Hedge fund update: workers feel pressure to cheat

(MoneyWatch) I've long railed against hedge funds. They charge hefty fees for lousy performance, as we'll see in a minute. But the results of a survey by the Hedge Fund Association should give you another strong reason to avoid them: Many people working in hedge funds feel compelled to cheat in the hopes of getting higher returns.

According to the survey, 35 percent of those responding said they felt pressured by their fund's compensation structure to engage in unethical behavior. In addition, 25 percent said they felt other pressure to engage in such behavior. Regarding the leadership of these funds, 28 percent of responders said their leaders were unlikely to report insider trading to the authorities if they discovered it, while 13 percent said their leaders would likely ignore it.

- Six ways to avoid expensive investment mistakes

- Hedge funds are too big to beat the market

- Building your own hedge fund

These problems persist despite the FBI launching a program a few years ago specifically aimed at rooting out insider trading at major hedge funds and mutual funds. According to the Los Angeles Times, no defendant has beaten the charges they've received due to the program. As for the Securities and Exchange Commission, 54 percent of those responding said they think the agency is ineffective at rooting out and prosecuting securities violations.

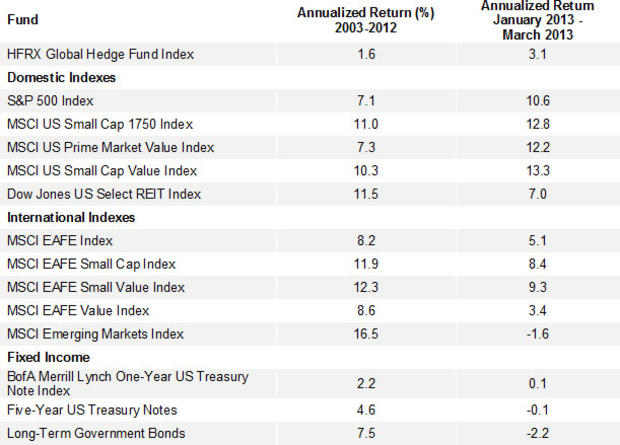

This just adds to the list of problems associated with hedge funds, which includes a lack of transparency, a lack of liquidity, poor tax efficiency and poor diversification with stocks. For all these problems, investors in hedge funds simply haven't been rewarded. Below are the returns of the HFRX Global Hedge Fund Index and several major stock and bond indexes. As you can see, it simply doesn't pay to invest in hedge funds.

The first quarter of 2013 didn't bring much relief from the poor performance as the HFRX index returned 3.1 percent. While that's a pretty good return for one quarter, it's not so good when looked at relative to the performance of stocks or a 60 percent stocks/40 percent bonds portfolio. We created three such portfolios, and the first quarter results are outlined below. All three outperformed the hedge fund index, by a range of 1% to 1.8%.

Image courtesy of Flickr user 401(K) 2013.