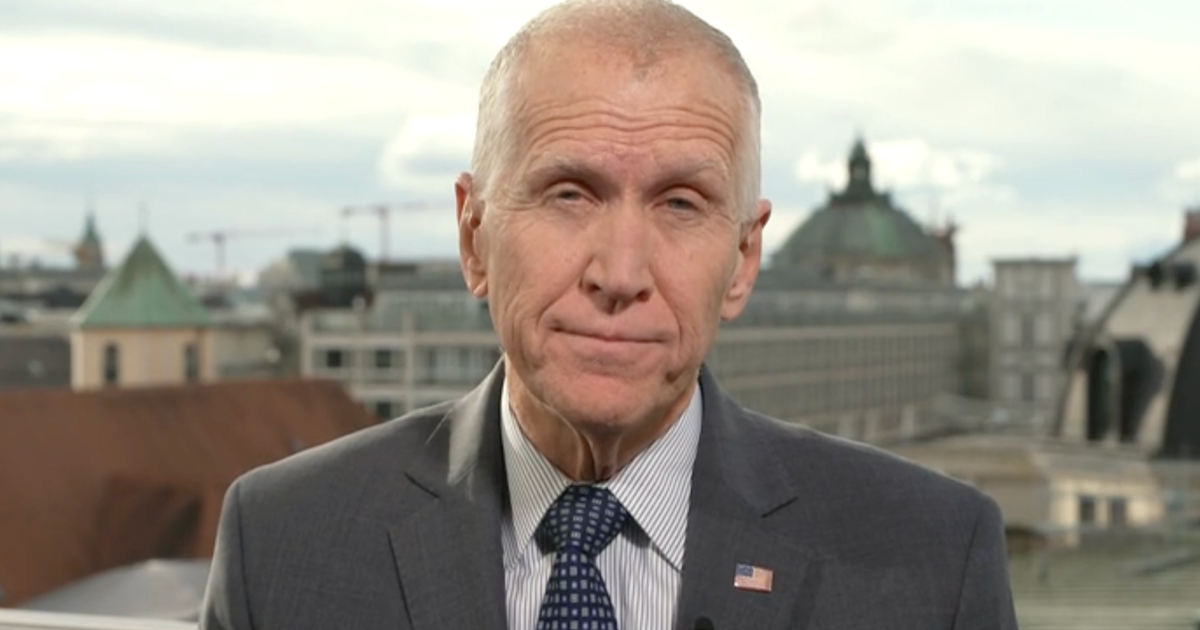

Despite conflicting analyses, Rep. McCarthy guarantees tax cuts for everyone in middle class

House Majority Leader Kevin McCarthy said Sunday that his party's tax plan will cut taxes for America's middle class, despite the fact that congressional budget scorekeepers say that likely won't be the case.

"Look, we are cutting rates. We're not raising rates. So, this is a tax cut," McCarthy said on CBS News' "Face the Nation."

When pressed on whether everyone in the middle class will get a cut, the California Republican said, "Yes. It is a fact that the first $55,000 you earn for a family of four will not pay any tax. So, it is a tax cut for the middle class."

Congressional budget analysis however has found, however, that middle class families will likely end up paying more in years 2023 and 2024 due to the sun setting of some provisions of the bill, including the proposed child tax credit. While the current proposal increases the child tax credit to $1,600 from $1,000, that provision is not permanent, thus costing families more in the long term.

But McCarthy said that economic growth will fix those discrepancies.

"Always in America, we've averaged more than 3 percent growth, but the lowest of growth we've had in those last eight years. If you look back to Bill Clinton, his worst growth year is higher than the largest of Barack Obama's. Growing the economy is the key to getting us working back and helping us to be able to balance the budget," said McCarthy.

"We know where the challenge is when it comes to entitlements," he added. "We've put those plans out there. We have to grow the economy and save the entitlements for the next generation by changing them to be actually prepared for the future."

The tax plan, which was formally rolled out last week, is billed by the GOP as providing a break to the middle class, although critics say the benefits will overwhelmingly be enjoyed by corporations and the rich. That's because the tax rate on corporations will be reduced to 20 percent from 35 percent, allowing the country's biggest companies to retain more of their profits.

McCarthy, however, said the tax plan will "make America competitive again."

"For decades the hard-working Americans have been ignored or forgotten from Washington, but not anymore. This Tax Cut and Jobs Act bill is going to be the start to changing that," said McCarthy.

Most Americans would like to see a tax cut for the middle class and small businesses, according to a new CBS News Poll, and a majority would like to see tax increases for large corporations (56 percent) and for the wealthy (58 percent).

Meanwhile, McCarthy said he wouldn't be opposed to seeing language tied into the Republican's tax bill that would remove the individual mandate as written under the Affordable Care Act.

"Well, I know people are talking about it. Currently, it is not in this bill. I know the Senate is looking at it. We will start marking up this bill in Ways and Means next week, and I look for having the bill on the floor the week after that. The Senate will come out with theirs shortly," added McCarthy.