Housing "short sales" is booming business

Anyone who remembers when mortgage rates were in double digits will appreciate this: The average rate for a 30-year-fixed mortgage fell today to 4.15 percent - the lowest in at least 40 years.

Despite the low mortgage rates, a lot of Americans are facing foreclosure. Some have found a way out, called a short sale.

Suzette Parris has spent her retirement savings trying to stay out of foreclosure.

"I actually expected to be here for a very long period of time," Parris said, "but unfortunately, it didn't work out that way."

The taxes and fees on her condo in suburban New York went up, but her paycheck stayed the same.

Parris tried to have her loan modified "numerous" times but she says her mortgage company kept saying "No, no, no, no, no."

"And then when I happened to fall behind, I fell behind one month, I called them, they said, 'Oh sorry, we can't help you.'"

She couldn't find a buyer for her condo, so she turned to realtor Mark Boyland, a "short sale" specialist.

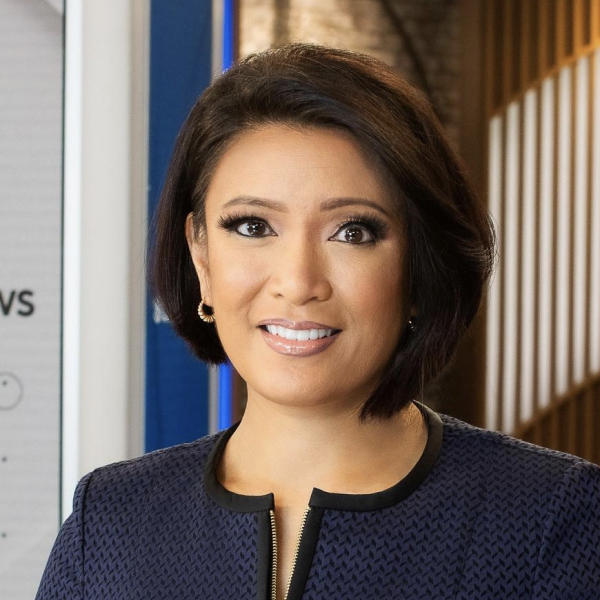

He told Quijano that in 2008 short sales represented about one percent of his business. "Last year it was about 36 percent of my business," Boyland said. "This year it might surpass 60 to 70% of our business."

In a short sale, a bank agrees to let a homeowner sell at a price that's LESS than what's owed on the mortgage. Homeowners avoid foreclosure; banks avoid being stuck with another foreclosed property.

But short sales are notorious for complications, like paperwork delays and banks pulling out of deals at the last minute.

"Initially the short sale system - if you could call it that - really wasn't a system," Boyland said. "It was broken. Each lender had their own process; each investor on the back end of each lender had their own guidelines. So it was kind of a mess there for a while."

That mess only contributed to the glut of distressed properties in the real estate market.

So last year, as part of a push by the Obama administration to reduce foreclosures, the Treasury Department unveiled a program to simplify short sales for struggling homeowners. Banks must now respond to a short sale request within 45 days.

Homeowners are also eligible for $3,000 in aid to move.

Suzette Parris has already started packing as she waits for a short sale to come through.

She says she has a lot of mixed emotions. "But I think that because I've gone through it for so long, I'm just at peace saying, 'Listen, whatever we have to do to try to start over, that's what I'm going to do.'"

By one estimate, short sales could prevent another 275,000 foreclosures this year.