Fed and ECB stimulus worries slam stocks

U.S. and European equities were hit hard on Thursday after the European Central Bank merely extended its bond-buying purchase program through 2017 (more was expected) and Federal Reserve Chair Janet Yellen continued to bolster the case for a December interest rate hike (which hasn't happened since 2006 and the prospect of which is making investors nervous).

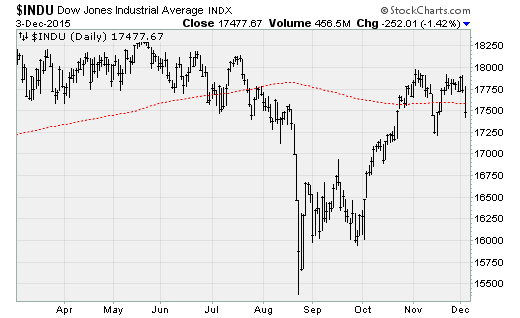

The Dow Jones industrials' loss of 1.4 percent, or 252 points, brought the blue-chip index back below its 200-day moving average -- a key level of medium-term trend support (see chart below). The Dow is now also in negative territory for the year-to-date. Credit markets were hit as well, with high-yield corporate bond yields rising to 15.4 percent, a six-year high. Gold gained 0.4 percent, while crude oil rose 3 percent to close above $41 a barrel.

Indications suggest the turbulence is set to continue.

Currencies saw big-time volatility, with the PowerShares U.S. Dollar Index Bullish Fund (UUP) suffering a 2.4 percent decline -- its worst one-day fall since March 2009 -- which acted as a destabilizing force in stocks, bonds and pretty much everything else.

For context, the March 2009 drop in the dollar was spurred by the Fed announcing it would, for the first time since World War II, start buying long-term U.S. Treasury bonds in a last-ditch stimulus effort.

Yellen's Thursday remarks before Congress' Joint Economic Committee largely repeated her Wednesday speech to the Economic Club in Washington, D.C. She again talked up rising confidence that inflation is set to return to the Fed's 2 percent target over the medium term, thanks to labor market gains and the diminishing impact of lower prices for energy and imports.

This confidence was the critical ingredient missing during the Fed's September "no hike" policy decision. She also repeated a warning about the consequences of the Fed waiting too long to start tightening monetary policy: the risk of falling behind rising inflation, which would require a more aggressive pace of rate hikes that could damage the economy.

Crude oil traded near $45 a barrel in January, not far from current levels. A modest rebound in oil prices could push energy inflation back into positive territory in just a few weeks' time. So, keep an eye on that.

In Europe, the ECB cut its deposit rate deeper into negative territory (by 0.1 percent to -0.3 percent) in line with estimates but less than the whispers of a 0.2 percent cut. The central bank also extended its asset purchase program by six months (through March 2017).

But investors frowned on the unchanged monthly purchase rate of $66 billion, sending the euro up strongly and pushing Germany's DAX stock index down 3.6 percent in a return to early November levels. Yellen felt compelled to comment on the market reaction, saying investors had expected ECB actions that were apparently not forthcoming.

The team at Oxford Economics noted that ECB President Mario Draghi has a history of overdelivering stimulus at "crucial moments," yet he failed to do so today. The rationale: The ECB was likely encouraged by some solid eurozone economic data recently.

On the U.S. economic front, the ISM nonmanufacturing index declined to 55.9 from 59.1 in October, below the consensus expectation of 58.2. New orders dropped to 57.5 from 62. Survey respondents commented on a weaker sales outlook, rising Obamacare-related costs and sluggish year-over-year revenue growth.

This adds to recent softness in durable goods, factory orders and ISM manufacturing activity, and suggests the economy is hitting an air pocket just as the Fed is considering raising the cost of credit for the first time in nearly a decade.

No wonder investors are balking.