History says stocks set up for a strong year

A year of vicious market volatility ultimately ended with a whimper, as the S&P 500 finished 2011 essentially unchanged. But if history is any guide, 2012 should propel stocks to solid gains, new research shows.

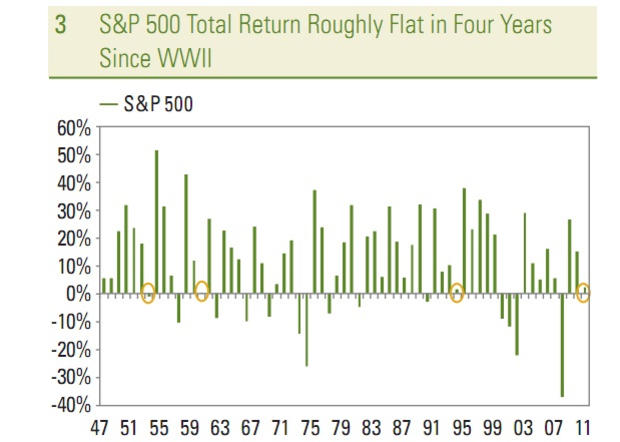

Over the past six decades, whenever the annual total return for the S&P 500 was roughly flat, the broader market bounced back sharply the following year, writes Jeffrey Kleintop, chief market strategist at LPL Financial.

Cash is trash for long-term investors

5 best developed markets for 2012

Best investment of 2012

"There have been four years since WWII when the total return for the S&P 500 was basically flat: 1953, 1960, 1994 and 2011," Kleintop says in a new note to clients. "All three of these years that preceded 2011 were followed by strong gains in the following year, averaging 38 percent." See the chart, courtesy of LPL, below:

The last time we saw a historical pattern similar to 2011 was 1994, Kleintop says, when the S&P 500 was basically unchanged for the year, even as earnings grew at a double-digit percent rate. And, as in 1994, defensive sectors, such as consumer staples and health care, outperformed in 2011.

"While things may have looked bleak in 1994, it turned out to be far from the end of the business cycle," Kleintop says. "In fact, 1994 turned out to be the set up for the strongest five-year run in history for stocks."

Kleintop isn't suggesting that we're about to embark on the same kind of run now, however. (Which is just as well, since it ended when the tech bubble burst.) Although the historical pattern suggests that a strong 2012 may follow a flat 2011, Kleintop's outlook remains somewhat more muted. LPL is forecasting an average return for the S&P 500 of 8 percent to 12 percent.

After last year's roller coaster ride to nowhere, investors should be grateful to get such returns.