How much does a $250,000 HELOC cost monthly now?

While it may be tempting to borrow money quickly, particularly if you're financial health has been hurt by stagnant inflation and higher interest rates, it's critical to first stop to calculate your repayment costs. Borrowing money at a high interest rate, even if it offers short-term relief, can result in a worse financial situation than you started with. So it's important to take the time to explore your options and to accurately calculate your repayment costs.

This step is especially important when borrowing money via your home equity. With a home equity line of credit (HELOC), for example, you can potentially borrow hundreds of thousands of dollars, now that the average home equity amount sits around $313,000. While most lenders will cap your borrowing amount at 80%, with that limit many homeowners can still secure a HELOC for just over a quarter of a million dollars.

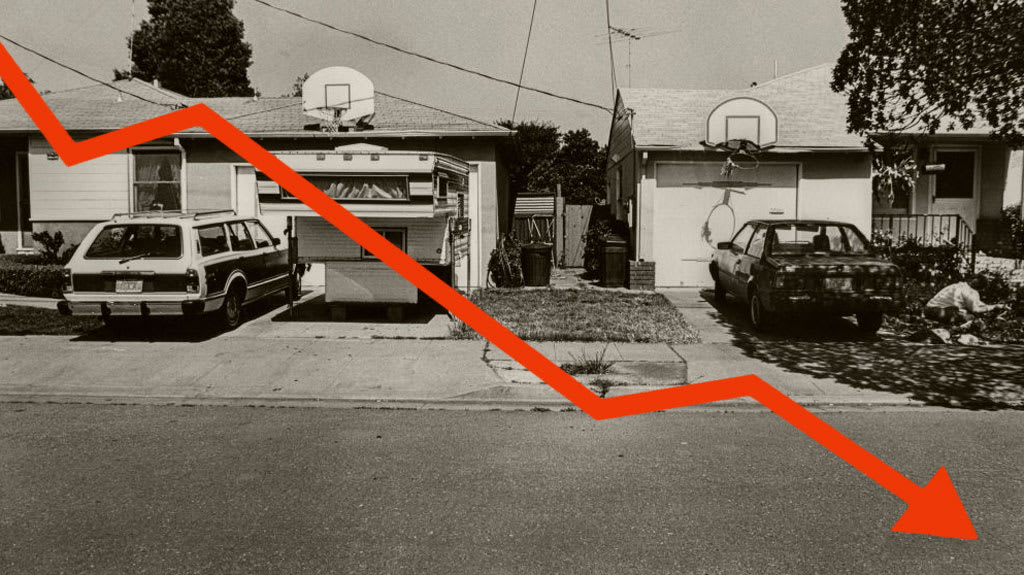

Before getting started, however, it's important to first calculate the monthly repayment costs. Fortunately, those seem to be getting cheaper and cheaper now that HELOC rates have been declining for more than a year. So, how much does a $250,000 HELOC cost monthly now? That's what we'll calculate below.

See how much equity you could borrow with a HELOC here.

How much does a $250,000 HELOC cost monthly now?

To calculate your monthly HELOC repayment, you'll need three numbers: the amount being borrowed, the interest rate it's being borrowed at and the repayment period length. That said, crunching HELOC repayment costs is impossible to do with precision as HELOC interest rates are variable and subject to change monthly. But that's an advantage now that HELOC rates fell in all of 2024 and continued to do so in the early months of 2025. Here, then, is what a $250,000 HELOC will cost monthly now, assuming today's rates remain the same:

- 10-year HELOC at 8.03%: $3,037.15 per month

- 15-year HELOC at 8.03%: $2,393.46 per month

With rates poised to fall further, however, it helps to know what these repayments could look like if rates fall by 25 basis points:

- 10-year HELOC at 7.78%: $3,004.21 per month

- 15-year HELOC at 7.78%: $2,357.49 per month

And here's what they'd look like if they jumped by 25 basis points from today's average:

- 10-year HELOC at 8.28%: $3,070.30 per month

- 15-year HELOC at 8.28%: $2,429.72 per month

Still, HELOC rates, particularly over a decade or more are likely to change by more than just 25 basis points (they're down almost two full points since the start of 2024). So if you know you want to borrow this much with a HELOC, it can be beneficial to calculate the costs against a series of realistic rate scenarios in addition to the above three.

See what HELOC rate you'd be eligible for now.

Don't overlook your credit score

All of the above interest rate scenarios won't matter much if your credit score isn't high. The above rates will typically be reserved for homeowners with good credit scores and a history of making payments on time (or early). So if that description doesn't fit you, consider improving your credit score and profile before applying. That means reviewing your credit report for errors, halting any additional credit applications and paying down as much high-interest debt as possible. With options like the debt avalanche and debt snowball methods, some smart strategies can help you tackle your debt now, improving your chances of securing a low HELOC rate when you do eventually apply for the line of credit.

The bottom line

A $250,000 HELOC comes with costs between $2,393 and $3,037 per month for qualified borrowers now, but those monthly payments can vary widely depending on the rate climate, your repayment period and your credit profile. Calculate your costs carefully, then, to better determine your affordability and consider speaking with a home equity lender who can help answer any questions specific to your borrowing circumstances.