services is a good place to start and they can help you right now. Click here to learn more.

Not everyone ends up needing or wanting to work with a tax relief expert, but for many people who are unable to get a handle on their taxes, working with an expert gives them the assurance they're looking for.

In some cases, a tax debt relief expert can save you money, but it could also be about gaining peace of mind, like with financial advice in general.

"The value of our services isn't a dollar-for-dollar match," says Lax. "It's more about recognizing that your time, the peace of mind and ongoing partnership with an expert is worth you not having to stress about it or feel alone in your situation."