Fact check: Trump offers skewed view of farm trade

President Donald Trump is promoting a lopsided view of agricultural trade as he assails "bad (terrible) Trade Deals with other countries." Agriculture is actually a strong point for U.S. commerce.

A look at his tweet Friday:

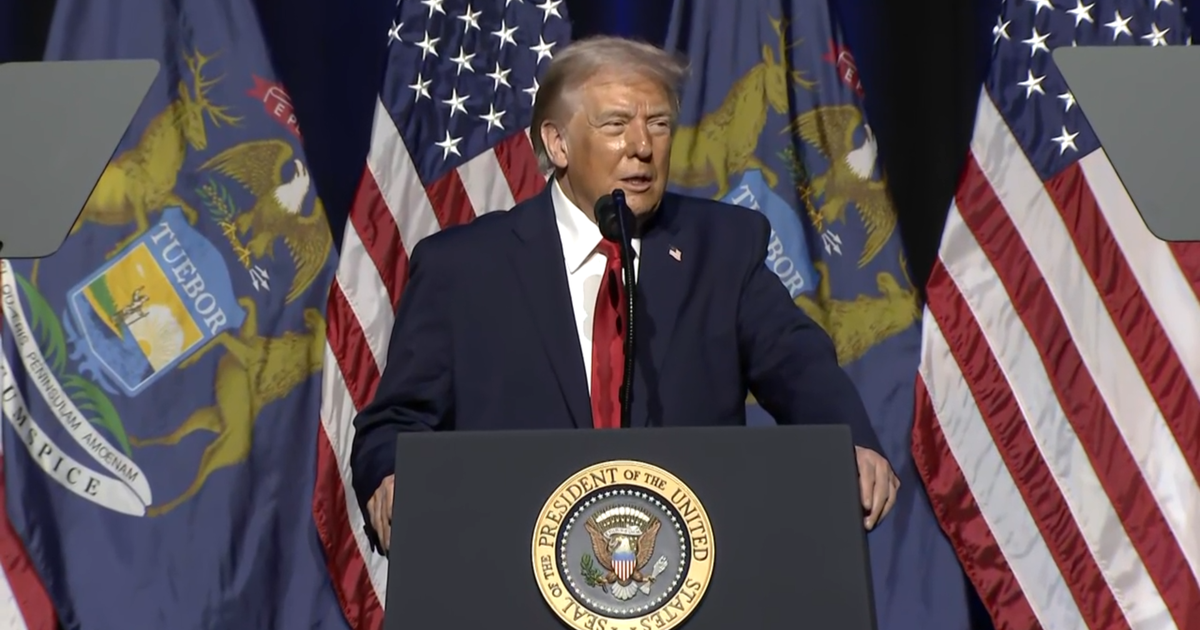

TRUMP: "Farmers have been on a downward trend for 15 years. The price of soybeans has fallen 50% since 5 years before the Election. A big reason is bad (terrible) Trade Deals with other countries. They put on massive Tariffs and Barriers. Canada charges 275% on Dairy. Farmers will WIN!"

THE FACTS:

You wouldn't know from the president's rhetoric that the U.S. exports more agricultural products than it imports, running a $17.4 billion surplus with the world last year on that front. Trump has several times cited 15 years of trouble for U.S. farmers even as his Agriculture Department highlights the fact that U.S. exports of food products have grown "steadily over the last two decades." The U.S. maintained a surplus in the latest monthly figures — $716 million in May.

As for soybeans, he is ignoring a big — and positive — reason why soybean prices fell in recent years to about $9.39 a bushel in 2017 from about $14 in 2012 and 2013: Farmers have been flooding the market with soybeans.

In fact, the Agriculture Department reported that a record 89 million acres of soybeans were harvested last year. That is about 13.3 million acres more than in 2013. Prices, of course, generally fall as supply rises to meet demand. The Agriculture Department figures suggest that soybean prices have held relatively steady since 2015, a sign that farmers are planting enough to meet their customers' needs.

But that was before the U.S. trade war with China. With China imposing a new, retaliatory tariff on U.S. soybeans, their price per bushel dropped this week by about 20 percent since early May to a 10-year low.

Soybeans profit margins aren't very large, meaning farmers can quickly go from breaking even to losing money. On June 1, a farmer with 1,000 acres of corn and soybeans expected a $42,000 return. That has dropped to a negative $126,000, according Christopher Hurt, an agricultural economist at Purdue University.

Chinese buyers are canceling orders for U.S. soybeans amid the prospect of higher tariff costs. At the same time, Beijing is encouraging farmers in China to plant more soy, apparently to help make up for any shortfall from the U.S.

Soybean exports have remained flat or dropped somewhat in recent years — peaking at $24.8 billion in 2012 after years of growth, and declining to $21.5 billion last year. But the overall value of the harvest has stayed strong. Soybean production in each of the last two years was valued at about $41 billion, approaching the peak of more than $43 billion in 2012 and 2013.

Soybeans only became a $30-billion-plus enterprise in the last decade.

Trump is right that Canada has steep dairy tariffs, averaging nearly 240 percent, according to the World Trade Organization. Despite that, the U.S. last year ran a $474 million surplus in dairy trade with Canada.