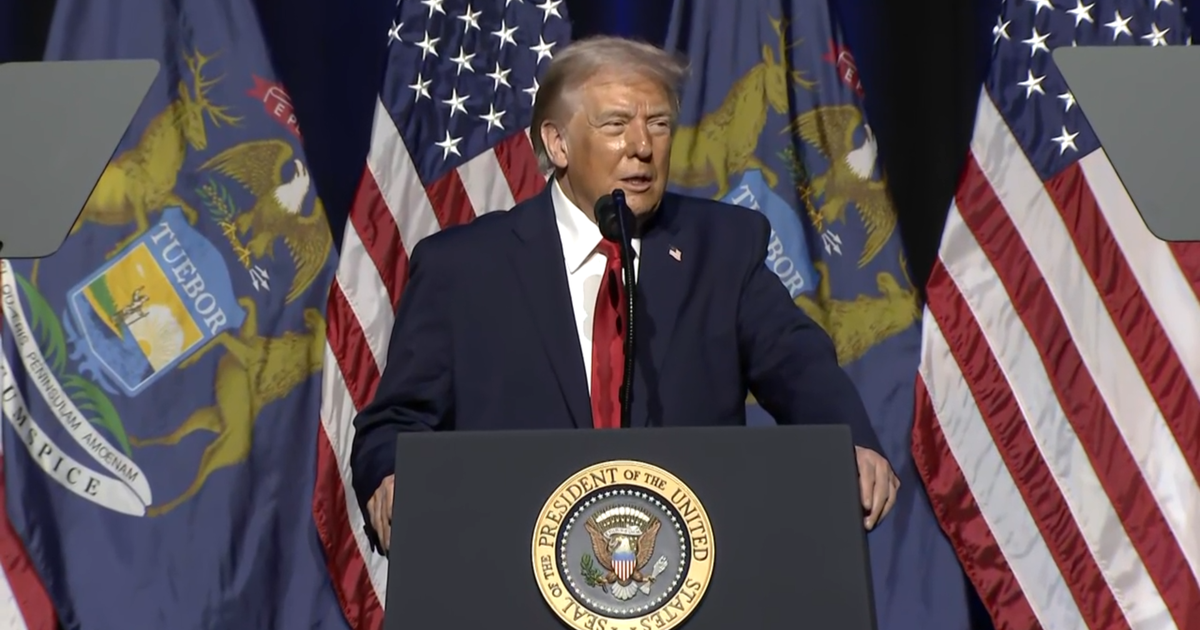

A week before the election, DJT stock surges amid Trump's rise in the betting markets

Donald Trump's media company is enjoying a stock market resurgence, with shares of Trump Media & Technology Group soaring on Tuesday as betting markets now wager the former president is favored to win in the November 5 election.

The focus on Trump Media — which trades under the ticker DJT, the same as Trump's initials — have led to a spike in trading volume, with the New York Stock Exchange halting trading of the stock several times on Tuesday due to unusual volatility.

Shares jumped $5.86, or 12.4%, to $53.22 in Tuesday afternoon trading. That increase amounts to a tidy windfall for Trump, who owns more than 57% of Trump Media shares, with the value of his stake having climbed $2.6 billion to more than $6 billion in the current rally, according to investment research firm S3 Partners.

The stock has surged more than 340% since hitting a low of $11.75 a share in September. Tuesday's spike came as the Nasdaq Composite Exchange, where Trump Media shares trade, rose 0.9% and stayed on track to close the day at a record high.

While the polls show that the presidential race is extremely close, the betting markets such as Polymarket are now predicting that Trump is favored to win the election.

"The price of DJT closely mirrors Trump's chances in prediction markets," S3 analysts said Tuesday in a note to investors.

While Polymarket last week said a sole French trader was behind four accounts that spent millions to purchase the Trump contract, the international platform determined it was not market manipulation.

Worth more than Elon Musk's X

Trump Media has been highly volatile since its stock started trading in March, initially surging to a valuation that topped $9 billion despite a history of losses, before dropping to its September low. Much of the stock's movement is tied to Trump's political fortunes, with DJT swinging upwards when his odds appear to improve.

After Tuesday's stock gains, Trump Media now sports a market capitalization of $10.3 billion. That tops established social media platforms including X (formerly Twitter), which is valued at around $9.4 billion based on the most recent value investment firm Fidelity assigned to its stake in the company.

The sharp swings in DJT shares has prompted comparisons with a meme stock, or a company whose shares trade on social media buzz instead of traditional analytical measures such as revenue growth and profitability. Trading volume in DJT shares has been unusually high in the last two weeks, with its trading volume topping 120 million shares on Tuesday, versus its 30-day average trading volume of 35 million shares, according to financial data firm FactSet.

"DJT has been very volatile due to speculators that are momentum players," University of Florida finance professor Jay Ritter wrote in an email to CBS MoneyWatch. "These speculators buy when the price rises, pushing up the price, but then sell when the tide turns, resulting in occasional big drops."

DJT price prediction

But Trump Media has little in the way of revenue or growth to attract institutional investors, while it's become expensive to short because of the cost to borrow shares, Ritter said.

"The company is losing money, burning through its cash. In the short run, anything can happen to the price, but the long-term trend will be down," he added.

The company's shaky financial position has invited short sellers, or investors that bet that a company's stock price will sink, to pile into DJT shares. And those shorts, who Trump Media executives have accused of manipulating the company's stock, could take a bath if Trump wins next week, according to S3.

By contrast, "DJT could become worthless if Trump were to lose," the analysts wrote.