Fed chair Jay Powell calls return to gold standard a bad idea

Federal Reserve Chair Jerome Powell is not a fan of returning the U.S. to the gold standard—something Fed nominee Judy Shelton advocates.

Testifying before the House Financial Services Committee on Wednesday, Powell responded to a question from Rep. Jennifer Wexton (D-Va.) on whether he would support pegging the U.S. dollar to the price of gold.

"No, I don't think that would be a good idea," Powell replied, noting that "no other country uses it."

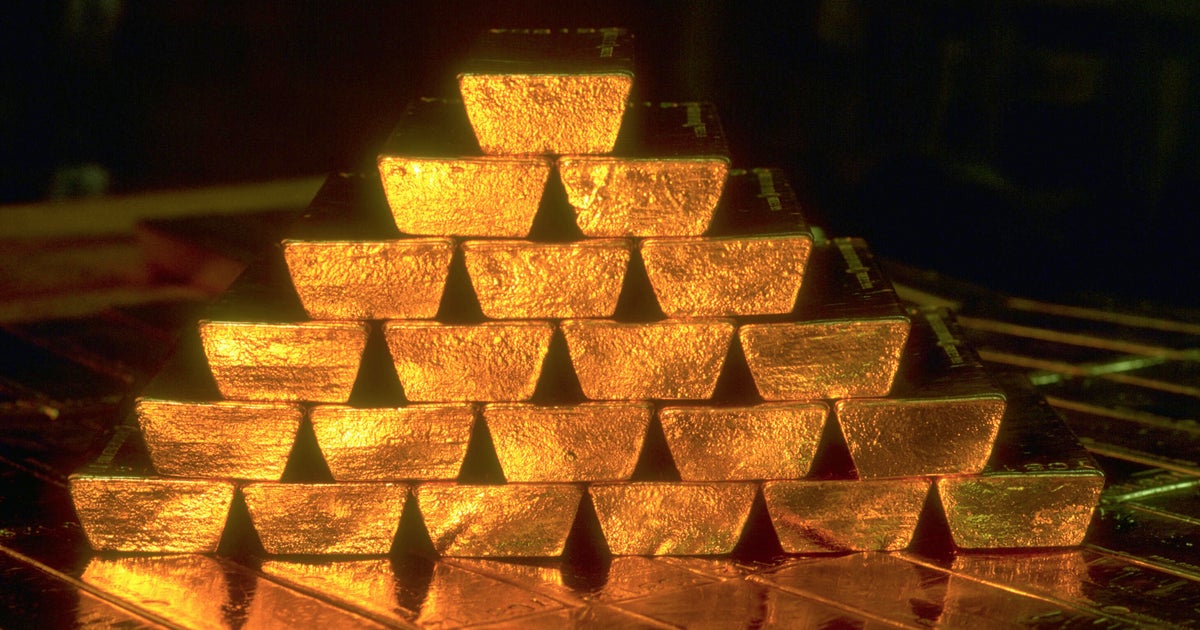

A return to the gold standard, which the U.S. used from 1879 to 1971, would allow consumers, banks and businesses to exchange a dollar for actual gold—but it would leave policymakers with less ability to respond to economic changes.

"You've assigned us the job of two direct real economy objectives: maximum employment and stable prices," Powell said Wednesday. "If you [wanted] us to stabilize the dollar to the price of gold, monetary policy could do that, but the other things would fluctuate and we wouldn't care. We wouldn't care if employment went up or down."

"This is why every country in the world abandoned the gold standard some decades ago," he added.

Powell emphasized that his disagreement with Shelton's view should not be construed as a comment on her fitness to serve on the Fed.

"We would never comment on the nominees. We are on the sidelines with that," he said.

Shelton isn't the only Fed nominee to support returning to gold. Stephen Moore and Herman Cain, both of whom have withdrawn their nominations, also supported the idea.