29 arrested in Egypt after thousands were swept up in Hoggpool cryptocurrency investment scam

Cairo — Egyptians who invested in a cryptocurrency mining app were hit last week with the daunting realization that the incredible profits they thought they were making all boiled down to fiction. The platform, called Hoggpool, was launched in August.

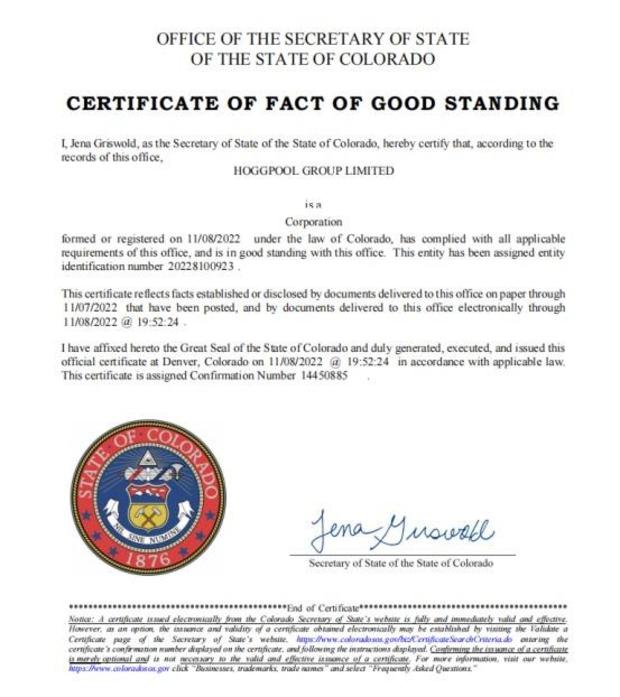

In a promotional video, a man introduced the company with a claim that it was founded in Colorado in

2019 and was investing in cutting-edge industries, from "life sciences technology" to "space tech and blockchain." He called it "one of the leading energy providers worldwide" and said it offered "cryptocurrency mining at all levels."

Potential investors were offered various plans starting from only about $10, with a fixed profit promised of $1 per day over a specific period. The investment options ranged up to an $800 crypto-mining "machine" with a $55 per-day payout.

Hoggpool told investors they could withdraw their money daily, minus a 15% tax, or wait until the end of the month and withdraw all their returns tax-free.

To Tarek Abd El-Barr, who works in medical supplies, it sounded like an incredible opportunity.

"They said they were 'workers in mining,'" he told CBS News. "No one in Egypt knows what mining coins is. We don't know anything about these things. We thought it was electronic investing — that they were like Amazon or Microsoft."

Pyramid and Ponzi schemes are nothing new in Egypt, but cryptocurrency scams are. Receptions, parties and meetings held by the people behind Hoggpool, in fancy hotels and other venues, gave users the impression that it was all aboveboard.

Lawyers and victims told CBS News that ads on social media platforms lured some in, but for many, it was acquaintances who had already been hooked.

Abd El-Barr's brother-in-law, who was using the app and seeing consistent profits, convinced him to join. Skeptical at first, he started with an investment of just 6,000 Egyptian pounds (about $200) in February. It seemed to work as promised, as such scams often do, and he got his money back with profits, so he tripled his investment.

The platform's biggest and final offer was a new "deposit funds" feature, with which users were told they could earn as much as five times the value of their existing investment in just five days. Abd El-Barr was skeptical again, but as it had worked thus far, he went ahead and took the risk, throwing all of his savings into the app.

On February 27, when he tried to withdraw his money, it didn't work. Two days later, on March 1, the app stopped working completely and the website vanished.

"Many people took loans from banks to invest in it. I used my car instalment money. Now I have missed two installments and the bank is calling me," he said.

Dozens of videos of people sharing their stories and crying out for help quickly flooded the internet.

On Saturday, Egyptian authorities announced the arrest of 29 suspects, including 13 foreign nationals, in connection with the scam. Police seized 95 phones, 3,367 SIM cards and about $194,000 worth of Egyptian and foreign currency as they made the arrests, the Ministry of Interior said in a statement. It said the culprits used 88 digital currency wallets to collect the money, then divided it into 9,965 e-wallets and converted it into bitcoin before transferring it into accounts around the world.

The statement said the suspects had bilked unsuspecting investors of at least 19 million pounds, or about $615,000, but many in Egypt believe the real total was likely much higher.

Lawyer Abdulaziz Hussein told CBS News he was representing more than 1,000 victims of the scam in Cairo alone, but that as many as 800,000 people around the country may have fallen prey to the scheme, losing as much as 6 billion pounds in total — the equivalent of about $194 million.

Cryptocurrency trading is illegal in Egypt, and another lawyer representing some of the victims said that had likely kept many from reporting the crime.

"Some of the victims might turn into suspects if the investigations prove they knew what they were doing was illegal," said Mahmoud El-Semri.

It is hard to tell how many of the victims might have continued investing, and recruiting others, with knowledge that the scheme involved banned cryptocurrency, especially as most appear to have joined through recommendations from friends or family — people they trusted and who, in many cases, probably meant well.

"Most people didn't look into the details of how this works, we just understood they would invest the money in programing," Hussein El-Faham, a lawyer who was swept up in the scam himself, told CBS News.

He said it was an elaborate scam that looked and sounded legitimate, complete with forged documentation.

El-Faham said he and others heard warnings about it being a scam, but as the app initially continued paying out money as promised, it was easy to dismiss those reports. The people behind the app even used the warnings of fraud as a marketing tool, he said.

El-Faham shared a screenshot with CBS News that showed the scammers warning users of "fake" apps, asking them — in poorly written Arabic — to "please be cautious, those scammers have a low-tech level, and they are stupid enough to copy our system layout. Keep your eyes open."

El-Faham lost about $6,000 to the scheme.

Dr. Sarah Zain, a physiotherapist, told CBS News she had her doubts about the app even as she used it, as it appeared to be an unsustainable business model, but she thought it would take longer to fall apart. She didn't get her money out in time and ended up losing more than $7,000, which she said she needed for an upcoming surgery.

"A friend of mine and her family invested two million pounds (about $65,000), she is not talking to anyone now," she said. "I can't believe we were that stupid! They did brainwash us."

Zain also put some blame on the government for allowing the scammers to operate openly for months.