Could the "fiscal cliff" raise taxes for retirees?

(MoneyWatch) The conventional wisdom when it comes to retirement planning is that your marginal income tax rate will be lower after you exit the workforce than when you were employed. This is the justification for contributing to 401(k) plans, IRAs and other retirement savings vehicles that defer taxes on your contributions and investment earnings until retirement.

On the other hand, many people think they'll be in higher tax brackets in retirement, a viewpoint colored by the current debate in Washington about income taxes and the looming "fiscal cliff." While I agree that the federal budget deficit needs attention and that there's a good possibility that federal income tax rates will change, it doesn't necessarily follow that most people's income tax rates will be higher in retirement.

- Roth vs. traditional IRA: Which is better?

- 3 ways to turn your IRA and 401(k) into a lifetime retirement paycheck

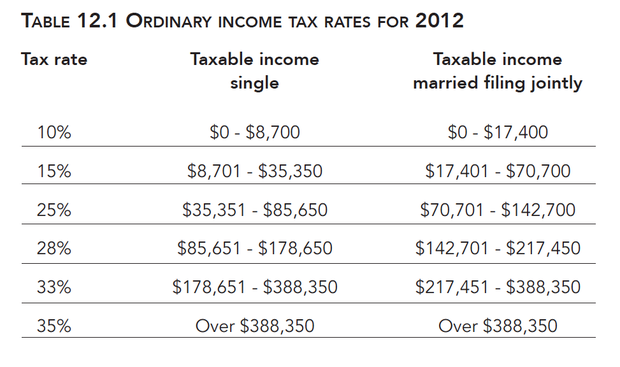

Let's take a look at the following table showing the federal income tax structure in 2012 to see what I mean.

It's important to understand that the above tax rates apply to your taxable income, which is your total income after you've subtracted exemptions and deductions.

Federal income taxes are progressive, meaning that different levels of income are taxed at increasingly higher rates. For example, suppose you're married filing jointly and your taxable income is $75,000 after applying deductions and exemptions. Here's how your federal income tax would be calculated:

- The first $17,400 of your taxable income would be taxed at 10 percent, which results in a tax amount of $1,740

- Your taxable income between $17,400 and $70,700 would be taxed at 15 percent, which results in a tax amount of $7,995 (15 percent of $70,700 minus the $17,400 that was taxed at 10 percent).

- Your taxable income between $70,700 and $75,000 would be taxed at 25 percent, which results in a tax liability of $1,075 (25 percent of $75,000 minus the $70,700 that was already taxed)

In this example, if you add up the amounts for each layer of your taxable income, the total federal income tax you owe would be $10,810.

The tax that applies to your highest layer of income is called your "marginal tax rate." Think of it as the rate that would apply to one more dollar of income above your current income.

Many middle-class Americans fall into the 25 percent marginal tax bracket while they're working, but fall into the 15 percent tax bracket or lower after they retire. That's because their income will be lower during their retirement years, and a portion of their Social Security income will be exempt from income taxes.

For the sake of argument, let's suppose that our political leaders raise income taxes in the future. If that were the case, income currently taxed at 15 percent would need to be taxed at more than 25 percent for your marginal tax rate to increase in your retirement years. This represents a 66.6 percent increase in the marginal tax bracket -- a very unlikely eventuality, given the political opposition to hiking taxes.

If you currently work and are in the 15 percent tax bracket, then you'll most likely fall in the 10 percent tax bracket when you're retired. Again, if tax rates are increased, then income that is currently taxed at 10 percent would need to be taxed at a rate higher than 15 percent for you to experience a higher income tax rate in retirement. That would amount to a 50 percent increase in tax rates, also unlikely.

This is why I contend that many workers will be in lower tax brackets in retirement, particularly older workers who are now in their peak earnings years. This would continue to justify the use of traditional retirement savings vehicles like deductible IRAs and 401(k) plans. (For more thoughts and some strategies to maximize the amount of your retirement income that you get to keep after paying taxes, please see my latest book, "Money for Life: Turn Your IRA and 401(k) Into a Lifetime Retirement Paycheck," which delves into more details on the subject.)

By contrast, younger workers who are at the beginning of their careers and who will earn much more in the future may well face higher taxes one day. In this case, they may be better off contributing to Roth IRAs and Roth 401(k) plans. The same conclusion might apply to an older worker who is experiencing a temporary decline in earnings.