Sam Bankman-Fried charged with fraud and money laundering

Federal prosecutors on Tuesday charged FTX Trading founder Sam Bankman-Fried with eight counts of fraud, money laundering and other financial crimes, according to an indictment unsealed Tuesday.

The U.S. attorney's office for the Southern District of New York alleges Bankman-Fried knowingly defrauded customers by using their cryptocurrency assets to pay for debts and expenses incurred by FTX's hedge fund, Alameda Research. Bankman-Fried and other accomplices also purposely submitted inaccurate documents to lenders who sent funds to Alameda, according to the indictment.

"It's fair to say that, by anyone's license, this is one of the biggest financial frauds in American history," U.S. Attorney Damian Williams said during a press conference in Manhattan on Tuesday.

The unsealed indictment also accuses Bankman-Fried of violating political contribution laws by donating to candidates and committees in New York under another person's name. Bankman-Fried made "tens of millions of dollars" in contributions to both Democrats and Republicans in order to sway public policy, Williams said.

"These contributions were disguised to look like they were coming from wealthy co-conspirators when, in fact, the contributions were funded by Alameda Research with stolen customer money," he said.

A lawyer for Bankman-Fried, Mark S. Cohen, said Tuesday that Bankman-Fried is reviewing the charges with his legal team and considering his options.

The maximum potential prison sentence from these charges is 115 years, according to Nicholas Biase, a spokesperson for U.S. prosecutors.

The charges come on top of fraud charges the U.S. Securities and Exchange Commission filed against Bankman-Fried on Tuesday. The SEC has accused Bankman-Fried of commingling FTX customers' funds at Alameda to make undisclosed venture investments, lavish real estate purchases and large political donations.

The Commodity Futures Trading Commission announced similar fraud charges against Bankman-Fried and FTX on Tuesday, alleging in a lawsuit that the company caused customers to lose $8 billion in deposits.

"Bankman-Fried's claims about FTX's sophiscated risk controls and other customer protections were simply bogus," Gurbir Grewal, the SEC's enforcement division director said during the press conference.

Prosecutors are trying to recover as much money for customers are possible, Michael Driscoll, assistant director in charge of the FBI's New York office, said during the press conference.

"This case is about fraud," he said. "Fraud is fraud. It does not matter the complexity of the investment scheme. It does not matter the amount involved."

U.S. to seek extradition

Authorities in the Bahamas arrested Bankman-Fried late Monday on behalf of the U.S. government for activities he allegedly engaged in while CEO of the now bankrupt cryptocurrency exchange. He was scheduled to testify about FTX's collapse on Tuesday before the House Financial Services Committee, but his name was removed from the witness list.

The U.S. is expected to ask authorities in the Bahamas to extradite Bankman-Fried, which experts said is likely within the scope of a treaty between the two countries that dates back to 1931.

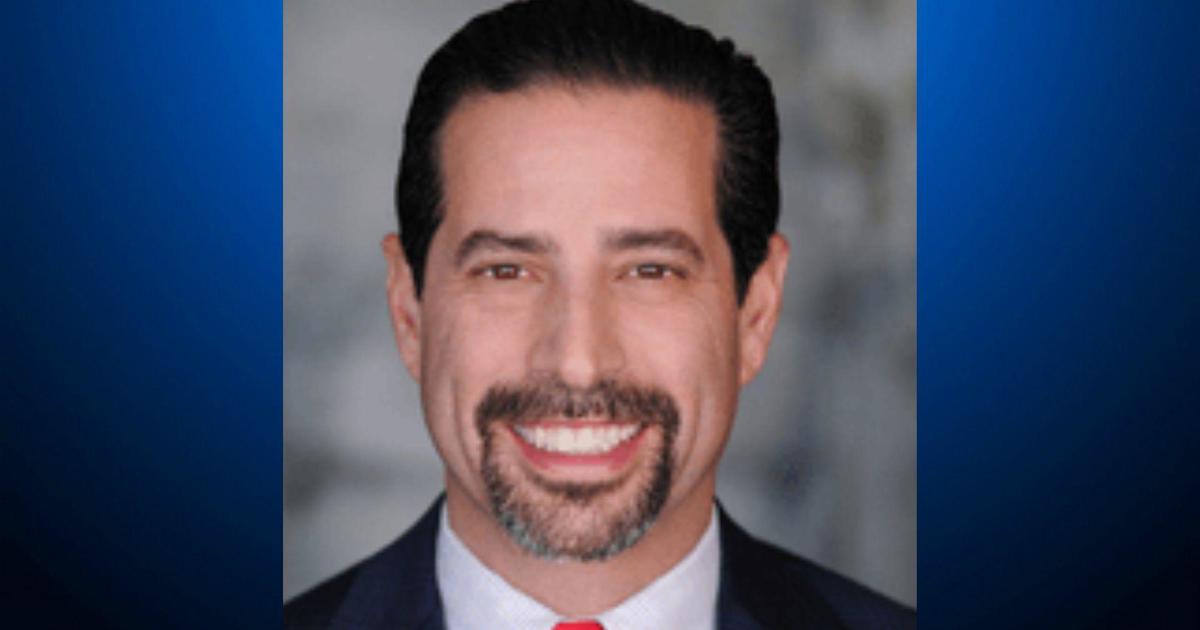

Because of that existing legal framework, "This would be a moment where one could strike while the iron is hot," Michael Parker, head of anti-money laundering and sanctions practice at law firm Ferrari & Associates, told CBS News. "If Mr. Bankman-Fried, for instance, went to another jurisdiction, it could be more difficult, and so the Bahamas may have been seen as a friendlier jurisdiction from which jurisdiction could take place."

In pursuing the case against Bankman-Fried, Parker said prosecutors will have to show that he knowingly committed the alleged crimes outlined in their indictment beyond a reasonable doubt.

Renato Mariotti, a legal analyst and partner at law firm Bryan Cave Leighton Paisner, told CBS MoneyWatch he expects extradition proceedings to go smoothly, although Bankman-Fried might not appear stateside until early next year.

Prior to his arrest, Bankman-Fried had been vocal about FTX's failure. At a New York Times Dealbook event last month, Bankman-Fried said he was unaware of the extent of FTX's problems and denied that he deliberately deceived customers and other parties the company did business with.

In court, defendants often deny any intent to commit fraud, Mariotti said, noting that such defenses are sometimes effective. But the FTX case might be different, he added.

"The fraud here is so extensive that it will be difficult to portray this as a small detail that he overlooked," Mariotti said.

"House of cards"

FTX was one of the world's largest cryptocurrency exchanges before it suddenly failed last month. Users withdrew roughly $5 billion of crypto assets in a single day as concerns mounted over the exchange's solvency.

John Ray III, who stepped in as FTX CEO after Bankman-Fried's resignation on Nov. 11 after a long career that included overseeing the Enron bankruptcy, said in a House hearing on Tuesday that about $7 billion was lost in the collapse. Ray alleged that Bankman-Fried and others at FTX misused customer funds, contributing to the losses.

Ray also said FTC "failed to implement virtually any of the systems or controls that are necessary for a company that is entrusted with other people's money or assets."

"Bankman-Fried's entire house of cards started to crumble as crypto asset prices plummeted in May of 2022 and as Alameda's lenders demanded repayment on billions of dollars in loans," Grewal said.

The Associated Press contributed to this report.