Dow 14,000: Stocks near new crest

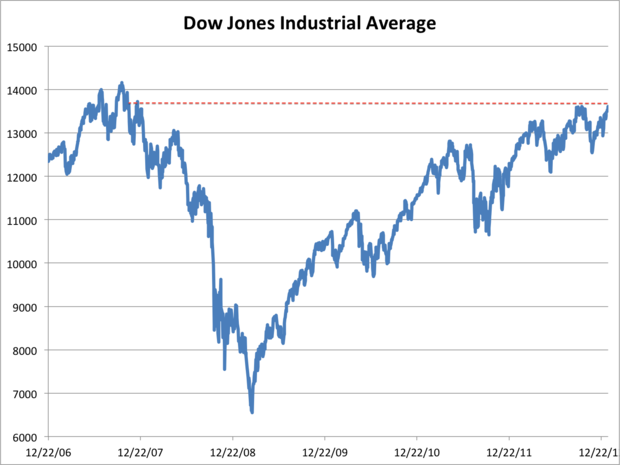

(MoneyWatch) U.S. stocks logged their fifth consecutive week of gains, driving the Dow Jones industrial average to its first close above 14,000 since 2007. With the index only, 155 points, or 1.1 percent, of its all-time nominal high of 14,165, the momentum appears to be with the bulls.

As we have have previously noted, 2013 to date has been most notable for what is absent: a eurozone seemingly on the brink of collapse, China's economy coming for a "hard landing," debt ceiling fight in Washington and, most importantly, any whiff of monetary tightening by the Federal Reserve.

- Dow closes above 14K for first time since 2007

- Economic tea leaves point toward steady recovery

- Economy hits pothole, but likely to avoid ditch

Last week also brought some positives into the mix. Job-creation was stronger in 2012 than originally thought, lending credence to the notion that the U.S. economy is finally gaining traction. Fourth-quarter corporate profits also have topped expectations -- of the roughly half of S&P 500 companies that have reported their latest quarterly earnings, two-thirds have beaten revenue forecasts, with the average growth rate of 4 percent higher than the 1-2 percent predicted by analysts. Meanwhile, investors keep pouring money into stock mutual and exchange traded funds. Mutual fund research firm Lipper reports $34.2 billion has flowed into stocks over the past four weeks, the largest equity infusion over that time frame since 1996.

Bearish investors predictably see the latest surge as too good to be true. After all, the last time the Dow crossed 14,000 in October 2007, it soon dropped a whopping 54 percent after the subprime crisis erupted before bottoming out in March 2009. Equally unsurprising, the bulls respond that things are dramatically different this time around, arguing that no financial meltdown is looming that economic recovery is picking up speed.

Certainly not up for debate is the strength of the current bull market. Since that March 2009 bottom 1,425 days ago, the S&P 500 has soared nearly 124 percent. Although not as strong as the bull markets of 1982-1987 and 1990-1998, which saw stocks shoot up 228 percent and 302 percent, respectively, the most recent upturn has obviously been pleased good news for most investors. Those who count small stocks among their holdings are even happier, as the S&P 400 mid-cap index and Russell 2000 have already surpassed their 2007 highs.

After closing out the best January for stocks in over a decade, it's of course time for the "January Effect." The old trading chestnut holds that as goes the first month of the year, so goes the entire year. The S&P 500 gained 5 percent last month, making it the 12th best January for the broad index since 1950.

According to S&P, when the index has risen more than 4 percent in January, the full year return has averaged 15.1 percent. One of the major exceptions was 1987, where a 13 percent January hike was later followed by an October crash and a full year return of -9.9 percent. In other words, it may not be advisable to trade on various Wall Street aphorisms, like the "January Effect" or "sell in May and go away."

-- DJIA: 14,009 up 0.8 percent on week, up 6.9 percent on year (1.1 percent off 2007 peak of 14,165)

-- S&P 500: 1,513, up 0.7 percent on week, up 6.1 percent on year (3.4 percent from 2007 peak of 1,565)

-- Nasdaq: 3,179, up 0.9 percent on week, up 5.3 percent on year

-- March crude oil: $97.77, up 0.2 percent on week

-- April gold: $1,670.60, up 0.8 percent on week

-- AAA national average price for gallon of regular Gas: $3.51, up 22 cents in past month

THE WEEK AHEAD:

Mon 2/4:

10 a.m. Factory orders

Tues 2/5:

Disney

10 a.m. ISM non-manufacturing index

Wed 2/6:

All State, Prudential, CVS, Time Warner, Visa

Chain-store sales

European Central Bank and Bank of England rate decisions (no change expected)

Thurs 2/7:

8:30 a.m. Weekly jobless claims

3 p.m. Consumer credit

Fri 2/8:

8:30 a.m. International trade

10 a.m. Wholesale inventories